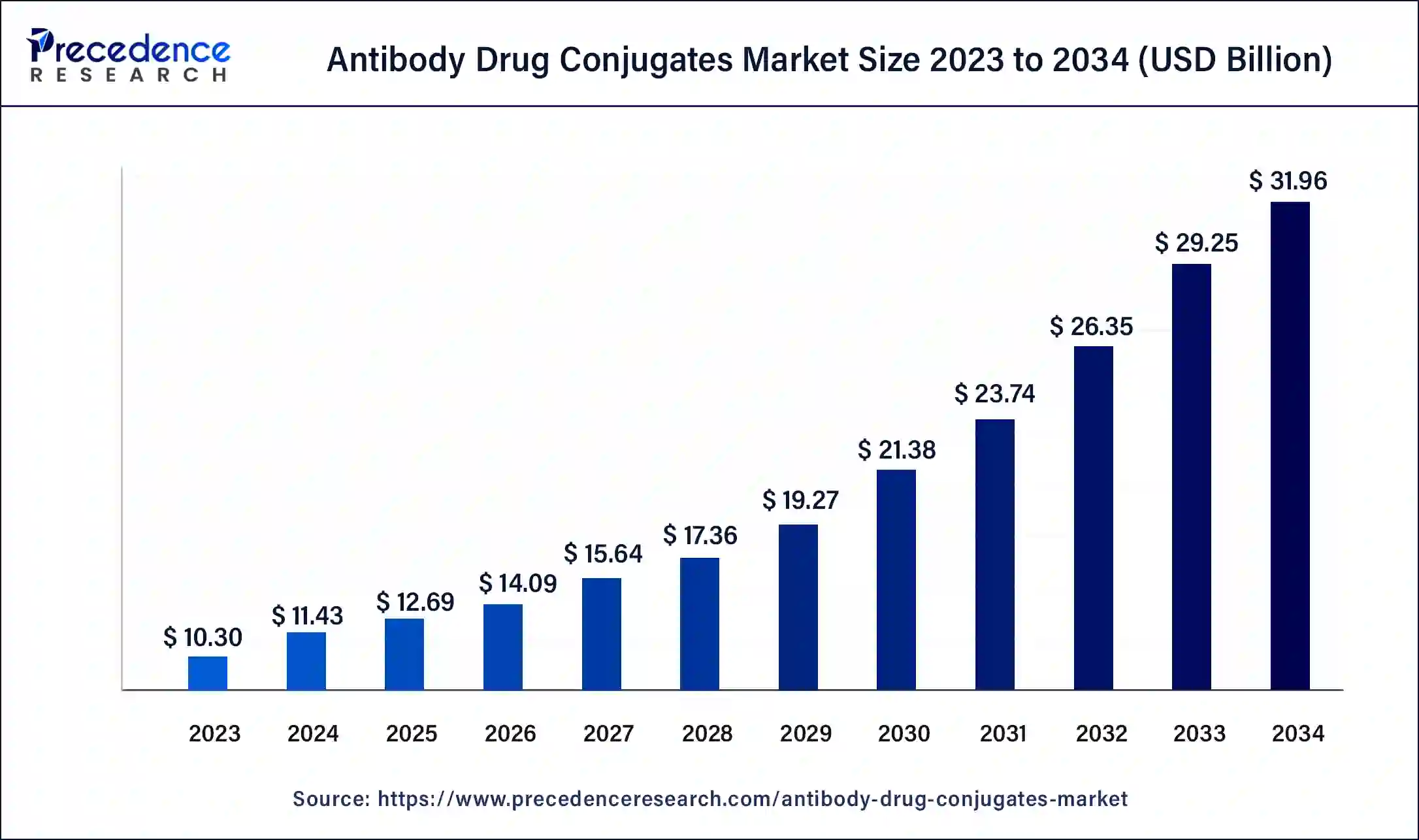

The global antibody drug conjugates (ADC) market has witnessed strong growth due to the rising prevalence of cancer and the increasing adoption of targeted therapies. Valued at USD 11.43 billion in 2024, the market is projected to reach USD 31.96 billion by 2034, growing at a robust CAGR of 10.83% from 2025 to 2034. North America dominates the market, while Asia Pacific is expected to register the fastest growth over the forecast period.

