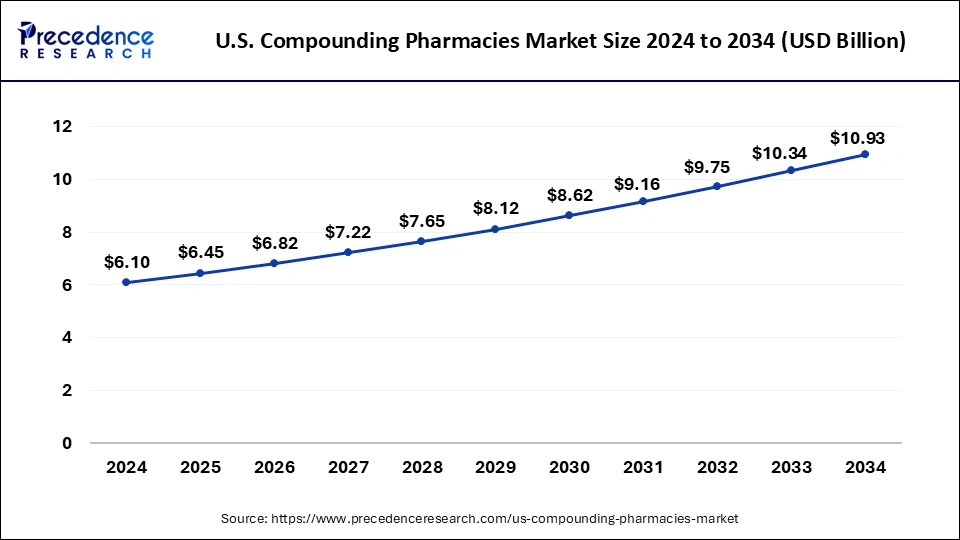

The U.S. compounding pharmacies market size is calculated at USD 6.45 billion in 2025 and is forecasted to reach around USD 10.93 billion by 2034, accelerating at a CAGR of 6.04% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

Market Overview

-

Size & Growth: The market size is projected to increase from USD 6.45 billion in 2025 to approximately USD 10.93 billion by 2034, growing at a CAGR of 6.04%.

Key Drivers:

-

-

The rising demand for personalized medications that cater to specific patient needs, such as customized dosages, routes of administration, or combinations of active ingredients.

-

Technological advancements, particularly the use of AI and robotics, are revolutionizing compounding processes, improving precision and reducing errors.

-

Increasing chronic disease burden, especially cancer and the aging population, which necessitates customized therapies.

-

View Sample: https://www.precedenceresearch.com/sample/1662

Key Segments

-

Product Insights

-

Oral Medications: Dominates the market with 36.21% share in 2024 and is expected to continue growing, driven by the need for easy-to-administer therapies.

-

Liquid Preparations: The fastest-growing segment, projected to expand due to the preference for liquid doses, especially for children and elderly patients.

-

-

Pharmacy Type

-

503A Pharmacies: Represent the bulk of the market, primarily serving domestic needs with customized formulations for individual patients.

-

503B Pharmacies: Have a smaller share but are expected to grow with increased demand for sterile medications and outsourcing of larger-scale production.

-

-

Sterility Insights

-

The non-sterile segment dominates, but the sterile compounding segment is expected to grow the fastest, driven by rising demand for injectables, ophthalmic medications, and other sterile formulations.

-

-

Therapeutic Area

-

Pain Management: A critical segment, growing due to the need for customized pain relief solutions that are not met by traditional pharmaceuticals.

-

Hormone Replacement: Hormone therapies are another key therapeutic area driving demand for compounded medications, particularly for conditions like menopause and thyroid issues.

-

Oncology: As cancer incidence increases, there is a strong demand for compounded medications to alleviate treatment side effects or provide specialized dosages.

-

-

End-User Insights

-

Hospitals remain the largest end-user, requiring specialized compounded medications for patient care, particularly in critical care settings.

-

Home Healthcare is also growing as more patients require long-term care and adherence to medications that may not be commercially available.

-

Technological Influence

-

AI & Automation: With AI and robotics, compounding pharmacies can offer more accurate and consistent formulations. These technologies also help streamline operations, reduce human errors, and ensure regulatory compliance.

-

Telehealth & E-commerce: The rise of telehealth is expanding access to compounded medications. Pharmacies are partnering with telemedicine services to reach patients who may not otherwise have access to specific compounded products.

Market Challenges

-

Regulatory Hurdles: Compliance with FDA and USP guidelines remains challenging, particularly in sterile compounding, where maintaining absolute sterility is critical.

-

Cost and Reimbursement: High operational costs, coupled with the lack of consistent insurance reimbursement for compounded drugs, are barriers to widespread adoption.

-

Competition from Big Pharma: Large pharmaceutical companies are increasingly releasing pre-formulated drugs that compete with compounded alternatives, putting pressure on the compounding sector.

Key Players

-

Fagron, B. Braun, Fresenius Kabi, and Empower Pharmacy are some of the major companies investing heavily in R&D and automation to stay competitive in this rapidly evolving market.

Recent Developments

-

Fagron launched an advanced software platform in February 2025 to improve workflows in 503A pharmacies.

-

Empower Pharmacy opened its second high-capacity 503B facility in Houston, focusing on sterile compounding using automated systems.

-

The FDA issued new guidelines in April 2025 regarding the phase-out of compounded GLP-1 drugs like semaglutide, aligning with the availability of commercial products.

Key Trends

-

Functional Medicine: The rising demand for holistic and personalized healthcare is accelerating the use of compounded medications.

-

Automation & AI: Continued growth in the use of automated systems for compounding, making the process more efficient, precise, and scalable.

-

Telehealth & E-commerce: With more patients seeking convenient access to personalized medications, pharmacies are increasingly providing digital platforms for consultations and orders.

Market Challenges & Opportunities

-

Challenges include stringent regulations and high costs related to compliance.

-

Opportunities lie in embracing automation, improving AI-driven precision, and forging strategic partnerships with telehealth and specialty clinics to broaden patient access.

Read Also: Biotechnology Market

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- U.S. Supplemental Health Market Size to Reach USD 66.45 Billion by 2034 - September 10, 2025

- Portable Medical Devices Market Size to Hit USD 202.52 Bn by 2034 - September 10, 2025

- U.S. Compounding Pharmacies Market Size to Hit USD 10.93 Bn by 2034 - September 10, 2025