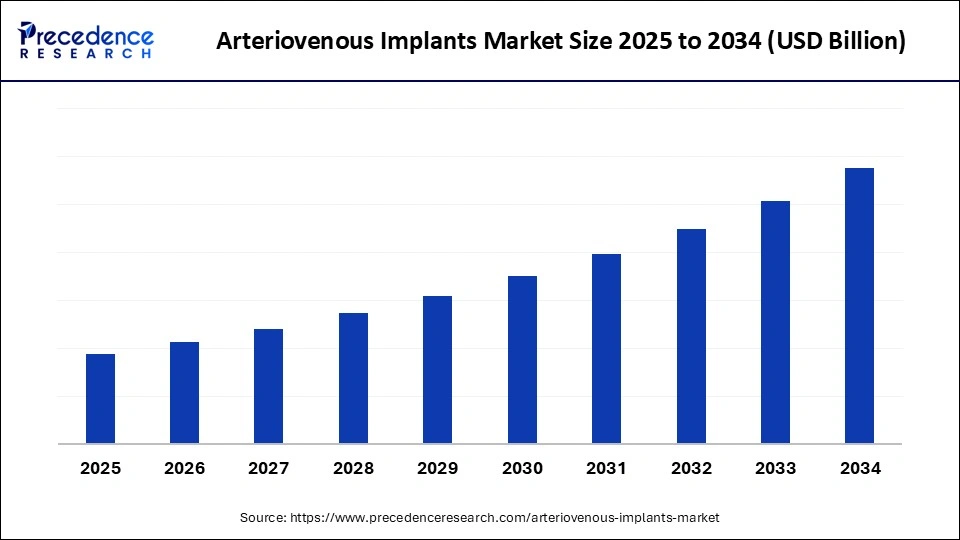

The global arteriovenous (AV) implants market is projecting impressive growth driven by an increasing prevalence of end-stage renal disease (ESRD) and expanding hemodialysis populations worldwide. With a forecast period spanning 2025 to 2034, the market is expected to sustain a healthy CAGR as new biomaterial-based vascular access technologies and supportive reimbursement landscapes push adoption.

As of 2024, North America leads in market value due to developed healthcare infrastructure and reimbursement, while Asia-Pacific marks the fastest regional growth, fueled by increasing chronic kidney disease prevalence and growing dialysis demands.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6773

Arteriovenous Implants Market Key Points

-

The market’s dominant region is North America, supported by robust dialysis care infrastructure and reimbursement policies.

-

Asia-Pacific is the fastest growing region, with rising ESRD prevalence motivating demand for vascular access solutions.

-

Over 808,000 Americans were living with ESRD in 2023, with about 68% undergoing dialysis—a key driver for implant utilization.

-

Prosthetic AV grafts and surgical AV fistula-related implants accounted for the largest market share due to their clinical preference in compromised vessels.

-

ePTFE grafts remain the leading material choice owing to their standardization and ongoing improvements such as heparin bonding.

-

Key industry players include Fresenius Medical Care, DaVita Inc., Medtronic, and Becton Dickinson, who are heavily investing in research and product innovation to strengthen market positioning.

Arteriovenous Implants Market Revenue Breakdown and Segmentation

The report highlights multiple segments in the arteriovenous implants market:

| Segment Category | Notable Market Leaders / Trends |

|---|---|

| Device / Product Type | Prosthetic AV grafts dominate, fastest growth from endoAVF devices (percutaneous) |

| Material / Technology | ePTFE grafts largest revenue share; fastest growth in tissue-engineered grafts and drug-eluting coatings |

| Indication / Clinical Use | Initial vascular access creation leads; access revision/salvage implants growing fastest |

| Procedure Type / Approach | Open surgical implantation dominant; fastest growing percutaneous and hybrid approaches |

| Revascularization / Salvage Device Type | Balloon angioplasty leads by volume; covered stents fastest growth segment |

| Product Ownership / Commercial Type | Branded originator grafts dominate; rapid CAGR in OEM/CDMO customized grafts |

| End-User / Treatment Setting | Hospital vascular surgery/interventional suites dominant; ambulatory/outpatient fastest growing |

| Patient Type / Demographics | Prevalent adult dialysis population largest; incident patients using percutaneous AVF growing fastest |

| Distribution Channel | Direct OEM and distributor channels dominate; fast growth expected in direct-to-clinic models |

| Region | North America largest; Asia-Pacific fastest growing |

Artificial intelligence (AI) is rapidly transforming the arteriovenous implants market by enhancing precision and patient outcomes at multiple stages of care. AI-powered imaging technologies enable clinicians to better evaluate vascular structures, ensuring optimal graft or fistula placement and minimizing procedural risks. This capability reduces complications and improves early patency rates.

