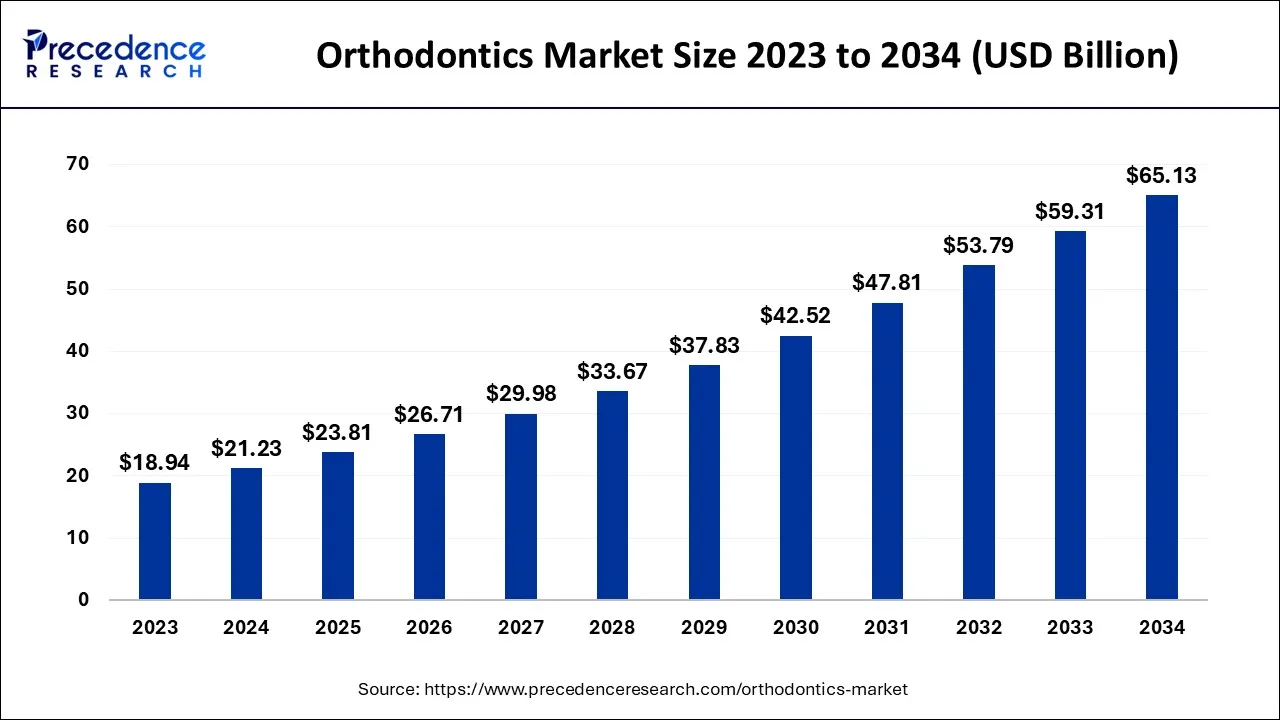

The global orthodontics market was valued at USD 21.23 billion in 2024 and is projected to grow from USD 23.81 billion in 2025 to approximately USD 65.13 billion by 2034, expanding at a robust CAGR of 11.9% during the forecast period.

Orthodontics Market Key Takeaways

-

The global market size reached USD 21.23 billion in 2024 and is expected to hit USD 65.13 billion by 2034.

-

The industry will grow at a CAGR of 11.9% from 2025 to 2034.

-

North America dominated the market with 37.55% revenue share in 2024, supported by a developed healthcare infrastructure.

-

Asia Pacific is expected to secure the second-largest position and record the fastest growth rate during 2025–2034.

-

By product, the instruments segment is anticipated to see significant growth.

-

By age group, adults accounted for the largest share in 2024, while the children segment is projected to expand considerably.

Read Also: Gynecological Devices Market

AI Integration in the Orthodontics Market

Artificial Intelligence (AI) is creating a transformative impact on orthodontics by improving clinical accuracy, operational efficiency, and patient engagement.

-

Treatment Planning – AI simplifies designing and producing braces and clear aligners, reducing manual errors and accelerating delivery times.

-

Diagnostics – AI-driven imaging enables enhanced detection of malocclusion and treatment customization.

-

Patient Engagement – AI platforms provide personalized treatment reminders, compliance tracking, and progress monitoring.