Read Also: Protein Expression Market

Key Market Takeaways

-

Regional Insights:

-

North America: 50% market share in 2024

-

Europe: Second-largest market globally

-

Asia Pacific: Fastest-growing at a CAGR of 19%

-

-

Product Insights:

-

Kadcyla: 22.60% market share in 2024

-

Enhertu: Fastest-growing segment

-

-

Antigen Target:

-

HER2 receptor: 24.40% market share

-

Trop-2: Highest CAGR of 14.80%

-

-

Application Insights:

-

Breast cancer: 28.90% market share

-

Ovarian cancer: Fastest-growing at CAGR of 13.20%

-

-

End User Insights:

-

Hospitals & clinics: 36.50% market share

-

Specialty cancer centers: Highest CAGR of 12.40%

-

-

Distribution Channel Insights:

-

Direct sales: 48.20% market share

-

Online platforms: Highest CAGR of 11.60%

-

U.S. Antibody Drug Conjugates Market

The U.S. ADC market was valued at USD 4.00 billion in 2024 and is expected to reach USD 11.28 billion by 2034, at a CAGR of 11.5%. North America leads globally, supported by high healthcare expenditure, robust R&D initiatives, and the increasing incidence of cancer.

Market Overview

Antibody drug conjugates are targeted cancer therapeutics combining monoclonal antibodies with potent cytotoxic agents. ADCs selectively target cancer cells, minimizing damage to healthy cells, which reduces systemic toxicity compared to conventional chemotherapy.

A typical ADC consists of:

-

Monoclonal antibody: Highly selective for the target antigen

-

Cytotoxic payload: Potent cell-killing agent

-

Stable linker: Connects the antibody to the payload for targeted delivery

Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 10.30 Billion |

| Market Size in 2024 | USD 11.43 Billion |

| Market Size by 2034 | USD 31.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.83% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growth Factors

-

Rising cancer prevalence globally, including ovarian, lung, breast, and colon cancers

-

Increasing clinical trials for next-generation ADCs

-

Investments in R&D by pharmaceutical companies

-

Government and private sector initiatives for cancer treatment and prevention

-

Technological innovations in linker technology, antibody design, and payload development

Market Challenges

-

High production costs due to advanced technologies and skilled workforce requirements

-

Limitations including low tissue penetration, immunogenicity, and drug resistance

-

Regulatory challenges and long development timelines

Opportunities

-

Growing government and private investments in cancer research

-

Expansion of specialty cancer centers and advanced oncology treatments

-

Adoption of digital platforms and direct-to-patient channels to increase awareness and accessibility

Segment Insights

Product Insights

-

Kadcyla: Largest market share due to adoption for breast cancer therapy

-

Enhertu: Fastest-growing segment driven by HER2-positive cancers

Antigen Target

-

HER2 receptor: Dominant in 2024

-

Trop-2: Fastest CAGR, driven by innovative ADCs like datopotamab deruxtecan (Dato-DXd) and sacituzumab govitecan (SG)

Application Insights

-

Breast cancer: Largest segment with 28.90% share

-

Ovarian cancer: Fastest-growing due to improved targeted therapies

End-User Insights

-

Hospitals & Clinics: Largest share

-

Specialty Cancer Centers: Fastest CAGR due to demand for precision oncology

Distribution Channel Insights

-

Direct Sales: Dominates with 48.20% share

-

Online Platforms: Fastest-growing due to digitization in healthcare

Regional Insights

-

North America: Largest market, supported by high healthcare expenditure and R&D

-

Europe: Second-largest, driven by rising cancer prevalence and research infrastructure

-

Asia Pacific: Fastest-growing, fueled by rising cancer incidence, geriatric population, and adoption of advanced therapies

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- PFAS Filtration Market Size to Hit USD 4.05 Billion by 2034 - October 8, 2025

- Medical Devices Market Size to Hit USD 1,146.95 Bn by 2034 - October 8, 2025

- Antibody Drug Conjugates Market Size to Hit USD 31.96 Bn by 2034 - October 8, 2025