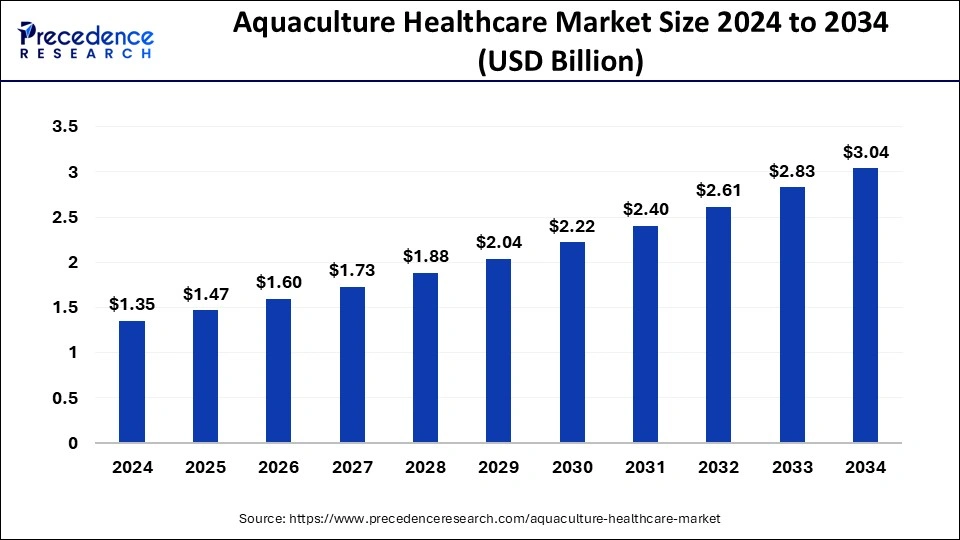

The global aquaculture healthcare market size was valued at USD 1.35 billion in 2024 and is projected to grow from USD 1.47 billion in 2025 to nearly USD 3.04 billion by 2034, registering a robust CAGR of 8.46% during the forecast period. The rising global demand for fish protein, coupled with the growing need for effective aquatic disease management, is significantly fueling market expansion.

Read Also: Cosmetic Dentistry Market

Aquaculture Healthcare Market Size 2025 to 2034

-

Market Size in 2024: USD 1.35 Billion

-

Market Size in 2025: USD 1.47 Billion

-

Market Size by 2034: USD 3.04 Billion

-

Growth Rate (2025–2034): CAGR of 8.46%

Aquaculture Healthcare Market Key Takeaways

-

The global aquaculture healthcare market is set to reach USD 3.04 billion by 2034.

-

Asia-Pacific is expected to witness the fastest growth over the forecast period.

-

By product, the drugs segment dominated in 2024, while medicated feed additives are anticipated to grow significantly.

-

By species, fish accounted for the largest share in 2024.

-

By infection, bacterial infections remained the leading segment in 2024.

-

By route of administration, topical treatments dominated the market in 2024.

-

By distribution channel, retail aqua stores led the market in 2024.

Role of Artificial Intelligence in the Aquaculture Healthcare Market

Artificial Intelligence (AI) is transforming aquaculture healthcare by enabling precision monitoring and disease prevention. AI-powered systems use sensors, cameras, and predictive analytics to

-

Monitor water quality and fish behavior

-

Detect early signs of disease

-

Automate feeding schedules to reduce waste

-

Optimize antibiotic use while enhancing sustainability

These innovations help aquaculture farmers make real-time, data-driven decisions, improving fish welfare, boosting productivity, and reducing operational risks.

Market Overview

The aquaculture healthcare market is driven by:

-

Growing demand for sustainable seafood

-

Increasing prevalence of aquatic diseases

-

Technological advancements in diagnostics and water quality monitoring

-

Government policies promoting food safety and aquaculture sustainability

Asia-Pacific continues to dominate due to large-scale fish farming practices, while North America and Europe lead in adopting advanced healthcare technologies and biosecurity measures.

