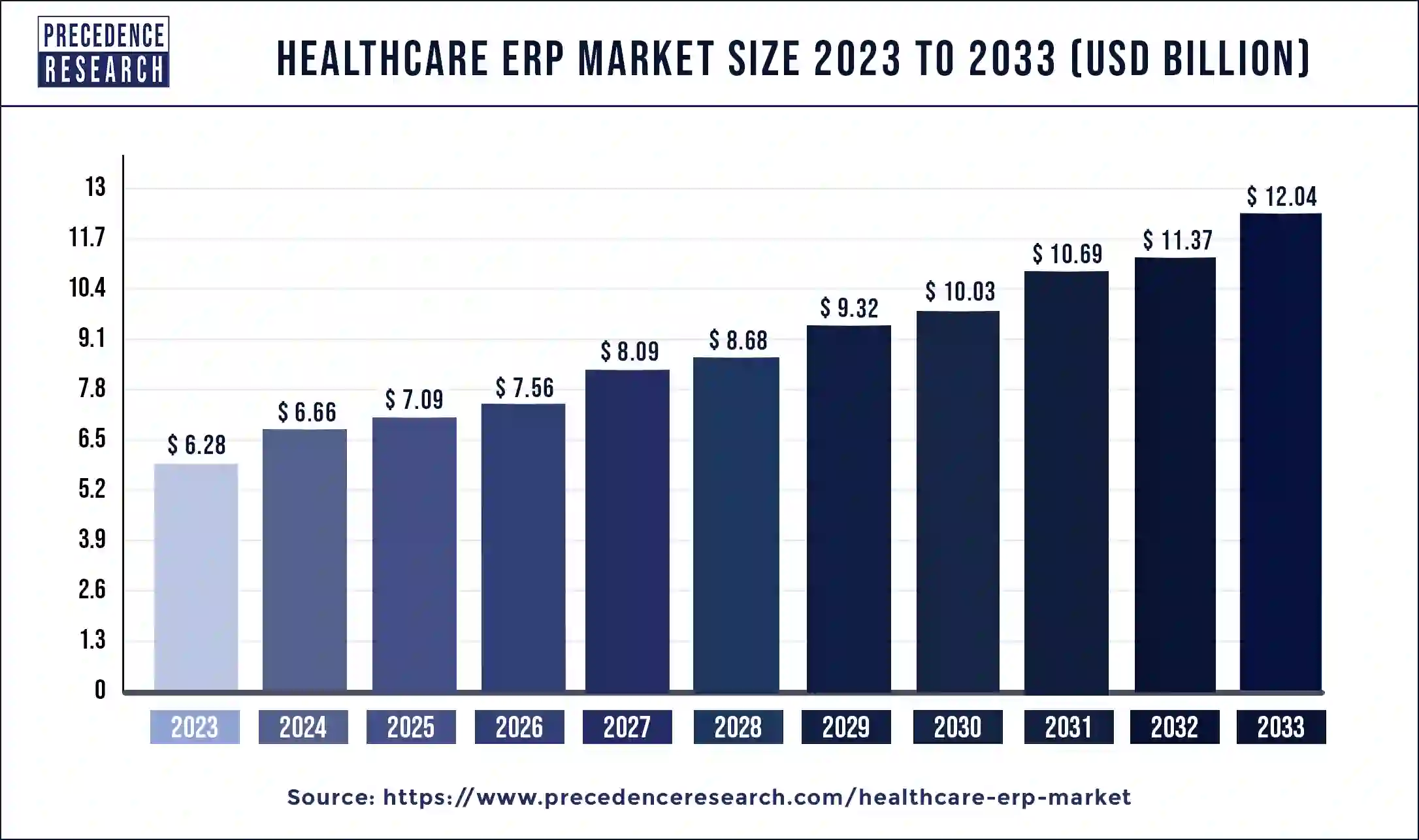

The global healthcare ERP market was valued at USD 6.66 billion in 2024 and is projected to reach USD 12.71 billion by 2034, growing at a CAGR of 6.68% during the forecast period. ERP systems are rapidly becoming essential for healthcare organizations to streamline operations, integrate clinical and administrative workflows, and optimize resources.

Key Market Takeaways

-

North America dominated the market in 2024 with a share of 34%, largely due to advanced healthcare infrastructure and early adoption of digital technologies.

