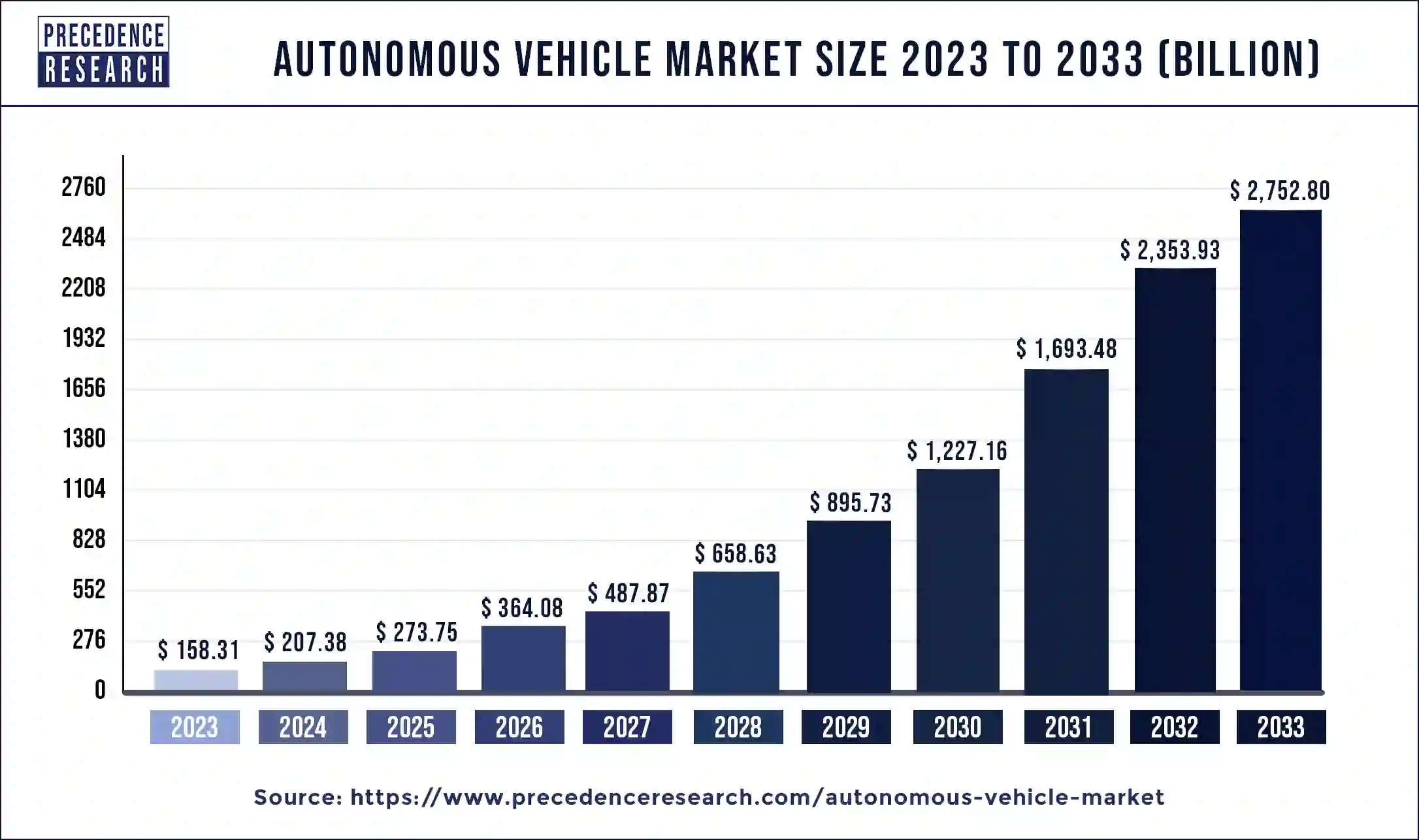

The global autonomous vehicle market size was estimated at USD 207.38 billion in 2024 and is predicted to increase from USD 273.75 billion in 2025 to approximately USD 4,450.34 billion by 2034, expanding at a CAGR of 36.3% from 2025 to 2034.

