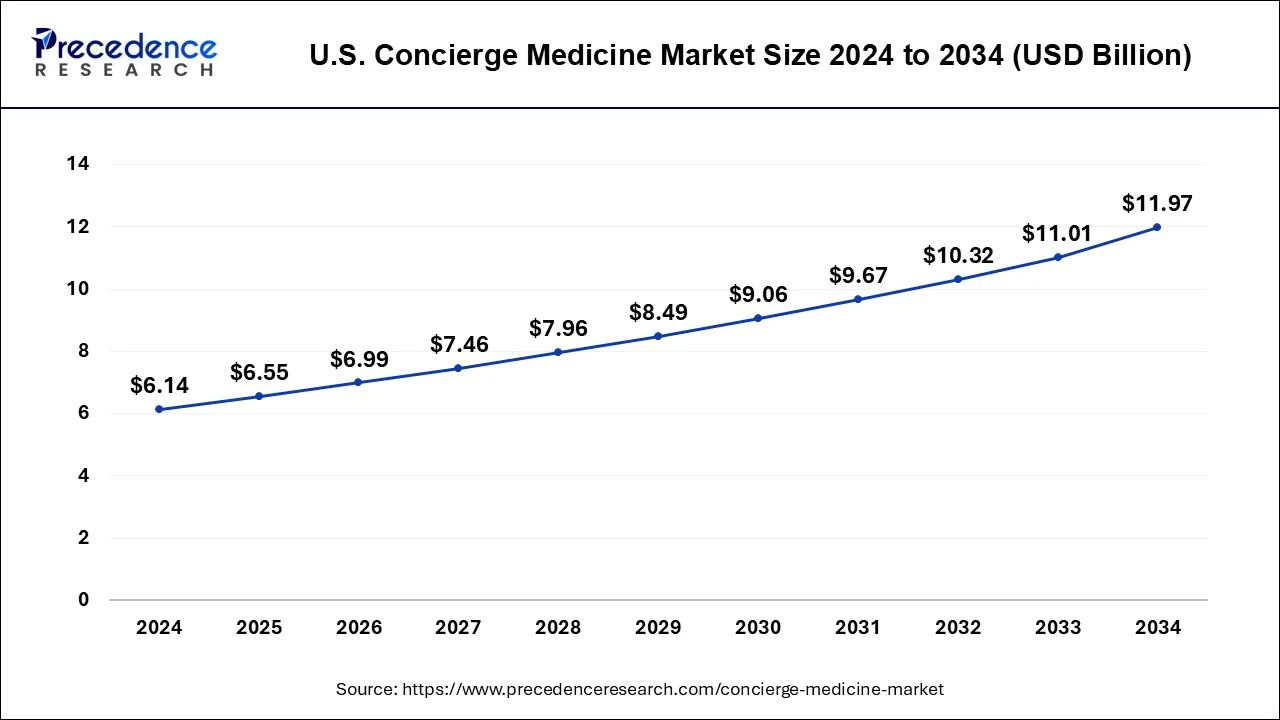

The U.S. concierge medicine market size reached USD 6.14 billion in 2024 and is projected to surpass USD 11.97 billion by 2034, growing at a CAGR of 6.88% from 2025 to 2034. This growth is being fueled by increasing patient demand for personalized care, a rise in high-net-worth individuals, digital health adoption, and physician-driven shifts toward more sustainable and patient-centered models of healthcare delivery.

U.S. Concierge Medicine Market Key Takeaways

-

Market size was valued at USD 6.14 billion in 2024.

-

It is expected to reach USD 11.97 billion by 2034.

-

The market will expand at a CAGR of 6.88% from 2025 to 2034.

-

By application, the other segment led the market in 2024, followed by primary care.

-

By ownership, the group segment dominated the U.S. concierge medicine market in 2024.

Role of AI in the U.S. Concierge Medicine Market

Artificial Intelligence (AI) is playing a transformative role in concierge healthcare across the U.S. AI-driven platforms such as IBM Watson Health support diagnostics, while HealthTap and Gyant provide 24/7 patient engagement through virtual assistants. Zebra Medical Vision is reshaping imaging analytics with early disease detection, and Olive AI automates back-office operations like billing and scheduling, reducing physician burnout.

