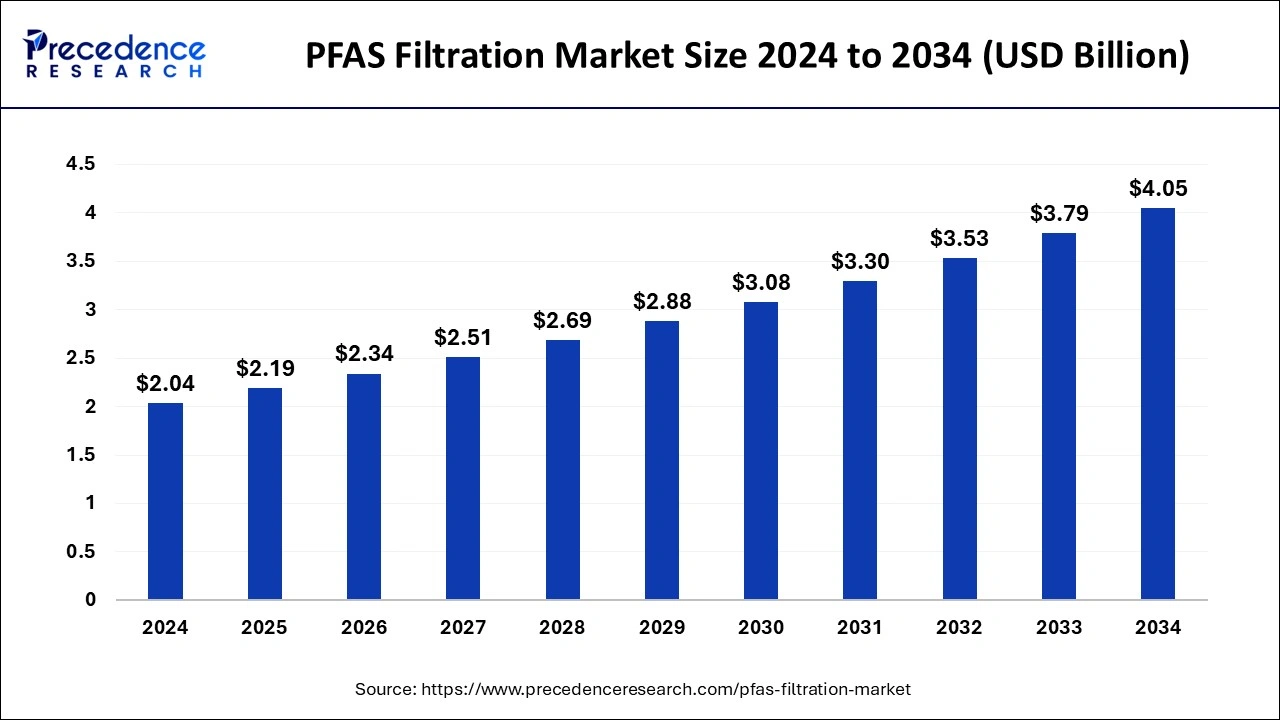

The global PFAS filtration market size was estimated at USD 2.04 billion in 2024 and is expected to increase from USD 2.19 billion in 2025 to approximately USD 4.05 billion by 2034, expanding at a CAGR of 7.11% during the forecast period. The growing need to prevent PFAS exposure—linked to severe health issues in humans and animals—is driving significant adoption of PFAS filtration technologies worldwide.

Read Also: Medical Devices Market

PFAS Filtration Market Key Takeaways

-

Market Size 2024: USD 2.04 Billion

-

Market Size 2034: USD 4.05 Billion

-

CAGR (2025–2034): 7.11%

-

Dominant Region (2024): Asia Pacific

-

Fastest Growing Region: North America

-

Leading Technology Segment (2024): Granular Activated Carbon (32.40% share)

-

Fastest Growing Technology Segment: Membrane Filtration (CAGR 9.70%)

-

Leading Media Type: Activated Carbon (38.10% share in 2024)

-

Fastest Growing Media Type: Bio-adsorbents & Nanomaterials (CAGR 10.50%)

-

Leading Application: Water Treatment (41.60% share in 2024)

-

Fastest Growing Application: Site Remediation (CAGR 9.90%)

-

Dominant End-use Industry: Municipal Water Utilities (36.80% share in 2024)

-

Fastest Growing End-use Industry: Residential (CAGR 9.50%)

-

Leading Distribution Channel: Direct Sales (34.20% share in 2024)

-

Fastest Growing Channel: Online Retail (CAGR 9.50%)

Market Overview

PFAS (Perfluoroalkyl and Polyfluoroalkyl Substances) are synthetic chemicals widely used in industrial and consumer applications. These “forever chemicals” are highly persistent in the environment—found in water, soil, air, and living organisms globally.

According to the Agency for Toxic Substances and Disease Registry (ASTDR), PFAS exposure can lead to thyroid disease, liver damage, obesity, fertility issues, hypertension, high cholesterol, and even cancer.