Market Overview

The autonomous vehicle (AV) market is witnessing rapid transformation, driven by advancements in artificial intelligence (AI), sensor technologies, and 5G connectivity. Consumer demand for safer, more efficient, and convenient modes of transportation continues to accelerate adoption. Leading players such as Tesla, Waymo, and Nvidia are investing billions in AV research and development, further fueling innovation.

Applications are expanding across personal mobility, shared robo-taxis, logistics, and commercial fleets. Safety features like adaptive cruise control, automated parking, and collision avoidance are becoming standard. While challenges remain — including regulatory hurdles, cybersecurity risks, and public trust issues — the market outlook is highly positive as governments, automakers, and technology providers collaborate to enable widespread adoption.

Read Also: Sterilization Equipment Market

Growth Factors

-

Rising Focus on Road Safety – AVs reduce accidents caused by human error, equipped with ADAS, lane-keeping, and collision-avoidance systems.

-

Increasing R&D Investments – Automakers (Tesla, BMW, Toyota, Honda) and tech firms (Nvidia, Intel, Waymo) are accelerating innovation through collaborations.

-

Environmental Benefits – AVs, especially EV-based models, reduce emissions, optimize fuel efficiency, and promote sustainable transportation.

-

Government Support & Smart Infrastructure – Investments in 5G, V2X, and smart city infrastructure enable faster adoption and regulatory readiness.

-

AI & Connectivity Integration – Real-time hazard detection, predictive maintenance, and route optimization enhance safety and efficiency.

-

Rising Demand in Logistics & Transportation – Autonomous trucks and delivery fleets improve efficiency, reduce costs, and optimize supply chains.

-

Passenger Convenience & Accessibility – AVs offer hands-free mobility, increasing accessibility for elderly and disabled populations.

Opportunities

-

Government Initiatives: R&D funding, regulatory frameworks for Level 4/5 autonomy, and incentives for green mobility accelerate deployment.

-

Smart Cities & 5G Expansion: Infrastructure rollouts enable AV-V2X communication and large-scale pilot programs.

-

Commercial Applications: Growth in robo-taxis, autonomous shuttles, and self-driving logistics vehicles presents huge revenue potential.

-

Public-Private Partnerships: Collaboration between governments, automakers, and AI startups strengthens AV ecosystems.

-

Mobility-as-a-Service (MaaS): The rise of subscription-based and shared AV mobility services is reshaping transport economics.

Restraints

-

Cybersecurity Risks: AVs are vulnerable to hacking, ransomware, and false sensor signals.

-

High Development Costs: Advanced sensors (LiDAR, radar), AI chips, and redundant safety systems increase costs.

-

Infrastructure Limitations in Emerging Markets: Poor road quality and inadequate digital infrastructure delay adoption in countries like India and Brazil.

-

Safety Concerns: Functional safety failures, unpredictable weather, and sensor malfunctions hinder consumer trust.

Challenges

-

System Reliability: Sensor misreadings or software errors may cause unexpected accidents.

-

User Acceptance: Public skepticism around safety and control slows adoption.

-

Economic Disruptions: Decline in repair, insurance, and crash-related industries.

-

Regulatory Variations: Differing regional standards slow global deployment.

Value Chain Analysis

-

Raw Material Sourcing: Specialized steel, plastics, and electronics for AV sensors. (Key players: NXP, Qualcomm)

-

Component Manufacturing: AI chips, LiDAR, radar, cameras, and software. (Key players: Nvidia, Bosch, Intel)

-

Vehicle Assembly & Integration: OEM integration of hardware and software. (Key players: Tesla, GM, Mercedes)

-

Testing & Validation: Simulation, real-world trials, and certification. (Key players: Waymo, TÜV SÜD)

-

Sales & Mobility Services: Direct sales, ride-sharing, robo-taxis, subscription models. (Key players: Tesla, Uber, Ford)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025