Artificial Intelligence and Analytics in Surgery Market Key Takeaways

- In terms of revenue, the global artificial intelligence and analytics in surgery market was valued at USD 238.15 million in 2024.

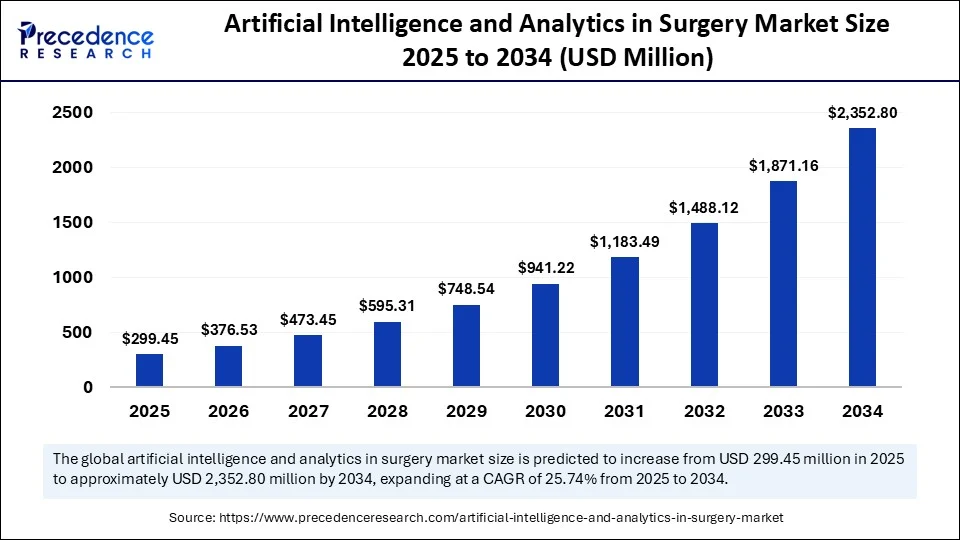

- It is projected to reach USD 2,352.8 million by 2034.

- The market is expected to grow at a CAGR of 25.74% from 2025 to 2034.

- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By application, the intraoperative guidance and navigation segment held the biggest market of 34% in 2024.

- By application, the surgical workflow and efficiency optimization segment is expected to witness the fastest CAGR during the foreseeable period.

- By technology, the computer vision and image recognition segment captured the highest market share of 38% in 2024.

- By technology, the predictive analytics platform segment is expected to witness the fastest CAGR during the forecast period.

- By surgical specialty, the general surgery segment contributed the major market share of 29% in 2024.

- By surgical specialty, the neurosurgery segment is expected to witness the fastest CAGR during the forecast period.

- By deployment mode, the cloud-based AI platforms segment held the largest market share of nearly 64% in 2024. And the same segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

- By end user, the hospital & surgical centers segment generated the major market share of 61% in 2024.

- By end user, the ambulatory surgical centers segment is expected to witness the fastest CAGR during the forecast period.

Market Overview

The artificial intelligence and analytics in surgery market is rapidly becoming a key battlefield for med-tech companies, robotics innovators, and hospital systems. Major players invest in platforms that combine predictive analytics, augmented reality navigation, robotics, and digital surgical workflow tools.

The convergence of AI, cloud computing, big data from EHRs, and surgical robotics creates a compelling value proposition for high-volume surgical centers and integrated delivery networks. Strategic partnerships—between tech firms, device companies, and hospitals—accelerate product adoption. The market is expected to grow exponentially as payers begin rewarding more accurate, low‑complication care pathways.

Market Drivers

Value-based care demands: Hospitals seek to reduce readmissions, shorten stays, and avoid complications—metrics that AI analytics help address. Healthcare provider competition: Leading academic medical centers adopt cutting-edge AI surgery platforms to differentiate services and attract high‑value referrals.

Strategic alliances and investment: Major tech firms, robotics companies, and surgical OEMs are investing heavily to co-develop integrated AI surgery solutions. Analytics monetization and SaaS models: Cloud-based subscription models reduce upfront equipment capital and allow predictable recurring revenue for vendors.