Aquaculture Healthcare Market Growth Factors

-

Rising awareness of the health benefits of fish proteins

-

Government support for aquaculture expansion

-

Increasing prevalence of diseases and parasites in fish and crustaceans

-

Growing R&D investments for vaccines, probiotics, and eco-friendly treatments

-

Expansion of fish farming operations globally

Market Dynamics

Drivers

-

Rising demand for fish oil (rich in omega-3 fatty acids for cardiovascular health)

-

Growing disease outbreaks in aquaculture species, necessitating healthcare interventions

Restraints

-

Low acceptance due to limited awareness about aquaculture healthcare solutions

-

Lack of knowledge about aquatic animal diseases in certain regions

Opportunities

-

Rising disposable incomes fueling demand for nutritious seafood

-

Growth of aquaponics systems integrating fish and plant farming

-

Expansion of shrimp farming in Asian countries

Product Insights

-

Drugs segment dominated in 2024, essential for disease control and growth enhancement.

-

Medicated feed additives are expected to grow rapidly, especially in bacterial disease management.

Species Insights

-

Fish held the largest share in 2024 due to high global demand for fish protein.

-

Freshwater species such as tilapia and carp remain prominent, while marine species like seabass and seabream are gaining traction.

Infection Insights

-

Bacterial infections were the most prevalent in 2024, causing significant economic losses.

-

Viral infections are projected to grow due to the rising global spread of iridoviruses and other pathogens.

Route of Administration Insights

-

Topical treatments led the market in 2024 for managing external infections.

-

Oral administration is expected to grow fastest due to ease of use in large-scale farms.

Distribution Channel Insights

-

Retail aqua stores dominated in 2024 due to accessibility in emerging economies.

-

Online channels are gaining momentum, offering convenience, bulk orders, and expert consultations.

Regional Insights

-

Asia-Pacific: Largest and fastest-growing market, driven by large-scale fish farming in China, India, Vietnam, and Indonesia.

-

North America: Significant adoption of vaccines, probiotics, and diagnostics.

-

Europe: Strong regulatory frameworks and focus on sustainable aquaculture practices.

Recent Developments

-

March 2025: Zeolitech launched Ziobind, a natural mineral-based product that improves pond water quality.

-

January 2025: Rising trend of autogenous vaccines for species-specific disease prevention.

-

March 2025: ICAR-CIBA sequenced the goldlined seabream genome, boosting breeding and disease resistance efforts.

Aquaculture Healthcare Market Key Players

- Xylem Inc.

- Archer Daniels Midland Company

- Elanco

- Bayer Animal Health

- Merck & Co. Inc.

- Virbac S.A.

- Alltech

- Zoetis (Pfizer, Inc.)

- Benchmark Holdings Plc.

- Pentair plc.

- AKVA Group.

Segments Covered in the Report

By Product

- Vaccines

- Antibiotics

- Antifungals

- Parasiticides

- Anti-Viral Drugs

- Medicated Feed Additives

- Others

By Species

- Fishes

- Freshwater

- Tilapia

- Carp

- Others

- Marine Species

- Seabass Seabream

- Turbot

- Others

- Diadromous Species

- Salmon

- Trout

- Others

- Freshwater

- Crustaceans

- Prawns

- Shrimps

- Others

- Others

By Infection

- Bacterial Infection

- Viral Infection

- Parasitic Infection

- Fungal Infection

By Route of Administration

- Topical

- Oral

- Parenteral

- Immersion

- Spray

By Distribution Channel

- Veterinary Hospitals

- Veterinary Pharmacies

- Online Pharmacies

- Retail /Aqua Stores

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Ultra Low Temperature Freezer Market Size to Reach USD 1,721.56 Mn by 2034 - September 18, 2025

- U.S. Dental Anesthesia Market Size to Surge USD 530.27 Mn by 2034 - September 18, 2025

- India Class C and Class D Medical Devices Market Size to Hit USD 12.57 Bn by 2034 - September 18, 2025