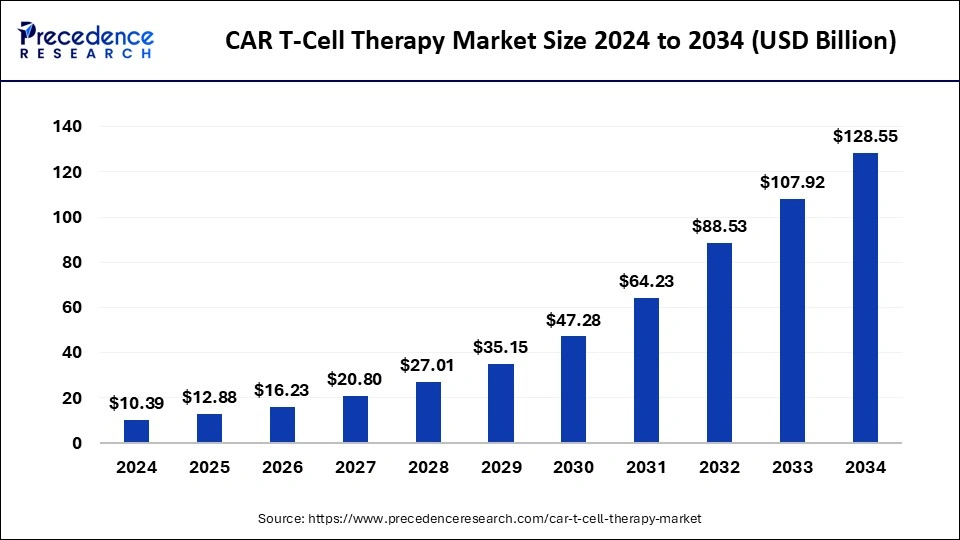

The global CAR T-cell therapy market was valued at USD 10.39 billion in 2024 and is projected to grow substantially, reaching an estimated USD 128.55 billion by 2034. This rapid expansion represents a CAGR of 29.10% from 2025 to 2034, reflecting the increasing demand for innovative cancer therapies and the significant improvements in CAR T-cell technology.

Read Also: Systemic Inflammatory Response Syndrome Treatment Market

Key Takeaways

-

Market Size in 2024: USD 10.39 billion

-

Market Size in 2034: USD 128.55 billion

-

CAGR from 2025 to 2034: 29.10%

-

Dominated Region: North America with a 39.84% market share in 2024

-

Fastest Growth Region: Asia Pacific with a projected CAGR of 29.8%

Key Drivers of Market Growth

-

Rising Cancer Incidences

-

Cancer cases worldwide, particularly hematologic malignancies such as lymphoma, leukemia, and multiple myeloma, are on the rise. CAR T-cell therapy has shown significant efficacy in treating these cancers, which has fueled market growth.

-

Blood cancer rates are particularly high, with the U.S. alone reporting one person diagnosed with leukemia or lymphoma every 3 minutes.

-

-

Advancements in Biotechnology and Research

-

Continuous innovation in CAR T-cell therapy, including new treatment methods, target antigens (like CD19 and BCMA), and advancements in gene editing and manufacturing processes, is contributing to accelerated growth.

-

Research into solid tumors and the expansion of CAR T-cell therapy into autoimmune diseases are broadening the potential of this therapy beyond oncology.

-

-

Personalized Medicine

-

CAR T-cell therapy is a prime example of personalized medicine, where a patient’s own T cells are modified to target their specific cancer cells. This reduces systemic toxicity and offers more targeted treatment, contributing to better patient outcomes and lower side effects.

-

-

Regulatory Approvals and Market Penetration

-

Increasing regulatory approvals from major health authorities such as the FDA have boosted market confidence and led to greater commercial adoption of CAR T-cell therapies.

-

The availability of approved therapies like Yescarta (axicabtagene ciloleucel) and Kymriah (tisagenlecleucel) for treating B-cell malignancies has increased the demand for CAR T treatments.

-

Regional Insights

-

North America (particularly the U.S.) dominated the CAR T-cell therapy market in 2024, with a revenue share of 39.84%. The region benefits from well-established healthcare infrastructure, extensive research and development, and high investment in biotechnology.

-

Projected Market Size for the U.S. in 2034: USD 28.16 billion

-

CAGR in the U.S. (2025–2034): 29.70%

-

The increasing elderly population and the high incidence of blood cancers contribute to the demand for innovative treatments like CAR T-cell therapy.

-

-

Asia-Pacific is anticipated to experience the fastest growth during the forecast period, with a CAGR of 29.8% from 2025 to 2034. The rising cancer prevalence, along with favorable government policies and growing biotech industries in countries like China, is driving this growth.

-

China is a key player, with its government investment in biotechnology, which is accelerating the adoption of cell and gene therapies.

-

-

Europe also holds a substantial share of the CAR T-cell therapy market, led by countries like Germany, where advanced medical research, clinical trials, and strong healthcare infrastructure foster CAR T development.

Therapeutic and Technological Segmentation

-

Target Antigens

-

CD19 was the leading target antigen in 2024, particularly for treating B-cell malignancies such as leukemia and lymphoma.

-

BCMA (B-cell maturation antigen) is rapidly gaining traction, especially in the treatment of multiple myeloma, with several BCMA-targeted therapies already showing promising results in clinical trials.

-

-

Therapeutic Types

-

Autologous CAR-T Cell Therapy dominated the market in 2024 due to its personalized approach and success in treating blood cancers.

-

Allogeneic CAR-T Cell Therapy, using donor-derived T cells, is growing rapidly and is expected to account for a larger market share due to its broader applicability and faster treatment timeline.

-

-

Manufacturing Methods

-

Centralized Manufacturing held the largest share in 2024, as it ensures consistent quality control and scalability. However, in vivo CAR T therapy, which delivers CAR genes directly to T cells inside the patient’s body, is expected to grow the fastest due to its lower costs and faster treatment times.

-

-

Technology/Vector

-

Viral Vectors dominated the market due to their efficiency in gene transfer, ensuring sustained CAR expression.

-

Dual and Multiple Antigen Targeting is an emerging trend, allowing CAR T-cells to overcome tumor antigen escape by targeting multiple markers, improving efficacy in solid tumors.

-

Challenges and Opportunities

-

Challenges

-

Side Effects: CAR T-cell therapy is associated with severe side effects such as cytokine release syndrome (CRS) and neurotoxicity, which need to be managed carefully.

-

High Cost: The complex manufacturing process of autologous CAR T-cell therapies makes them expensive, limiting accessibility, especially in low-resource settings.

-

-

Opportunities

-

Solid Tumors: The successful expansion of CAR T-cell therapy beyond hematologic malignancies to solid tumors could significantly increase the patient pool and market size.

-

AI and Automation: The integration of AI and automation in the CAR T-cell manufacturing process holds promise for improving efficiency, reducing costs, and enhancing scalability.

-

Regulatory Support: As CAR T-cell therapies gain more regulatory approvals and commercial traction, market growth will accelerate.

-

Conclusion

- Bone Grafts and Substitutes Market Size to Surpass USD 5.68 Billion by 2034 - September 11, 2025

- Drug of Abuse Testing Market Size to Hit USD 23.05 Billion by 2034 - September 11, 2025

- CAR T-Cell Therapy Market Size to Reach USD 128.55 Bn by 2034 - September 11, 2025