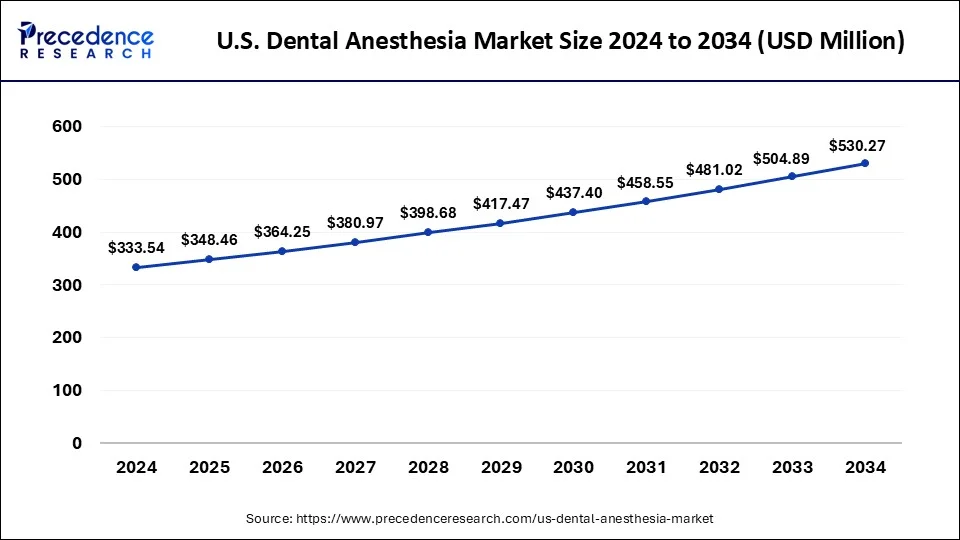

The U.S. dental anesthesia market size was valued at USD 333.54 million in 2024, estimated at USD 348.46 million in 2025, and is projected to reach around USD 530.27 million by 2034, growing at a CAGR of 4.80%. The rise in oral healthcare treatments, cosmetic dentistry demand, and the growing popularity of pain-free dentistry are key factors fueling market expansion.

U.S. Dental Anesthesia Market Size 2025 to 2034

-

Market Value (2024): USD 333.54 million

-

Market Value (2025): USD 348.46 million

-

Market Value (2034): USD 530.27 million

-

CAGR (2025–2034): 4.80%

Read Also: India Class C and Class D Medical Devices Market

Role of AI in U.S. Dental Anesthesia

Artificial Intelligence is reshaping dental anesthesia by enabling dose personalization based on age, weight, and medical history, improving workflow efficiency, and reducing risks. AI-powered robots for anesthesia delivery are being explored, while AI also enhances patient scheduling, clinical documentation, and safety—boosting trust in modern dental care.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 333.54 Billion |

| Market Size in 2025 | USD 348.46 Billion |

| Market Size by 2034 | USD 530.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Anesthesia Type, End User, and Packaging Type |

Key Takeaways

-

Local anesthesia dominated with a 58.82% share in 2024.

-

Articaine led product type with 34.75% share in 2024; Lidocaine expected to be fastest-growing.

-

Clinics held a 52.87% market share in 2024; hospitals are expected to grow notably.

-

Cartridges dominated packaging with a 55.47% share in 2024, while ampoules & vials saw the fastest growth.

-

Rising patient inclination toward sedation and pain-free dentistry is accelerating demand.

Market Overview

Dental anesthesia includes injections, sprays, and gels to numb specific areas during procedures. Its safety, combined with rising oral health awareness, insurance coverage, and advanced technologies, supports market growth. The U.S. remains a leader due to its strong healthcare infrastructure and concentration of global dental device and pharmaceutical manufacturers.

U.S. Dental Anesthesia Market Growth Factors

-

Rising Prevalence of Dental Issues: The increasing incidence of oral health problems, including dental caries, gum disease, and other conditions, is driving higher demand for dental procedures, which in turn fuels the growth of the dental anesthesia market.

-

Lifestyle Changes: Higher disposable incomes and changing dietary habits, such as increased consumption of processed and sugary foods, combined with more sedentary lifestyles, are contributing to a rise in dental and oral health issues, thereby expanding market demand.

-

Aging Population: The growing geriatric population is more prone to dental problems that require frequent and complex treatments, increasing the need for dental anesthesia during these procedures.

-

Awareness and Cosmetic Dentistry Trends: Rising awareness about oral hygiene and the growing popularity of dental aesthetic procedures for improved facial appearance are further driving market growth.

-

Government Investment: Increased investment by the U.S. government in healthcare and dental care programs, including consumer dental products and services, is supporting the adoption and accessibility of dental anesthesia, boosting market expansion.

Segment Insights

By Product Type

-

Articaine dominated in 2024; Lidocaine projected as fastest-growing.

-

Other products include Mepivacaine, Bupivacaine, and Prilocaine.

By Anesthesia Type

-

Local anesthesia held the largest share in 2024.

-

General anesthesia & sedation are projected to expand significantly.

By End User

-

Clinics led in 2024; hospitals expected to see strong growth with advanced dental departments.

By Packaging Type

-

Cartridges dominated in 2024; ampoules & vials to grow fastest due to safety and durability.

U.S. Dental Anesthesia Market Companies

- 3M

- Dentsply Sirona

- Laboratories Inibsa

- Zeyco

- Henry Schein, Inc

- Cetylite, Inc.

- Septodont Holding

- Aspen Holdings

- Centrix Inc

Segments Covered in the Report

By Product Type

- Articaine

- Lidocaine

- Mepivacaine

- Bupivacaine

- Prilocaine

- Others

By Anesthesia Type

- General Anesthesia and Sedation

- Local Anesthesia

By End User

- Hospitals

- Clinics

- Others

By Packaging Type

- Ampoules and Vials

- Catridges

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Ultra Low Temperature Freezer Market Size to Reach USD 1,721.56 Mn by 2034 - September 18, 2025

- U.S. Dental Anesthesia Market Size to Surge USD 530.27 Mn by 2034 - September 18, 2025

- India Class C and Class D Medical Devices Market Size to Hit USD 12.57 Bn by 2034 - September 18, 2025