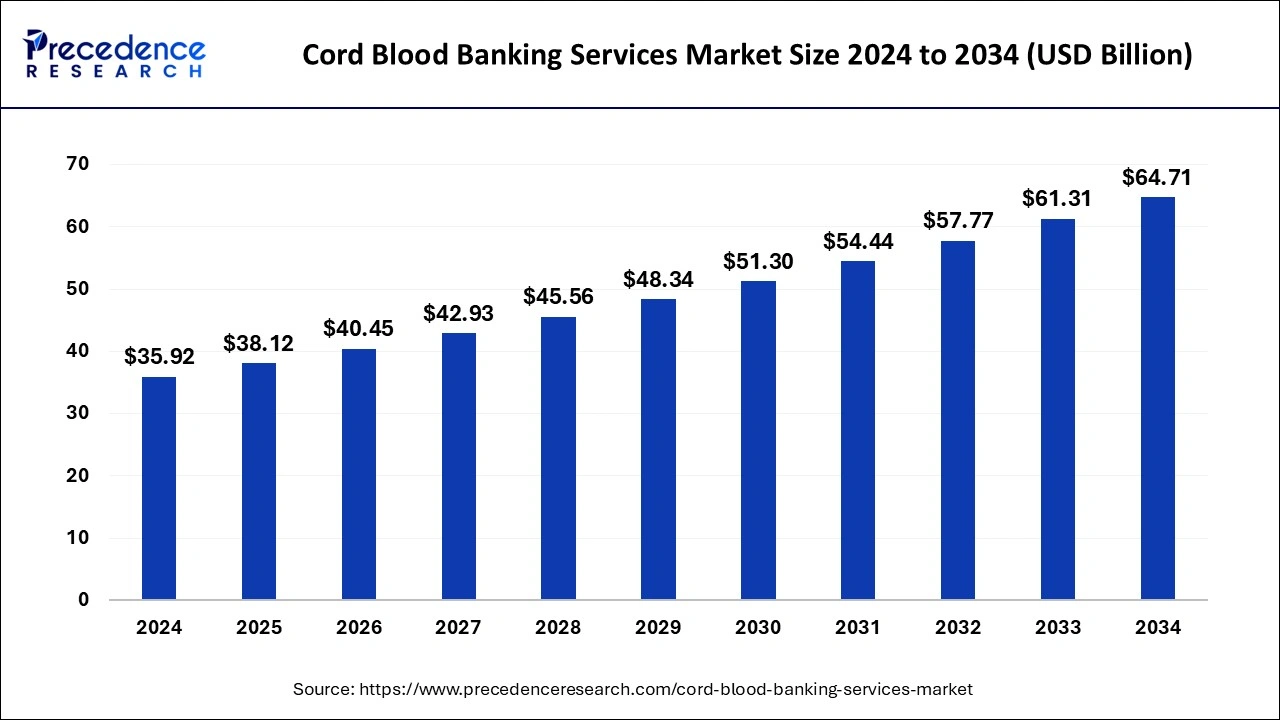

The global cord blood banking services market size was valued at USD 3.09 billion in 2024 and is projected to grow from USD 3.27 billion in 2025 to approximately USD 5.81 billion by 2034, registering a CAGR of 6.61% from 2025 to 2034.

Cord Blood Banking Services Market Key Takeaways

-

The global market was valued at USD 3.27 billion in 2025 and is anticipated to surpass USD 5.81 billion by 2034.

-

North America dominated the market in 2024, holding 36.28% revenue share, supported by strong healthcare infrastructure and rising awareness.

-

Asia Pacific is forecasted to record the highest CAGR over the next decade due to high birth rates, increasing awareness, and government investments.

-

By storage services, private cord blood banks led the market in 2024, while public cord blood banks are projected to witness faster growth.

-

By component, the cord tissue segment dominated in 2024, while the cord blood segment is expected to expand rapidly.

