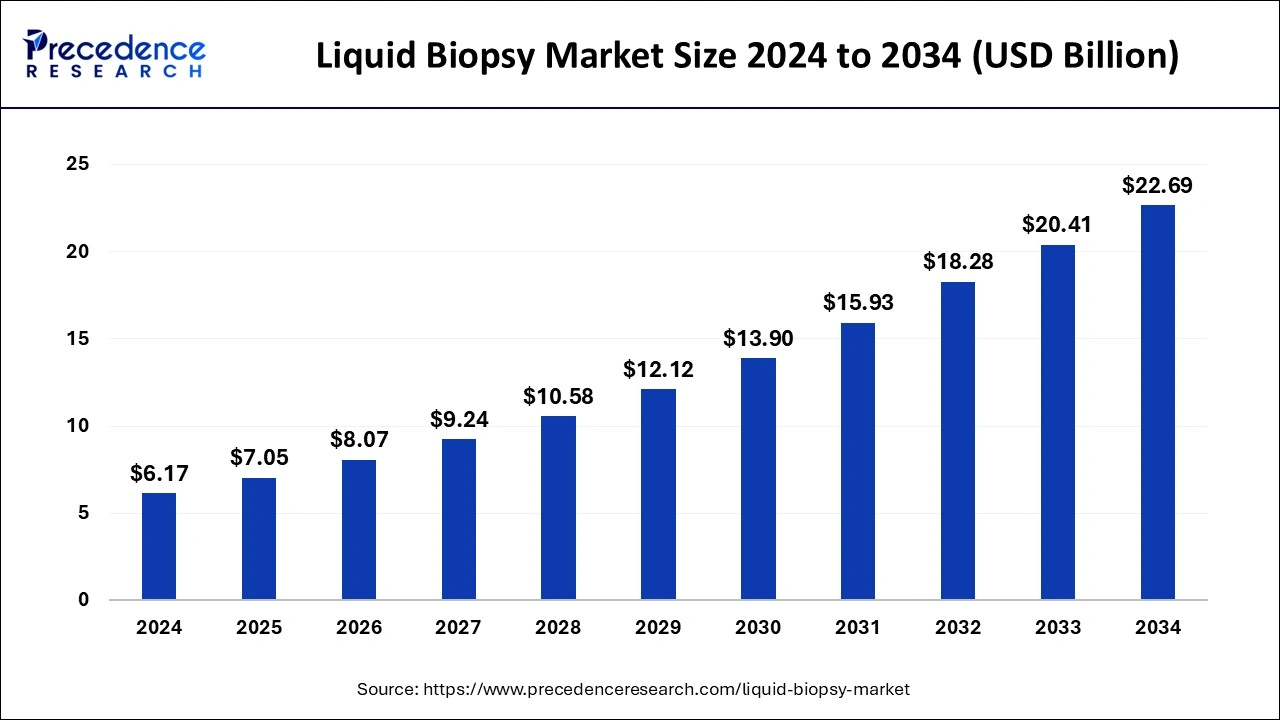

The global liquid biopsy market was valued at USD 6.17 billion in 2024 and is expected to reach approximately USD 22.69 billion by 2034, expanding at a CAGR of 13.91% from 2025 to 2034. Liquid biopsy is gaining rapid adoption as a non-invasive alternative to tissue biopsy, enabling early cancer detection, real-time disease monitoring, and personalized treatment planning. This approach is revolutionizing oncology diagnostics by providing faster, cost-effective, and highly accurate insights into tumor progression and therapy response.

Liquid Biopsy Market Size 2025 to 2034

-

2025 Market Size: USD 7.05 Billion

-

2034 Market Size: USD 22.69 Billion

-

Growth Rate (2025–2034): CAGR of 13.91%

-

Largest Market: North America

-

Fastest Growing Market: Asia Pacific

Key Takeaways

-

North America contributed 45.59% of revenue in 2024.

-

Next-generation sequencing (NGS) dominated with 65.20% share in 2024.

-

Blood-based tests accounted for 67.59% share.

-

Clinical usage held a 72.17% share in 2024.

-

Cell-free DNA (cfDNA) biomarker contributed 47.87% revenue share.

-

Kits & consumables represented 53.12% of the market in 2024.

-

Lung cancer was the leading indication (32.10%).

-

Screening applications accounted for 39.27% of revenue.

