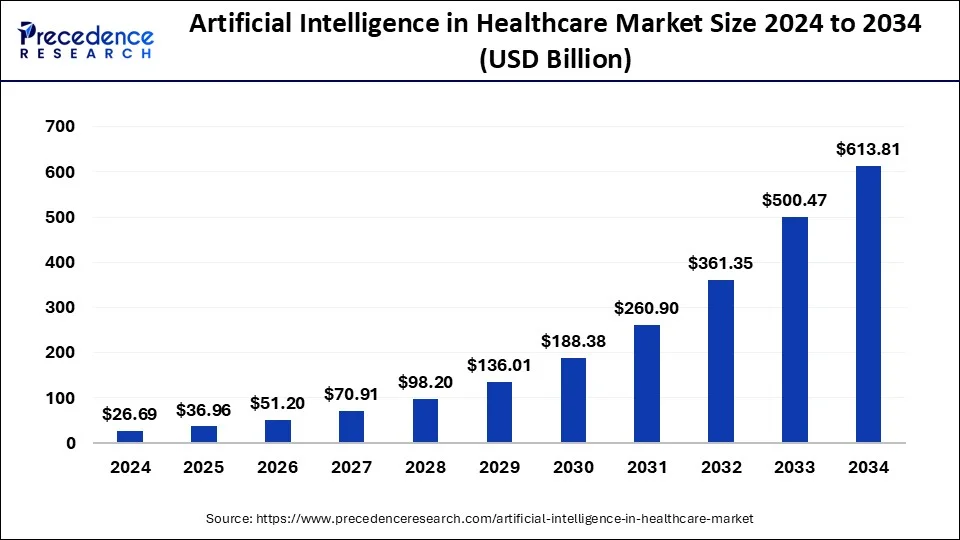

The global Artificial Intelligence in Healthcare market, valued at USD 26.69 billion in 2024, is projected to surge to approximately USD 613.81 billion by 2034, growing at a robust compound annual growth rate (CAGR) of 36.83 % between 2025 and 2034.

Read Also: eClinical Solutions Market

What’s Driving the Surge?

Why is AI in Healthcare Poised for Explosive Growth?

-

Data deluge and digital health adoption: The explosion of electronic health records (EHRs), wearable devices, and genomics data necessitates AI for meaningful interpretation and actionable insights.

-

Diagnostics & imaging revolution: AI is increasingly becoming indispensable in radiology, pathology, and imaging workflows — improving speed, accuracy, and earlier detection.

-

Drug R&D acceleration: AI platforms are significantly reducing time and cost in early-stage drug discovery, screening, and biomarker identification.

-

Operational efficiency: Healthcare institutions are embracing AI to streamline administrative tasks, reduce redundancy, optimize resource allocation, and cut costs.

-

Policy & funding tailwinds: Government initiatives and regulatory incentives are supporting AI deployment in public health, telemedicine, and clinical decision support systems.

Regional & Segment Dynamics

-

North America remains the powerhouse, accounting for over 45 % of 2024 revenues thanks to advanced digital infrastructure, high healthcare IT spending, and supportive regulation.

-

Asia Pacific is forecasted to post the fastest growth over 2025–2034, driven by expanding healthcare access, rising AI adoption in China, India, and Southeast Asia, and government digital health agendas.

-

Europe, Latin America, and MEA are gradually catching up, with 5G deployment, regional AI policies, and cross-border collaborations enhancing uptake.

-

In component mixes, software dominates current spending, while services (such as deployment, consulting, maintenance) are projected to grow fastest owing to increasing complexity and demand for customization.

-

On the application front, while medical imaging & diagnostics remains the largest segment, drug discovery & development is rising rapidly.

-

Machine learning-based tools currently lead within the technology mix, but computer vision, NLP, and context-aware systems are gaining momentum.

-

Among end-users, healthcare providers (hospitals, clinics) dominate adoption today; however, pharmaceutical and biotech firms will see increasing uptake as AI becomes integral to R&D pipelines.

Breakthroughs & Use Cases

-

Chinese health AI startup DeepSeek has been successfully deployed across tertiary hospitals, enhancing diagnostic accuracy and streamlining workflows in imaging and pathology.

-

Integrative AI frameworks that fuse imaging, genomics, and EHR data (multimodal AI) have demonstrated improved predictive performance across clinical endpoints.

-

Hybrid fairness-aware models are being developed to reduce bias across demographic groups and ensure equitable AI-driven outcomes.

-

In India, several start-ups are piloting AI systems in diabetic retinopathy screening and cardiology risk stratification, demonstrating the viability of scalable AI in emerging markets (internal Precedence Research coverage).

Challenges & Headwinds

-

High upfront costs & ROI uncertainty: Implementation costs for AI systems (data infrastructure, integration, validation) remain substantial, and many providers remain unsure of return timelines.

-

Data privacy, security & compliance: Ensuring patient data protection and adherence to HIPAA, GDPR, and other local regulations is critical and complex.

-

Algorithm bias & fairness: Unrepresentative datasets and opaque models can exacerbate disparity in care if not addressed proactively.

-

Regulatory & reimbursement ambiguity: Many jurisdictions are still crafting frameworks for clinical approval, liability, and reimbursement of AI tools.

-

Skepticism & clinician trust: Resistance from clinicians due to perceived “black box” behavior and fear of deskilling can slow adoption.

-

Interoperability & legacy systems: Integrating AI solutions into existing EHRs and hospital IT landscapes can be technically challenging.

What’s Next?

-

Will regulatory convergence — such as unified AI in healthcare guidelines — unlock broader adoption?

-

Can generative AI models (e.g., large language models) disrupt clinical documentation, decision support, and research workflows?

-

How will edge AI solutions (running on-device) evolve to reduce latency and preserve patient privacy in remote settings?

-

Which emerging regional markets (e.g., Southeast Asia, Latin America, Africa) will leapfrog older systems and scale AI faster?

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Lysine Market to Hit USD 3.08 Billion by 2034 - October 13, 2025

- Artificial Intelligence in Healthcare Market to Soar to USD 613.81 Billion by 2034 - October 13, 2025

- eClinical Solutions Market to Reach USD 25.85 Billion by 2034 - October 9, 2025