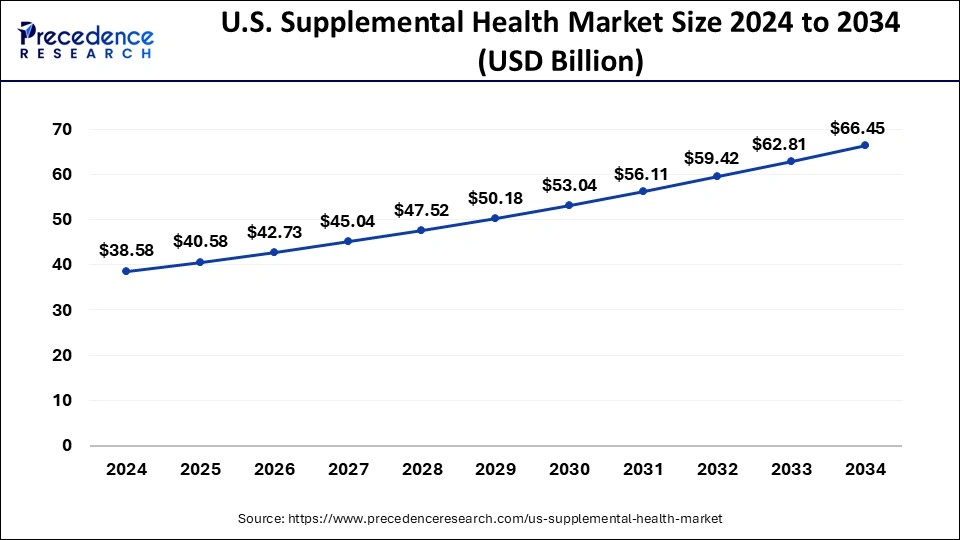

The U.S. supplemental health market size accounted for USD 40.58 billion in 2025 and is forecasted to hit around USD 66.45 billion by 2034, representing a CAGR of 5.60% from 2025 to 2034. This growth is driven by rising healthcare costs, increasing awareness of out-of-pocket expenses, and the growing demand for additional coverage beyond primary health insurance plans.

U.S. Supplemental Health Market Overview (2025–2034)

Market Size and Growth Projections

-

2024 Market Value: USD 38.58 billion

-

2025 Market Value: USD 40.58 billion

-

2034 Projected Market Value: USD 66.45 billion

-

CAGR (2025–2034): 5.60%

View Sample: https://www.precedenceresearch.com/sample/3063

Key Insights and Trends

-

Market Drivers:

-

Growing Awareness: Increasing consumer awareness about the limitations of basic health insurance plans (e.g., deductibles, premiums, and uncovered medical expenses) is leading to a greater uptake of supplemental health insurance products.

-

Technological Advancements: The incorporation of technology, such as telemedicine, AI, and mobile apps, is making supplemental health insurance more accessible and improving the customer experience.

-

-

Market Restraints:

-

Limited Coverage: Many supplemental insurance plans come with exclusions or limited coverage, which could hinder adoption. For example, cancer policies often offer limited benefits, particularly for specific diagnoses or procedures.

-

Provider Limitations: Some insurance providers face challenges related to limited service capacity and resources, impacting their ability to serve the entire market.

-

-

Market Opportunities:

-

Rising Healthcare Costs: As healthcare expenses continue to climb, more people are seeking supplemental health insurance to bridge the gap left by their primary insurance coverage. This is a significant growth opportunity for companies in the market.

-

Innovation in Healthcare Products: Continuous advancements in healthcare technology are enabling the development of new, more efficient, and tailored supplemental health products.

-

Market Segmentation by Product (2024)

-

Hospital Indemnity Insurance

-

Generated over 21.90% of the market revenue in 2024.

-

-

Critical Illness Insurance

-

Growth Rate: Fastest-growing segment from 2025 to 2034.

-

Description: Provides lump-sum payments for critical illnesses not covered by traditional insurance.

-

-

Accident Insurance

-

Anticipated to grow at the highest rate from 2025 to 2034.

-

Relevance: Covers medical and out-of-pocket expenses following accidents.

-

-

Dental Insurance

-

Largest segment by revenue in 2024.

-

Distribution Channel Insights

-

Brokers: Contributed over 60.50% of the revenue share in 2024.

-

Direct-to-Consumer (DTC): Expected to grow at the highest rate during the forecast period due to increasing adoption of online platforms for purchasing insurance policies.

-

Agents: The agent segment is also expected to grow significantly from 2025 to 2034 as more individuals seek personalized assistance for their supplemental insurance needs.

Demographic Insights

-

Individuals Aged 65 and Above

-

This segment dominated the market in 2024, accounting for more than 96.90% of the revenue share.

-

Growth: Expected to expand at the highest CAGR during the forecast period due to the growing elderly population, most of whom are eligible for Medicare.

-

-

Individuals Aged Below 65 with an Eligible Disability

-

This demographic is growing at a notable rate, as many in this category require supplemental health insurance due to gaps in public healthcare coverage like Medicaid.

-

Product Breakdown (2022-2024)

-

Critical Illness Insurance

-

2024: USD 5.79 billion

-

-

Accident Insurance

-

2024: USD 4.23 billion

-

-

Hospital Indemnity Insurance

-

2024: USD 8.45 billion

-

-

Worksite Life Insurance

-

2024: USD 7.14 billion

-

-

Dental Insurance

-

2024: USD 12.98 billion

-

Leading Companies in the U.S. Supplemental Health Market

-

American International Group, Inc.

-

Anthem, Inc.

-

Assurant, Inc.

-

AXA Group

-

Cigna Corporation

-

Humana Inc.

-

MetLife, Inc.

-

Zurich Insurance Group AG

Conclusion

The U.S. supplemental health market is set for substantial growth, driven by rising healthcare costs, increased awareness of supplemental insurance benefits, and technological advancements that enhance service delivery. With a projected CAGR of 5.60% from 2025 to 2034, the market is positioned for continued expansion, especially as the aging population grows and more consumers seek protection against healthcare expenses not covered by primary insurance.

Visit: Portable Medical Devices Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

- U.S. Supplemental Health Market Size to Reach USD 66.45 Billion by 2034 - September 10, 2025

- Portable Medical Devices Market Size to Hit USD 202.52 Bn by 2034 - September 10, 2025

- U.S. Compounding Pharmacies Market Size to Hit USD 10.93 Bn by 2034 - September 10, 2025