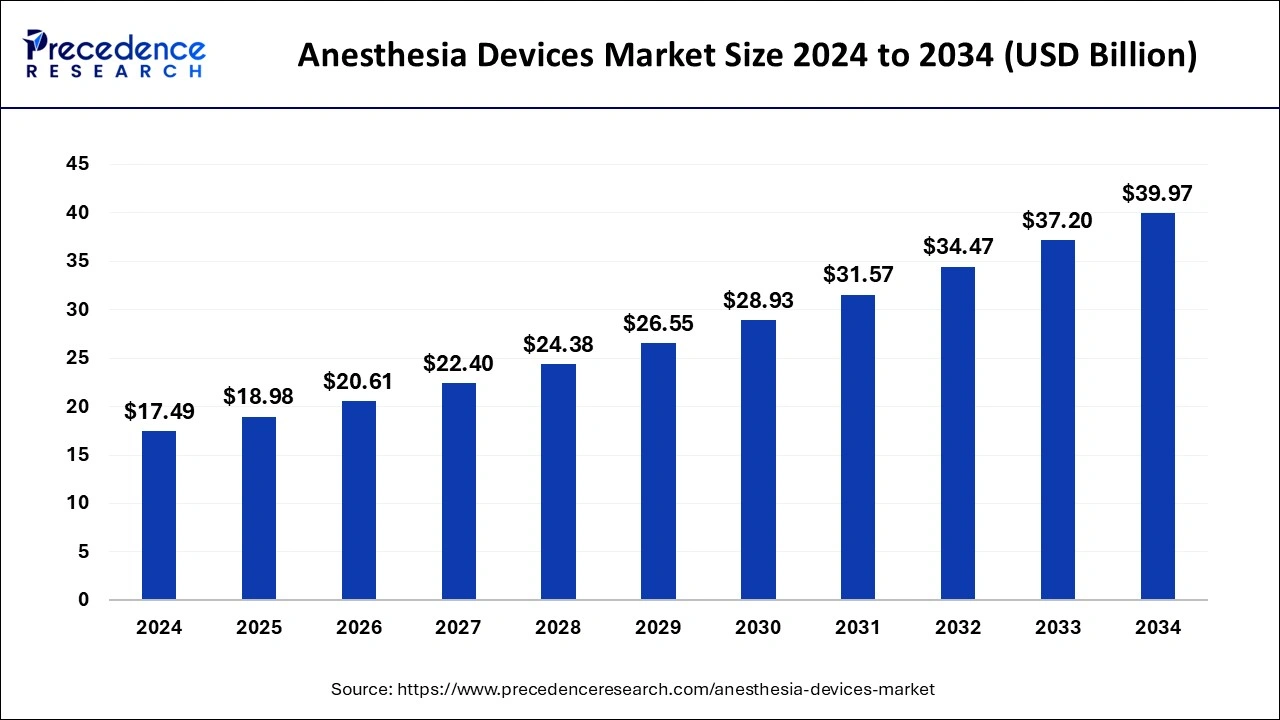

The global anesthesia devices market was valued at USD 17.49 billion in 2024 and is projected to grow from USD 18.98 billion in 2025 to around USD 39.97 billion by 2034, expanding at a CAGR of 8.62% during the forecast period. Growth is fueled by the rising prevalence of chronic diseases, increased surgical volumes worldwide, rapid technological innovations, and the integration of artificial intelligence (AI) into anesthesia care.

Key Takeaways

-

Market Size: USD 17.49 billion in 2024; projected at USD 39.97 billion by 2034.

-

Growth Rate: CAGR of 8.62% (2025–2034).

-

By Product: Anesthesia delivery machines led the market with over 49.67% share in 2024.

-

By Application: Cardiology held the largest market share at 25.01% in 2024.

-

By End User: Hospitals dominated with more than 58.59% share in 2024.

-

Regional Insights: North America led with a 41.86% share in 2024, while Asia-Pacific is expected to record the fastest growth.

-

U.S. Market: Valued at USD 6.49 billion in 2024, projected to reach USD 13.25 billion by 2034 at 7.40% CAGR.

Read Also: Generic Sterile Injectable Market

Market Overview

Anesthesia devices play a critical role in modern surgical care by managing pain, controlling patient breathing, and stabilizing vital parameters such as blood pressure and heart rhythm during procedures. These devices are also used to reduce anxiety before operations and to ensure patient safety and comfort throughout the process.

The global demand for anesthesia devices is directly linked to the rising burden of cardiovascular, neurological, and orthopedic disorders, the increasing number of road traffic accidents, and the growth of surgical procedures worldwide. Post-pandemic, the market witnessed a strong recovery as deferred surgeries resumed, boosting equipment demand.