To address this growing environmental and health challenge, the U.S. Environmental Protection Agency (EPA) has added PFAS compounds to the Toxics Release Inventory (TRI), requiring companies to report PFAS releases, even in small concentrations.

Filtration technologies such as activated carbon and reverse osmosis membranes are the most widely adopted solutions for PFAS removal.

The Role of Artificial Intelligence (AI) in PFAS Treatment

Artificial intelligence (AI) is revolutionizing PFAS filtration by enabling smarter, more efficient water purification systems.

Machine learning models are being used to:

-

Develop one-step PFAS collection and degradation systems.

-

Optimize flow reactors for enhanced PFAS breakdown.

-

Improve ion concentration detection accuracy compared to traditional sensors.

AI-driven water quality systems are expected to play a key role in achieving zero-pollution initiatives and real-time PFAS monitoring across national water management programs.

PFAS Filtration Market Growth Factors

1. Regulatory and Customer Pressure

Global and regional authorities are enforcing stricter PFAS regulations, compelling industries and utilities to implement treatment technologies to ensure compliance and safeguard consumer health.

2. Elimination of Service Disruptions

Utilities are investing in robust PFAS treatment infrastructure to quickly respond to contamination events, minimizing water service interruptions and restoring consumer confidence.

3. Health Benefits

PFAS filtration systems significantly reduce exposure risks, helping mitigate serious health conditions linked to contaminated water and food.

4. Environmental Protection

The adoption of PFAS filtration mitigates contamination in air, soil, and water, promoting sustainability and supporting global climate and pollution control goals.

Market Dynamics

Driver – PFAS Contaminating Water and Food

PFAS exposure primarily occurs through contaminated food and drinking water. Industrial discharge, landfill leaching, sewage treatment, and firefighting foams are major PFAS sources.

Studies indicate that 77% of public water systems have yet to fully implement PFAS treatment solutions, despite available technologies capable of removing up to 99% of regulated PFAS compounds.

Restraint – High Cost of Treatment

PFAS filtration systems are expensive to implement and maintain, costing billions annually across public and private water systems. Without significant PFAS production reduction, global environmental costs could exceed USD 100 trillion in cumulative impact.

Opportunity – Biological Methods

Biological PFAS removal methods—such as biodegradation, bioremediation, bioabsorption, and phytoremediation—are emerging as sustainable, cost-effective, and eco-friendly alternatives.

These techniques offer long-term scalability and safety compared to traditional chemical treatments.

Technology Insights

-

Granular Activated Carbon (GAC) dominated in 2024 with a 32.40% share due to affordability, proven PFAS removal efficacy, and compatibility with existing water treatment systems.

-

Membrane Filtration (including nanofiltration and reverse osmosis) is the fastest-growing technology, capable of removing over 90% of PFAS, including short-chain compounds that are harder to eliminate using traditional methods.

Media Type Insights

-

Activated Carbon led the market with 38.10% share in 2024, favored for its high adsorption capacity and EPA-approved standards for PFAS removal.

-

Bio-adsorbents and Nanomaterials are emerging rapidly (CAGR 10.50%) due to their enhanced adsorption efficiency, reusability, and potential for sustainable large-scale deployment.

Application Insights

-

Water Treatment accounted for the largest share (41.60%) in 2024, driven by growing contamination levels and strict regulatory frameworks.

-

Site Remediation is expected to expand fastest (CAGR 9.90%) due to increasing cleanup initiatives and advanced in-situ PFAS removal technologies.

End-use Industry Insights

-

Municipal Water Utilities dominate the market (36.80% share), supported by large-scale public infrastructure and funding for PFAS treatment systems.

-

Residential Segment is witnessing rapid adoption (CAGR 9.50%), with consumers increasingly investing in point-of-entry and point-of-use filtration systems for home water safety.

Distribution Channel Insights

-

Direct Sales (34.20% share in 2024) remain the primary channel, enabling tailored PFAS solutions through engineering firms and OEMs.

-

Online Retail is projected to grow significantly (CAGR 9.50%), driven by consumer awareness and accessibility of home filtration systems.

Regional Insights

Asia Pacific

Asia Pacific dominated the global PFAS filtration market in 2024, led by industrial expansion, urbanization, and increasing environmental awareness.

Countries like India, China, and Singapore are advancing water treatment infrastructure with digital systems such as SCADA and telemetry.

Regional efforts focus on wastewater reuse, sanitation, and PFAS control, supported by partnerships and policy incentives.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- PFAS Filtration Market Size to Hit USD 4.05 Billion by 2034 - October 8, 2025

- Medical Devices Market Size to Hit USD 1,146.95 Bn by 2034 - October 8, 2025

- Antibody Drug Conjugates Market Size to Hit USD 31.96 Bn by 2034 - October 8, 2025