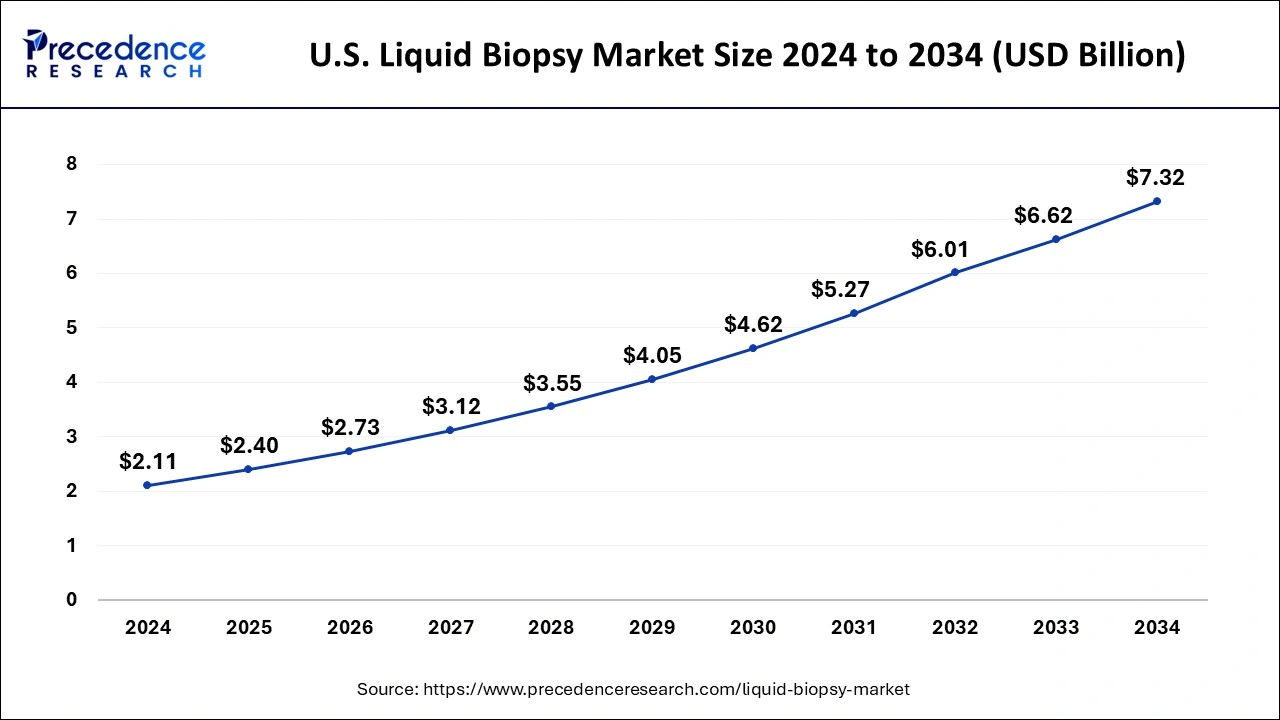

The U.S. liquid biopsy market was valued at USD 1.85 billion in 2024 and is projected to reach approximately USD 6.62 billion by 2034, expanding at a CAGR of 13.55% during the forecast period from 2025 to 2034. The market is driven by the rising prevalence of cancer, increasing adoption of advanced genomic technologies, and the growing use of minimally invasive diagnostic methods.

Read Also: Healthcare Staffing Market

Key Takeaways

-

Market Size: USD 1.85 billion in 2024; projected USD 6.62 billion by 2034.

-

Growth Rate: CAGR of 13.55% (2025–2034).

-

Leading Biomarker Type: Circulating tumor cells (CTCs) expected to dominate 2025–2034.

-

Leading Application: Cancer therapeutic applications held the largest market share in 2024.

-

Fastest Growing Sample Type: Blood (plasma/serum).

-

Top End-User: Hospitals and laboratories in 2024.

Market Overview

Liquid biopsy is a revolutionary diagnostic technique that involves sampling and analyzing biological fluids, such as blood or urine, to detect and monitor diseases like cancer. Unlike traditional tissue biopsies, liquid biopsies are minimally invasive, painless, and more convenient, making them particularly suitable for patients unable to undergo surgery.