On the manufacturing side, AI and machine learning models are leveraged to develop next-generation grafts engineered for greater durability and reduced thrombosis incidence. The integration of AI in research accelerates the innovation cycle leading to more effective, patient-specific vascular implants that improve long-term clinical outcomes.

What Factors Are Driving the Market Growth?

The primary driver is the rising global burden of ESRD, which creates an urgent need for reliable vascular access for hemodialysis patients. Increasing incidence rates, especially in aging populations and regions affected by lifestyle diseases like diabetes, enhance demand. Moreover, advancements in biomaterials such as heparin-bonded ePTFE and acellular tissue-engineered vessels improve graft durability and reduce infection risks, encouraging clinical adoption.

Supportive reimbursement policies in North America and evolving dialysis infrastructure in Asia Pacific further reinforce market growth. Additionally, the preference for hemodialysis over peritoneal dialysis globally contributes to higher implant utilization rates.

What Opportunities and Trends Are Shaping the Market?

How are innovations in biomaterials and graft technologies expanding market applications?

Innovations like bioengineered grafts resistant to infection and thrombosis open new avenues for vascular access solutions. The development of drug-eluting and antimicrobial coatings, alongside tissue-engineered vessels with FDA breakthrough designations, presents significant growth opportunities. These advances reduce reintervention rates and hospitalizations, appealing to both clinicians and payers.

Why are minimally invasive approaches gaining momentum?

Percutaneous and hybrid techniques for AV fistula creation reduce procedural duration, lower complication rates, and enable access in patients unsuitable for open surgery. Growth in integrated toolsets like covered stents and thrombectomy devices supports these trends, encouraged by clinical guidelines and regulatory approvals.

Arteriovenous Implants Market Regional and Segmentation Analysis

North America remains the market leader owing to established dialysis facilities, strong reimbursement, and concentrated R&D efforts by market leaders like Fresenius Medical Care and Medtronic. The region’s adherence to rigorous clinical guidelines and extensive registry data underpins adoption confidence.

In contrast, Asia Pacific is the fastest-growing market with increasing CKD prevalence and expanding dialysis infrastructure. Regional manufacturing capacity growth and improved regulatory clarity fuel the introduction of advanced implant technologies.

Other key market segments showcase a clear preference for prosthetic grafts in older and diabetic patients, with a shift towards percutaneous AV fistula creation in incident patients. Hospital-based vascular surgery dominates treatment settings, while outpatient facilities show rapid procedural growth.

Latest Breakthroughs and Key Players

-

FDA approval and clinical prioritization of acellular tissue-engineered vessels mark pivotal milestones.

-

Heparin-bonded surface modifications on ePTFE grafts enhance early patency and reduce thrombosis cases.

-

Advanced covered stent grafts deliver improved lesion patency rates, becoming standard in salvage procedures.

Arteriovenous Implants Market Companies

- Access Vascula / Vascular Access Solutions

- Transverse Medical

- Terumo Corporation

- Olympus / Pentax

- NxThera / Lombard Medical

- Nipro Corporation

- Merit Medical Systems

- Medtronic

- LeMaitre Vascular

- InnAVasc Medical

- Gore & Associates (W. L. Gore)

- Cook Medical

- Boston Scientific

- BD (Becton, Dickinson & Company) / BD Interventional

- B. Braun Melsungen AG

What Challenges and Cost Pressures Exist?

Despite advancements, high risks of infection and thrombosis remain critical challenges, especially due to bloodstream infections post-implantation. Procedural complications, patient acceptance barriers, and awareness limitations also restrain market growth. Additionally, cost pressures surrounding recurrent interventions and sophisticated device pricing impact healthcare budgets.

Case Study: Impact of Advanced Graft Technologies on Patient Outcomes

A leading dialysis center in North America incorporated heparin-bonded ePTFE grafts combined with AI-powered vascular imaging in preoperative planning. This integration led to a 25% reduction in infection-related hospitalizations within one year and improved graft patency rates by over 15%, demonstrating the tangible benefits of technology-driven vascular access improvements.

Read Also: Smart Retinal Implants Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025