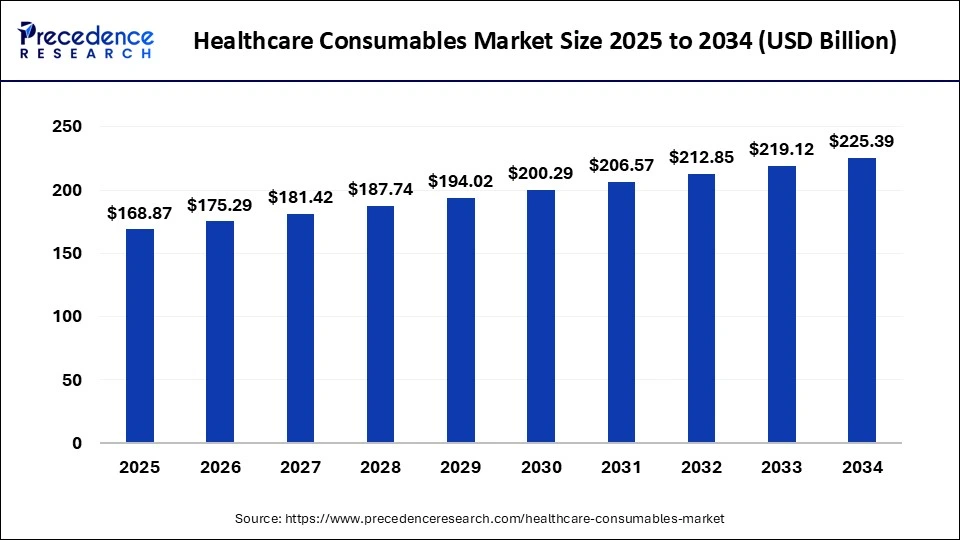

The global healthcare consumables market size is calculated at USD 168.87 billion in 2025 and is forecasted to reach around USD 225.39 billion by 2034, accelerating at a CAGR of 2.90% from 2025 to 2034. The global healthcare consumables market is witnessing consistent growth as hospitals, clinics, and healthcare institutions increasingly rely on disposable and sterilized supplies to ensure patient safety and effective treatment.

Market Overview

Healthcare consumables are essential medical products used on a daily basis to support diagnostics, treatment, and patient care. These include items such as sterilization consumables, wound care supplies, diagnostic consumables, disposable masks, gloves, and drug delivery products. Their importance surged significantly during the COVID-19 pandemic and continues to remain high due to the rising prevalence of chronic diseases, surgical procedures, and hospital admissions.

Increased awareness about infection control, advancements in healthcare infrastructure, and the shift towards minimally invasive surgeries are further propelling demand. Additionally, the growing geriatric population—more vulnerable to chronic conditions—remains a major driver of healthcare consumables usage worldwide.

Read Also: Histoplasmosis Treatment Market

Healthcare Consumables Market Key Takeaways

-

Market size valued at USD 162.37 billion in 2024, projected to hit USD 225.39 billion by 2034.

-

CAGR of 2.90% expected from 2025 to 2034.

-

North America dominated the market with 42% share in 2024.

-

By product type, sterilization consumables led the market in 2024.

-

By raw material, the plastic resin segment accounted for the largest revenue share.

-

By end user, hospitals contributed the highest share at 67% in 2024.

Regional Insights

North America: Market Leader

North America held the largest share of the healthcare consumables market in 2024, accounting for 42%. Growth in this region is fueled by high healthcare expenditure, advanced infrastructure, and increasing outpatient and emergency visits. According to CDC data, the U.S. alone recorded 45 million outpatient surgeries, 900 million physician visits, and 155 million emergency department visits in 2019, highlighting the significant demand for consumable medical supplies.

Asia Pacific: Fastest-Growing Market

Asia Pacific is expected to witness the highest growth rate during the forecast period. The region is experiencing a rapid rise in geriatric population, increasing hospital penetration, and higher adoption of diagnostic and surgical services. According to the World Health Organization (WHO), nearly 80% of the global elderly population will reside in low- and middle-income countries by 2050, creating massive growth opportunities for consumable products.

Europe: Strong Market Presence

Europe is projected to hold a significant share, supported by a mature healthcare system, increased spending, and stringent hygiene protocols. Countries like Germany, France, and the UK are driving adoption, with an emphasis on sustainability and eco-friendly disposable products. Germany, in particular, is advancing toward biodegradable consumables and innovative infection control solutions.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 168.87 Billion |

| Market Size by 2034 | USD 225.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.90% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Raw Material, End User, Region |

Market Dynamics

Key Growth Drivers

-

Rising geriatric population prone to chronic conditions and requiring regular healthcare support.

-

Increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and COPD.

-

High hospital admissions due to road accidents, surgeries, and long-term treatments.

-

Infection control awareness, leading to greater demand for sterilization and disposable consumables.

Challenges

-

Environmental concerns due to heavy usage of single-use plastics in medical consumables.

-

High cost of waste disposal and compliance with infection control laws.

-

Growing competition from sustainable and reusable alternatives.

Opportunities

-

Shift towards eco-friendly solutions, including biodegradable and compostable consumables.

-

AI-powered supply chain optimization improving manufacturing efficiency and inventory management.

-

Expansion of waste-to-energy facilities, helping address medical waste challenges.

Role of Artificial Intelligence in Healthcare Consumables

Artificial Intelligence (AI) is increasingly being integrated into the healthcare consumables industry. AI applications include:

-

Streamlined manufacturing through predictive maintenance and automated quality control.

-

Inventory management with real-time tracking and reduced wastage.

-

Supply chain optimization via improved demand forecasting and route scheduling.

-

Reduced operational costs by aligning production with market requirements.

AI is helping manufacturers and healthcare providers minimize costs, ensure product availability, and enhance efficiency across the entire value chain.

Market Segmentation

By Product Type

-

Sterilization Consumables (largest in 2024)

-

Wound Care Consumables

-

Diagnostic Consumables

-

Respiratory Supplies

-

Drug Delivery Products

-

Incontinence Products

-

Disposable Gloves & Masks

-

Hand Sanitizers (fastest-growing segment)

-

Others

By Raw Material

-

Plastic Resin (dominant segment)

-

Non-Woven Materials (fastest-growing)

-

Rubber, Glass, Paper, Metals, Others

By End User

-

Hospitals (largest segment with 67% share in 2024)

-

Clinics & Physician Offices

-

Others

Competitive Landscape

-

BD

-

Thermo Fisher Scientific

-

3M

-

Johnson & Johnson

-

Cardinal Health, Inc.

-

Baxter International, Inc.

-

Medtronic

-

B. Braun Melsungen AG

-

Boston Scientific Corporation

-

Avanos Medical, Inc.

Recent Developments

-

March 2024 – Hindustan Syringes and Medical Devices (HMD) launched Dispojekt single-use syringes with safety needles.

-

January 2024 – Ahlstrom received FDA 510(k) approval for its Reliance Fusion sterilization wrap.

-

May 2023 – Bayer established a precision health unit to develop consumer-focused health technologies.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025