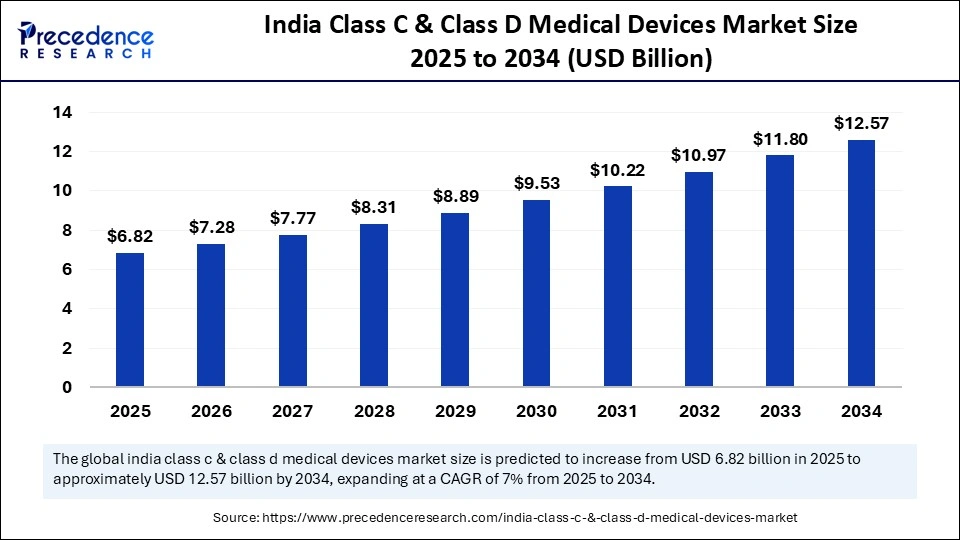

The India Class C and Class D medical devices market size reached USD 6.40 billion in 2024 and is projected to grow from USD 6.82 billion in 2025 to around USD 12.57 billion by 2034, expanding at a CAGR of 7.00% during the forecast period. Growth is fueled by rising healthcare investments, government initiatives, the increasing burden of chronic illnesses, and rapid technological advancements that enable the adoption of sophisticated medical products.

Market Overview

The Central Drugs Standard Control Organization (CDSCO) regulates Class C and Class D devices, ensuring stricter oversight compared to Class A and B. These devices are high-risk (e.g., pacemakers, defibrillators, drug-eluting stents, bone fixation implants, intraocular lenses) and primarily used in hospitals and specialized clinics.

Factors such as an aging population, rising chronic disease prevalence, and the ‘Make in India’ and Production Linked Incentive (PLI) schemes are propelling market growth. Local manufacturing, combined with R&D investments, is improving patient outcomes and strengthening India’s medical device ecosystem.

Read Also: Cosmetic Dentistry Market

India Class C and Class D Medical Devices Market Size 2025 to 2034

-

Market Value (2024): USD 6.40 billion

-

Market Value (2025): USD 6.82 billion

-

Market Value (2034): USD 12.57 billion

-

CAGR (2025–2034): 7.00%

India Class C and Class D Medical Devices Market Key Takeaways

-

The market is projected to grow at a CAGR of 7.00% from 2025 to 2034.

-

By product type, the other segment held the largest share of 84.80% in 2024.

-

The surgical sutures segment is anticipated to record notable growth over the forecast period.

-

By end-user, hospitals and ambulatory surgery centers accounted for 45.90% share in 2024.

-

The clinics and physicians’ office segment is expected to expand at a CAGR of 6.8% between 2025 and 2034.

Role of AI in Medical Devices: Transforming India’s Healthcare Sector

Artificial Intelligence (AI) is reshaping the medical devices ecosystem in India by enhancing precision, efficiency, and patient outcomes.

-

Anesthesia machines powered by AI optimize anesthetic drug dosages and predict patient responses.

-

Pain management devices use AI to monitor patient movement and personalize therapy plans.

-

Dental applications leverage AI-driven simulations to develop advanced filling materials.

-

ENT devices utilize AI in audiology to improve surgical planning and hearing aid fitting.

Market Dynamics

Drivers

-

Government initiatives such as the National Medical Devices Policy and PLI scheme support local innovation and reduce import dependency.

-

Increased demand for life-support and diagnostic devices supported by government healthcare programs.

Restraints

-

Complex regulatory approvals delay market entry and device adoption.

-

Shortage of skilled professionals to operate advanced medical equipment hinders efficiency.

Opportunities

-

Cybersecurity integration ensures safety, reliability, and patient data protection, boosting social acceptance and long-term adoption.

Product Type Insights

-

Other segment (including imaging systems, infusion pumps, and oncology devices) dominated the market in 2024.

-

Surgical sutures are expected to grow rapidly due to rising surgical interventions and their critical role in recovery.

End-User Insights

-

Hospitals & Ambulatory Surgery Centers accounted for the largest share in 2024 and will remain dominant.

-

Clinics & Physicians’ Offices are projected to grow the fastest, driven by demand for specialized treatments like cardiology and orthopedics.

India Class C & Class D Medical Devices Market Companies

-

India Medtronic Pvt. Ltd.

-

GE Healthcare Pvt. Ltd.

-

DHR Holding India Pvt. Ltd.

-

3M India Ltd.

-

Baxter India Pvt. Ltd.

-

Stryker India Pvt. Ltd.

-

Braun Medical India Pvt. Ltd.

-

Arena Medical Care Pvt. Ltd.

Segments Covered in the Report

By Product Type

- Wound care dressing

- Advanced wound dressing

- Silicone foam dressings

- Non-silicone foam dressings

- Hydrocolloid dressings

- Hydrofiber dressings

- Film dressings

- Alginate dressings

- Collagen dressings

- Hydrogel dressings

- Wound contact dressings

- Superabsorbent dressings

- Others

- Traditional wound dressing

- Surgical sutures

- Monofilament

- Multifilament

- Orthopedic implants

- Knee replacement implants

- Fixed bearing

- Mobile bearing

- Others

- Hip replacement implants

- Others

- Orthopedic implants

- Cardiovascular devices

- Ventilators

- Catheters

- Stents

- Anesthesia machines

- Medical imaging equipment

By End-user

- Hospitals and ambulatory surgery centers

- Orthopedic clinics and others

- Clinics and physicians’ offices

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- U.S. Dental Anesthesia Market Size to Surge USD 530.27 Mn by 2034 - September 18, 2025

- India Class C and Class D Medical Devices Market Size to Hit USD 12.57 Bn by 2034 - September 18, 2025

- Aquaculture Healthcare Market Size to Surge USD 3.04 Bn by 2034 - September 18, 2025