-

By application, diabetes held the largest share in 2024, while cancer treatment applications are projected to grow at the fastest CAGR.

AI Integration in the Cord Blood Banking Services Market

Artificial Intelligence (AI) is revolutionizing the cord blood banking services industry by enhancing the accuracy, efficiency, and personalization of processes across the value chain. From sample collection to long-term storage, AI-powered tools are enabling higher standards of precision and operational scalability.

Key areas where AI is driving transformation include

-

Automated Donor Selection and Eligibility – AI systems streamline donor matching by analyzing genetic and health data, ensuring the most suitable cord blood units are collected and preserved.

-

Sample Viability and Inventory Monitoring – Predictive algorithms monitor storage conditions and sample quality in real-time, extending the longevity and usability of preserved stem cells.

-

Predictive Analytics for Usage Optimization – Machine learning models evaluate clinical data to determine the best applications for stored cord blood, improving treatment outcomes.

-

Personalized Customer Engagement – AI-powered platforms provide parents with customized reminders, educational resources, and tailored storage recommendations, enhancing overall customer experience.

Market Dynamics

Driver

Simplicity and safety of cord blood for stem cell harvesting

Cord blood is a safe and minimally invasive source of stem cells, making it an increasingly preferred choice for families. Its ease of collection and therapeutic potential across multiple medical conditions is fueling adoption globally.

Restraint

Limited awareness among clinicians and expectant parents

A lack of widespread knowledge about cord blood banking services continues to hinder market penetration, particularly in developing nations where educational outreach and clinical promotion remain limited.

Opportunity

Rising awareness and adoption of regenerative medicine

With growing knowledge about the therapeutic potential of stem cells in treating cancers, blood disorders, diabetes, and immune conditions, demand for cord blood banking services is poised to accelerate. AI-powered sample tracking, predictive analytics, and personalized engagement further strengthen opportunities.

Regional Insights

-

North America led the market in 2024, driven by a high number of service providers, advanced cryopreservation technologies, and supportive government measures. The U.S. cord blood banking services market alone is expected to grow from USD 1.02 billion in 2024 to USD 1.57 billion by 2034 at a CAGR of 4.52%.

-

Asia Pacific is projected to grow at the highest CAGR, supported by a large population base, rising healthcare expenditure, and growing awareness of stem cell applications. China, with advanced facilities and strategic investments, held the largest share in 2024.

-

Europe maintained a significant share in 2024, led by Germany, where favorable government policies, strong R&D, and precision medicine initiatives are fostering growth.

Market Scope

| Report Coverage | Details |

|---|---|

| Market Size in 2025 | USD 3.27 Billion |

| Market Size by 2034 | USD 5.81 Billion |

| Growth Rate | CAGR of 6.61% (2025–2034) |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Storage Services, Component, Application, and Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Cord Blood Banking Services Market Companies

- Global Cord Blood Corporation

- CBR Systems Inc.

- PerkinElmer Inc. (ViaCord LLC)

- Cryo-Cell International

- Cordlife Group Limited

- AlphaCord LLC

- ATCC

- CSG-BIO

- California Cryobank Stem Cell Services LLC

- Cord Blood Foundation (Smart Cells International)

- Singapore Cord Blood Bank

- FamiCord

Segment Covered in the Report

By Storage Services

- Public Cord Blood Banks

- Private Cord Blood Banks

By Component

- Cord Blood

- Cord Tissue

By Application

- Cancer Disease

- Diabetes

- Blood Disease

- Immune Disorders

- Metabolic Disorders

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Read Also: U.S. Concierge Medicine Market

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Smart Medical Devices Market Size to Sore USD 168 Bn by 2034 - September 17, 2025

- Orthodontics Market Size to Reach USD 65.13 Billion by 2034 - September 17, 2025

- Gynecological Devices Market Size to Hit USD 23.22 Billion by 2034 - September 17, 2025