Wearable devices such as Fitbit and Apple Health now enable real-time patient monitoring, fostering proactive health management. By streamlining workflows and empowering data-driven decisions, AI is not only enhancing operational efficiency but also creating a hyper-personalized concierge care experience.

Market Overview

Concierge medicine—often referred to as retainer or boutique medicine—is rapidly expanding across the U.S. This model provides patients with direct physician access, minimal wait times, extended consultations, and personalized wellness programs through membership or retainer fees.

The surge in demand comes as patients grow dissatisfied with traditional healthcare models marked by overcrowded systems and shorter consultations. High-net-worth individuals, aging baby boomers, and patients seeking preventive, wellness-driven care are the largest adopters of concierge medicine.

The integration of telehealth, AI tools, and digital platforms has also expanded concierge medicine’s accessibility, particularly post-COVID-19, where demand for personalized and preventive care accelerated significantly.

U.S. Concierge Medicine Market Growth Factors

-

Demand for customization in healthcare – patients seeking tailored care plans and direct access to physicians.

-

Rising dissatisfaction with mainstream healthcare – long wait times and rushed appointments.

-

Growth in high-net-worth individuals – more patients willing to pay membership fees for premium services.

-

Increasing aging population – higher focus on chronic disease management and preventive care.

-

Adoption among physicians – doctors seeking reduced burnout and greater autonomy.

-

Telemedicine expansion – enabling broader reach of concierge services.

Market Dynamics

Driver: Rising Cases of Diabetes

The U.S. reported 37.3 million diabetes cases in 2022, expected to grow to 39.7 million by 2030. Concierge medicine provides personalized treatment, frequent monitoring, and better coordination with specialists—making it an attractive model for diabetes management.

Restraint: Shortage of Physicians

The U.S. could face a shortage of up to 122,000 physicians by 2032. Since concierge medicine requires smaller patient panels, the physician shortage may restrict adoption, limiting accessibility to patients in certain regions.

Opportunity: Wellness and Preventive Programs

Government and employer-led wellness programs are creating new opportunities for concierge medicine to expand into holistic care, integrating nutrition, fitness, mental health, and lifestyle coaching into traditional clinical services.

Application Insights

-

Others Segment (urology, gynecology, neurology, orthopedics) dominated in 2024, driven by patient preference for private and personalized healthcare.

-

Primary Care Segment stood as the second-largest, with concierge primary care offering extended consultation times and preventive health strategies.

-

Cardiology Segment is expected to grow strongly due to the rising cardiovascular disease prevalence.

-

Pediatrics is emerging as a lucrative segment, focusing on preventive wellness and parental demand for 24/7 access.

Ownership Insights

-

Group Ownership dominated in 2024, benefiting from economies of scale, shared resources, and diversified specialties.

-

Independent Ownership is growing rapidly, allowing physicians to retain autonomy and build direct patient relationships.

Regional Insights

-

California: Leading state with high adoption of telehealth and AI-driven concierge platforms, supported by affluent populations and strong startup ecosystems.

-

New York: Concierge medicine thrives in urban centers like NYC, where busy professionals and families demand convenience and same-day access to physicians.

-

Massachusetts: Home to world-class hospitals and research hubs, the state is seeing strong adoption of elite concierge practices and integration with digital health startups.

Recent Developments

-

Jan 2025: MDVIP partnered with mental health providers to launch a behavioral wellness initiative, integrating psychology into concierge care.

-

Dec 2024: SignatureMD introduced hybrid concierge offerings for rural practices, enabling flexible pricing.

Read Also: Bone Grafts and Substitutes Market

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Orthodontics Market Size to Reach USD 65.13 Billion by 2034 - September 17, 2025

- Gynecological Devices Market Size to Hit USD 23.22 Billion by 2034 - September 17, 2025

- Cord Blood Banking Services Market Size to Hit USD 5.81 Billion by 2034 - September 17, 2025