This market is a practical outcome of advances in human genome sequencing and high-sensitivity detection assays, enabling accurate detection of circulating tumor cells (CTCs), cell-free DNA (cfDNA), RNA, and other biomarkers. Despite its advantages, challenges such as limited sensitivity and specificity of certain liquid biopsy tests can hinder market growth.

Market Dynamics

Drivers

-

Rising Prevalence of Cancer: Cancer remains a leading cause of death globally, with nearly 10 million deaths in 2020. Liquid biopsy offers early detection, therapy monitoring, and patient comfort, increasing its adoption.

-

Technological Advancements: Development of NGS, PCR, digital PCR, and epigenetic analysis improves diagnostic accuracy and treatment monitoring.

Restraints

-

Reduced Sensitivity in Certain Tests: Low concentrations of ctDNA post-treatment can lead to false-negative results, impacting reliability.

Opportunities

-

Companion Diagnostics: Co-development of companion diagnostics with therapeutic drugs supports personalized treatment, accelerating commercialization and improving outcomes.

Segment Insights

By Biomarker Type

-

CTCs: Dominant segment.

-

RNA (microRNA, mRNA): Expected CAGR of 9.20%, increasingly used for prognosis, treatment monitoring, and cancer diagnosis.

By Technology/Platform

-

Next-Generation Sequencing (NGS): Largest share in 2024 at 42.10%, enabling comprehensive genomic profiling.

-

Epigenetic Analysis: Expected CAGR of 9.50%, important for minimal residual disease (MRD) detection and personalized therapy.

By Test Type/Application

-

Therapy Selection/Companion Diagnostics: Largest share 27.80%, guiding treatment decisions based on genetic alterations.

-

MRD Detection: Expected CAGR 10.30%, increasingly used to monitor cancer relapse with minimal procedures.

By Cancer Type

-

Lung Cancer (NSCLC, SCLC): Largest share 28.60%, driven by demand for precision medicine.

-

Pancreatic Cancer: Expected CAGR 8.70%, with liquid biopsies enabling early detection and treatment monitoring.

By Product & Service Type

-

Services: Largest share 44.90%, including laboratory testing, sample collection, and data interpretation.

-

Software & Bioinformatics Tools: Expected CAGR 9.10%, critical for analyzing genomic data.

By Clinical Setting/End-User

-

Reference Laboratories: Largest share 39.70%, including major players like Foundation Medicine and Guardant Health.

-

Biopharmaceutical & Biotechnology Companies: Expected CAGR 8.90%, leveraging liquid biopsy for drug development and clinical trials.

By Sample Type

-

Blood (Plasma/Serum): Largest share 81.30%, widely used for sensitivity and sample handling.

-

Cerebrospinal Fluid (CSF): Expected CAGR 9.40%, important for CNS tumor monitoring.

By Business Model

-

Centralized Testing Labs: Largest share 46.20%, providing a wide range of liquid biopsy services.

-

Direct-to-Consumer (DTC) Testing Models: Expected CAGR 10.60%, enabling consumer access to genetic information.

Leading Companies

-

ANGLE plc

-

Biocept Inc.

-

Bio-Rad Laboratories Inc.

-

Epigenomics AG

-

Exact Sciences Corporation

-

F. Hoffmann-La Roche AG

-

Guardant Health Inc.

-

Illumina Inc.

-

MDxHealth SA

-

Menarini Silicon Biosystems

-

QIAGEN N.V.

-

Thermo Fisher Scientific Inc.

Conclusion

The U.S. liquid biopsy market is poised for strong growth over the next decade, driven by rising cancer prevalence, advanced genomic technologies, and growing adoption of minimally invasive diagnostics. With NGS, epigenetic analysis, and companion diagnostics at the forefront, liquid biopsies are transforming cancer detection, monitoring, and personalized therapy, offering significant opportunities for healthcare providers, laboratories, and biotech companies.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Clinical Trials Market Size to Reach USD 149.58 Billion by 2034 - October 8, 2025

- U.S. Liquid Biopsy Market Size To Hit USD 6.62 Billion By 2034 - October 8, 2025

- Healthcare Staffing Market Size to Reach USD 82.47 Bn by 2034 - October 8, 2025