Role of AI in the Anesthesia Devices Market

Artificial Intelligence is revolutionizing the anesthesia ecosystem:

-

Automated Monitoring: AI tracks vital signs in real time, alerting anesthesiologists to potential risks.

-

Customized Dosing: Algorithms predict the optimal dosage of anesthetics tailored to each patient’s physiology.

-

Predictive Analytics: AI models can anticipate adverse outcomes, helping to prevent complications.

-

Surgical Planning: AI enables multi-variable risk scoring based on clinical, biological, and imaging data, guiding surgeons in decision-making.

-

Innovation Example: The U.S. Army Institute of Surgical Research in partnership with MIT is developing AI-driven devices for trauma anesthesia, capable of mapping nerve bundles and guiding automated injections for pain management (2025).

Regional Insights

North America

-

Held 41.86% market share in 2024.

-

Growth is driven by the rapid adoption of advanced surgical technologies, the high prevalence of chronic diseases, and a strong healthcare infrastructure.

-

The U.S. alone is forecast to reach USD 13.25 billion by 2034.

-

Product innovation is high: Dräger launched its Atlan anesthesia workstation in the U.S. in 2023, further strengthening the market.

Europe

-

Strong market presence supported by advanced healthcare systems and demand for minimally invasive surgeries.

-

Increasing government focus on patient safety is fueling demand for modern anesthesia workstations and monitoring systems.

Asia-Pacific

-

Projected to be the fastest-growing region.

-

Rising geriatric population, higher chronic disease incidence, and growing investments in healthcare infrastructure drive demand.

-

Recent collaborations, such as the 2025 Russian-Chinese project on localized medical device production, are expected to accelerate market growth.

Middle East & Africa / Latin America

-

Emerging markets are seeing an increasing adoption of anesthesia devices due to expanding healthcare infrastructure and growing demand for advanced surgical procedures.

Market Dynamics

Driver – Rising Demand for Cardiovascular Procedures

Cardiovascular diseases are a major global health burden. Increasing cases of coronary artery disease, hypertension, and heart failure are driving the need for advanced surgical procedures such as bypass surgeries, angioplasties, and implantations. These require precise anesthesia delivery and monitoring, fueling demand for next-gen devices.

Restraint – Regulatory Hurdles & Patient Risks

Anesthesia devices face strict regulatory standards, increasing R&D and compliance costs. Additionally, anesthesia itself carries risks such as hypoxia, adverse drug reactions, and post-operative complications, sometimes limiting adoption.

Opportunity – Customized & Integrated Anesthesia Systems

The industry is witnessing a shift toward personalized anesthesia, tailoring doses to patient-specific needs. Integrated systems with automated controls reduce errors, enhance efficiency, and support precision medicine. This trend presents lucrative opportunities for manufacturers.

Segment Insights

By Product

-

Anesthesia Delivery Machines: Dominated with a 49.67% share in 2024.

-

Anesthesia Disposables & Accessories: Expected the fastest growth due to increasing surgical volumes.

-

Monitors & AIMS (Anesthesia Information Management Systems): Demand rising for real-time monitoring and electronic record-keeping.

By Type

-

General Anesthesia: Largest segment; essential for complex surgeries.

-

Local Anesthesia: Fastest-growing, as it is safer, less invasive, and allows quicker recovery.

By Application

-

Cardiology: Held 25.01% share in 2024 and will remain dominant.

-

Neurology: Fastest growth anticipated, supported by rising neurodegenerative disease prevalence and growing adoption of neuro-anesthesia departments (e.g., PGI’s planned expansion in 2025).

By End User

-

Hospitals: Largest segment, accounting for 58.59% share in 2024, driven by advanced infrastructure and higher surgical volumes.

-

Ambulatory Surgical Centers & Clinics: Expected to grow steadily with the rise of day-care surgeries.

Key Market Players

-

Ambu A/S

-

Becton, Dickinson and Company

-

General Electric (GE Healthcare)

-

3M Company

-

Draegerwerk AG & Co. KGAA

-

Smiths Medical

-

Koninklijke Philips N.V.

-

B. Braun Melsungen AG

-

Teleflex Incorporated

-

SunMed

Conclusion

The anesthesia devices market is on a strong growth trajectory, supported by rising surgical volumes, technological breakthroughs, and the integration of AI. With increasing demand for personalized anesthesia solutions and advancements in monitoring systems, market players are well-positioned to capitalize on emerging opportunities. North America remains the dominant hub, while Asia-Pacific is set to deliver exponential growth over the next decade.

- Cell Therapy Manufacturing Market Size to Reach USD 18.89 Billion by 2034 - September 25, 2025

- Medical Device Outsourcing Market Size to Hit USD 525.53 Billion by 2034 - September 25, 2025

- Anesthesia Devices Market Size to Surpass USD 39.97 Billion by 2034 - September 24, 2025