-

Asia-Pacific is projected to grow at the fastest CAGR, driven by rising healthcare expenditure, aging populations, and increasing digitalization of healthcare services.

-

On-premise ERP solutions dominated in 2024, while cloud-based ERP systems are projected to experience the fastest growth due to cost-effectiveness, scalability, and remote access.

-

By function, finance and billing led the market in 2024, with inventory and material management expected to grow fastest in the coming years.

-

Hospitals are currently the largest end-users, while clinics are projected to witness significant growth.

Role of AI and Advanced Technologies in Healthcare ERP

Artificial Intelligence has revolutionized the healthcare ERP landscape by enabling data-driven decision-making and predictive insights:

-

Predictive Analytics: Forecasting patient volumes, optimizing staffing schedules, and managing inventory requirements.

-

Workflow Optimization: Identifying inefficiencies in clinical and administrative processes, reducing operational bottlenecks.

-

Natural Language Processing (NLP): Extracting and analyzing unstructured data from electronic health records (EHRs).

-

Virtual Assistants & Chatbots: Managing routine patient inquiries, supporting staff, and reducing administrative workload.

U.S. Healthcare ERP Market Outlook (2025–2034)

The U.S. healthcare ERP market was valued at USD 1.90 billion in 2024 and is projected to grow to USD 3.35 billion by 2034, at a CAGR of 5.83%. Key factors contributing to this growth include

-

High adoption of digital healthcare solutions.

-

Increased government support for health IT infrastructure.

-

Rising prevalence of chronic diseases and growing healthcare expenditures.

-

Integration of ERP with Electronic Health Records (EHRs) to improve patient care management.

Market Dynamics

Drivers

-

Growing Demand for Digital Management Solutions: Healthcare ERP systems centralize patient, inventory, and financial data, reducing redundancies and enhancing decision-making.

-

Rising Hospital Admissions: Due to chronic diseases like diabetes, cardiovascular disease, and cancer, the demand for efficient healthcare management is growing.

-

Integration with AI and Cloud Technology: Enhances workflow efficiency, resource allocation, and predictive capabilities.

Opportunities

-

Advanced analytics to forecast patient admissions and optimize resource allocation.

-

Expansion of ERP adoption in small and mid-sized healthcare facilities, especially in emerging economies.

-

Increasing interest in cloud-based ERP solutions for cost-effective scalability.

Restraints

-

High initial implementation costs and integration complexity with legacy systems.

-

Data security and compliance concerns with sensitive patient and financial information.

Segment Insights

By Function

-

Finance & Billing: Largest revenue contributor in 2024; manages complex billing cycles and insurance claims.

-

Inventory & Material Management: Expected fastest growth; improves supply chain efficiency and ensures real-time stock monitoring.

-

Patient Relationship Management (PRM): Enhances patient engagement and care personalization, improving satisfaction and loyalty.

By Deployment

-

On-Premise ERP: Favored for control, security, and compliance by large healthcare organizations.

-

Cloud-Based ERP: Fastest growing; supports remote access, modular deployment, and reduces upfront costs.

By End-Use

-

Hospitals: Primary adopters due to scale and complexity.

-

Clinics: Expected rapid adoption to streamline operations and enhance patient care.

-

Nursing Homes & Others: Growing adoption driven by need for administrative efficiency and patient monitoring.

Regional Insights

-

North America: Largest market; advanced healthcare infrastructure, early digital adoption, and government support drive ERP deployment.

-

Asia-Pacific: Fastest-growing region; increasing healthcare investment, private sector expansion, and aging population drive ERP adoption.

-

Europe: Steady growth due to government initiatives and advanced IT adoption.

-

Latin America & MEA: Gradual adoption with rising private healthcare services and digital healthcare initiatives.

Healthcare ERP Market Companies

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- McKesson Corporation

- Sage Group Plc.

- Infor, Inc.

- Odoo

- QAD, Inc.

- Aptean

- Epicor Software Corporation

Segments Covered in the Report

By Function

- Supply Chain & Logistics

- Finance & Billing

- Inventory Management

- Patient Relationship Management

- Others

By Deployment

- On Premise

- Cloud

By End User

- Hospitals

- Clinics

- Nursing Homes

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Read Also: Cell Therapy Manufacturing Market

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com