How AI is Transforming the Liquid Biopsy Industry

Artificial intelligence (AI) is enhancing liquid biopsy by:

-

Improving early cancer detection and precision diagnostics.

-

Integrating data from genomics, proteomics, and imaging for holistic insights.

-

Enabling personalized treatment strategies by predicting therapy response.

-

Supporting precision oncology, where treatment is tailored to the patient’s unique molecular profile.

U.S. Liquid Biopsy Market Outlook (2025–2034)

The U.S. liquid biopsy market was valued at USD 2.11 billion in 2024 and is projected to reach USD 7.32 billion by 2034, expanding at a CAGR of 13.91%.

-

Growth is fueled by rising cancer prevalence and adoption of advanced diagnostic solutions.

-

The FDA’s approval of liquid biopsy tests for cancer detection and monitoring has accelerated clinical adoption.

-

Strong presence of market leaders, R&D institutions, and strategic alliances contribute to innovation.

Regional Insights

Asia Pacific

-

Expected to be the fastest-growing market.

-

Drivers include rising disposable incomes, expanding healthcare infrastructure, and growing awareness of non-invasive diagnostics.

-

Countries such as Japan and China are investing heavily in precision medicine and cancer research.

Europe

-

Rapid growth supported by regulatory approvals and strong government support for oncology diagnostics.

-

Increasing adoption of liquid biopsy assays in clinical practice for real-time mutation tracking and treatment monitoring.

-

The UK market is benefitting from clinical trials, government funding, and collaborative innovation.

Market Dynamics

Drivers

-

Growing prevalence of lung, breast, colorectal, and prostate cancers.

-

Rising demand for early, non-invasive cancer detection.

-

Advancements in next-generation sequencing and bioinformatics.

Restraints

-

High costs of advanced diagnostic technologies.

-

Limited reimbursement frameworks in emerging markets.

Opportunities

-

Expansion of precision medicine and biomarker technologies.

-

Development of highly sensitive liquid biopsy tests for real-time monitoring.

Segmental Analysis

By Technology

-

NGS (Dominant Segment): 65.20% revenue share in 2024 due to its ability to detect rare mutations.

-

PCR (Opportunistic Segment): Rising adoption in oncology diagnostics and genomic applications.

By Sample Type

-

Blood-based tests led the market in 2024 (67.59%).

-

Urine samples are projected to be the fastest-growing due to the convenience in urological cancer diagnosis.

By Usage

-

The clinical segment dominated with 72.17% share in 2024, driven by demand for early cancer detection and therapy monitoring.

By Indication

-

Lung cancer accounted for 32.10% share in 2024.

-

Breast cancer is projected to grow fastest, driven by high global prevalence.

By Circulating Biomarker

-

Cell-free DNA (cfDNA): Largest segment with 47.87% share in 2024.

-

Circulating tumor DNA (ctDNA): Fastest-growing biomarker segment.

By Product

-

Tests & services held a significant share in 2024.

-

Kits & consumables expected to grow rapidly with increasing adoption in diagnostic centers.

Recent Developments

-

April 2025: Labcorp launched two new oncology products, including the FDA-cleared PGDx elio plasma focus Dx liquid biopsy test.

-

January 2025: Tempus AI introduced an FDA-approved NGS-based diagnostic test, xT CDx.

-

February 2024: Myriad Genetics partnered with Japan’s National Cancer Center Hospital East for large-scale cancer screening studies.

Leading Market Players

-

Bio-Rad Laboratories

-

Guardant Health

-

Illumina, Inc.

-

Roche Diagnostics

-

Thermo Fisher Scientific

-

Johnson & Johnson

-

QIAGEN N.V.

-

Biocept Inc.

-

Laboratory Corporation of America Holdings

-

MDxHealth SA

Conclusion

The liquid biopsy market is positioned for significant growth as cancer prevalence rises and demand for non-invasive, accurate, and cost-effective diagnostic solutions increases. North America will remain dominant due to advanced healthcare infrastructure, while the Asia Pacific will emerge as the fastest-growing region.

Read Also: Smart Medical Devices Market

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Cosmetic Dentistry Market Size to Hit USD 59.52 Billion by 2034 - September 18, 2025

- Liquid Biopsy Market Size to Reach USD 22.69 Billion by 2034 - September 18, 2025

- Smart Medical Devices Market Size to Sore USD 168 Bn by 2034 - September 17, 2025