Key Opportunities

Platform bundles that combine predictive analytics, computer vision support, and robotic assist modules can emerge as high-margin offerings. Software-as-a-Service (SaaS) and analytics-as-a-service models provide clinicians access to AI diagnostics and outcomes prediction without large IT investments

Cross-institution benchmarking networks using aggregated surgical data can create pay-for-performance incentives. Professional training and credentialing services powered by AI analytics create new revenue streams. Global expansion into emerging markets allows adoption of cloud AI platforms even in hospitals lacking robotics infrastructure.

Major Challenges

Reimbursement uncertainty: Most AI surgery tools are not yet billable separately, making ROI solely dependent on internal cost savings or marketing advantage. Fragmented sales channels: Hospitals vary greatly in purchasing cycles, approval processes, and budgets, complicating scale. Intellectual property complexities around core algorithms and surgical data rights.

Integration with legacy systems: Older surgical theaters, imaging equipment, and EHRs may resist smooth integration, raising deployment costs. Surgeon training and retention: Vendors face pressure to deliver robust training and ongoing support to ensure safe adoption and minimize risk.

Recent Developments

Commercial players launched subscription analytics packages enabling hospitals to forecast surgical outcomes and identify high-risk patients proactively. Leading hospital systems partnered with tech firms to integrate predictive surgical dashboards into pre-operative clinics and workflow tools. Surgical robotics companies introduced optional AI modules—such as intraoperative tissue classification or suturing assistance—sold à la carte.

Startups raised venture rounds to build computer vision platforms for laparoscopic procedures, positioning themselves as potential acquisition targets. Some providers launched aggregate analysis networks, allowing multiple hospitals to benchmark surgical outcomes anonymously and participate in value-based care pilots. New hybrid commercial models emerged: device sales bundled with AI service subscriptions and surgical performance analytics platforms.

Artificial Intelligence and Analytics in Surgery Market Companies

- Medtronic plc (Touch Surgery, AI-based analytics)

- Intuitive Surgical, Inc. (Da Vinci AI)

- Johnson & Johnson (Ethicon + C-SATS)

- Stryker Corporation (Mako Smart Robotics + OrthoLogIQ)

- Siemens Healthineers (AI-Rad Companion, Syngo Carbon)

- Zimmer Biomet (ZBEdge AI Ecosystem)

- Surgical Theater (VR & AI for neurosurgery)

- Activ Surgical (AI-powered surgical vision)

- Caresyntax (AI-Driven OR Analytics)

- Proximie (AI for tele-surgery & collaboration)

- Theator (AI surgical video analytics)

- Digital Surgery (Medtronic-acquired, AI surgical training)

- BrainLAB AG (AI-powered navigation and analytics)

- Augmedics (AR-assisted spine surgery)

- VirtaMed (AI simulation for surgical training)

- Globus Medical (Robotic AI surgical platforms)

- GE HealthCare (AI-enhanced imaging integration)

- Surgical Intelligence GmbH

- Robocath (AI-enhanced robotic catheterization)

- Hyperfine (portable MRI with AI surgical use cases)

Segments Covered in the Report

By Application

- Intraoperative Guidance & Navigation

- Real-time Video Analytics

- Augmented Reality Overlays

- AI-Based Instrument Tracking

- Surgical Workflow & Efficiency Optimization

- OR Scheduling & Staff Coordination

- Turnaround Time Analytics

- Postoperative Outcomes Monitoring

- Preoperative Planning & Risk Stratification

- Surgical Training & Simulation

- AI-based Skill Assessment

- Virtual Reality Training Modules

By Technology

- Computer Vision & Image Recognition

- Machine Learning & Deep Learning Models

- Natural Language Processing (NLP)

- Predictive Analytics Platforms

- Robotic Process Automation (RPA)

- Augmented Reality (AR) / Virtual Reality (VR)

- Edge AI & IoT Integration in Surgery

By Surgical Specialty

- General Surgery

- Orthopaedic & Spine Surgery

- Neurosurgery

- Cardiothoracic Surgery

- Gastrointestinal & Colorectal Surgery

- Urology

- ENT & Ophthalmology

By Deployment Mode

- Cloud-Based AI Platforms

- On-Premises Solutions

- Hybrid Systems

By End User

- Hospitals & Surgical Centers

- Ambulatory Surgical Centers (ASCs)

- Academic Research Institutes

- Surgical Training Facilities

- AI Health Tech Startups & Innovation Labs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Sample @ https://www.precedenceresearch.com/sample/6501

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025