-

Future Outlook – Continued AI integration is expected to bring innovations in orthodontic diagnostics, predictive treatment outcomes, and fully automated aligner production.

U.S. Orthodontics Market Size and Growth 2025 to 2034

The U.S. orthodontics market was valued at USD 6.27 billion in 2024 and is projected to reach USD 19.03 billion by 2034, growing at a CAGR of 11.8%.

Key U.S. Growth Drivers

-

Advanced healthcare infrastructure and adoption of cutting-edge orthodontic technologies.

-

Increasing consumer awareness of aesthetic dental treatments.

-

High availability of orthodontists – around 10,568 active orthodontists in the U.S. as of 2017 (ADA).

-

Growing geriatric population – projected to reach 90 million by 2050.

Market Scope

| Report Coverage | Details |

|---|---|

| Market Size in 2025 | USD 23.81 Billion |

| Market Size by 2034 | USD 65.13 Billion |

| CAGR 2025–2034 | 11.9% |

| Base Year | 2024 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product, End User, Age Group, Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

U.S. Orthodontics Market Trends

-

Rising demand for aesthetic orthodontic solutions like clear aligners among adults and teens.

-

Growing adoption of 3D imaging, intraoral scanning, and AI-driven treatment planning.

-

High consumer spending on cosmetic dentistry — average patient spend reached USD 5,477 in 2017 (AACD).

-

Shift toward personalized, minimally invasive treatments enhancing patient satisfaction.

U.S. Orthodontics Market Trends

-

Rising demand for aesthetic orthodontic solutions like clear aligners among adults and teens.

-

Growing adoption of 3D imaging, intraoral scanning, and AI-driven treatment planning.

-

High consumer spending on cosmetic dentistry — average patient spend reached USD 5,477 in 2017 (AACD).

-

Shift toward personalized, minimally invasive treatments enhancing patient satisfaction.

Regional Insights

North America

-

Largest market share with strong healthcare systems.

-

Demand driven by clear aligners, minimally invasive techniques, and higher consumer spending on dental aesthetics.

Asia Pacific

-

Fastest-growing region, driven by large youth and geriatric populations.

-

High prevalence of dental malocclusions in India (20–43%) and China (45% among preschool children).

-

Expanding private dental clinics, rising disposable incomes, and dental tourism support growth.

China Market Trends

-

Rapid expansion due to urbanization and rising disposable income.

-

Strong demand for clear aligners among children and working professionals.

-

Government-backed healthcare reforms improving access to orthodontic care.

Europe

-

Expected to grow significantly due to rising dental disorders and strong government support.

-

Countries like Germany and the UK show growing innovation, collaborations, and regulatory support.

Market Dynamics

Driver

Rising Burden of Dental Ailments

Increasing prevalence of malocclusion, growing public awareness, and better access to dental care are fueling demand for orthodontics.

Restraint

Side Effects of Orthodontic Treatments

Extended treatments may lead to pain, gum inflammation, periodontal issues, and complications like enamel decalcification and TMJ disorders.

Opportunity

Unmet Needs in Emerging Markets

High treatment costs and limited specialists create opportunities for affordable orthodontics, tele-orthodontics, and mobile clinics, especially in underserved regions.

Product Insights

-

Instruments – Significant growth due to rising adoption of digital technologies like 3D imaging and CAD/CAM systems.

-

Supplies – Includes brackets, archwires, retainers, and aligners; growing demand driven by patient preference for clear aligners and aesthetic products.

End-User Insights

-

Dental Clinics – Dominated the market in 2024, fueled by rising numbers of orthodontists and private clinics globally.

-

Hospitals – Expected to expand steadily with growing multi-specialty hospitals and reimbursement support for orthodontic procedures.

Age Group Insights

-

Adults – Largest segment in 2024, driven by demand for discreet, aesthetic treatments like ceramic braces and clear aligners.

-

Children – Anticipated to grow significantly due to rising prevalence of malocclusions, school-based screening programs, and the availability of customized aligners for children.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Smart Medical Devices Market Size to Sore USD 168 Bn by 2034 - September 17, 2025

- Orthodontics Market Size to Reach USD 65.13 Billion by 2034 - September 17, 2025

- Gynecological Devices Market Size to Hit USD 23.22 Billion by 2034 - September 17, 2025