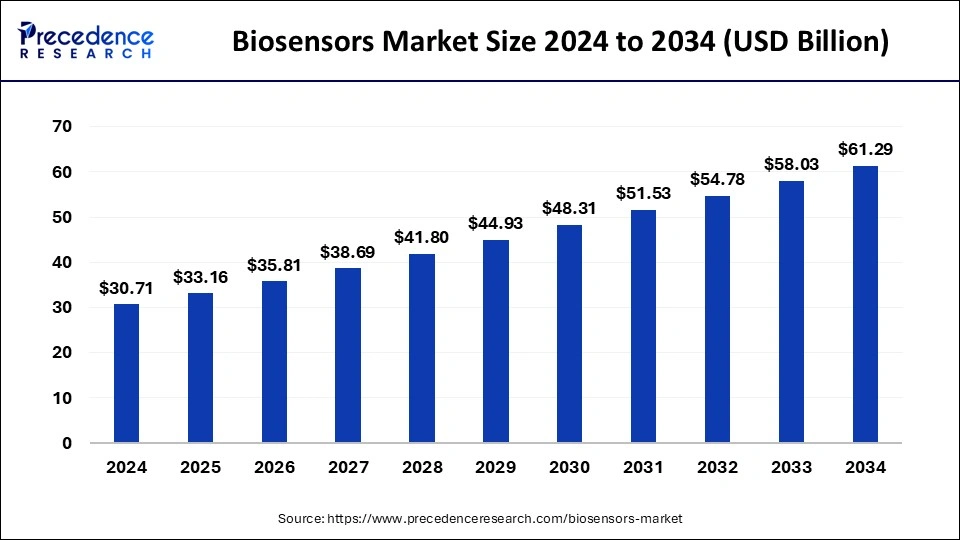

The global biosensors market is projected to grow significantly, reaching USD 61.29 billion by 2034 from an estimated USD 33.16 billion in 2025, reflecting a CAGR of 7.07% during the forecast period (2025–2034). In regional analysis, North America accounted for a market size of USD 12.12 billion in 2024 and is anticipated to expand at a CAGR of 6.83% over the same period. All market size estimations and forecasts are based on revenue (USD Million/Billion), with 2024 as the base year.

Key Market Insights

-

Market Size: USD 33.16 billion in 2025; projected USD 61.29 billion by 2034.

-

Growth Rate: CAGR of 7.07% from 2025–2034.

-

Leading Region: North America (39.46% revenue share in 2024)

-

Fastest-Growing Technology: Optical biosensors.

-

Fastest-Growing Application: Agriculture.

-

Highest-Growth End User: Food industry.

AI Driving Next-Generation Biosensing

Artificial intelligence is playing a pivotal role in transforming biosensors from passive detectors into intelligent systems capable of learning, adapting, and predicting physiological changes in real time. Machine learning (ML) and deep learning (DL) algorithms enable biosensors to interpret complex biological data, detect anomalies, and predict disease onset.

In healthcare, AI-enabled biosensors are advancing point-of-care diagnostics, allowing early detection of conditions such as diabetes, cardiovascular disorders, and neurodegenerative diseases. Wearable devices integrated with AI can alert users to potential arrhythmias before symptoms arise, while personalized biosensing solutions are improving diagnostic accuracy and treatment planning.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 61.29 Billion |

| Market Size in 2025 | USD 33.16 Billion |

| Market Size in 2024 | USD 30.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.07% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, End Use, Technology, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Overview

North America led the market in 2024 with a 39.46% revenue share, driven by the high prevalence of chronic diseases, robust healthcare infrastructure, and active regulatory support. The U.S. remains a global innovation hub, with strong R&D capabilities and favorable reimbursement policies.

Europe is the second-fastest-growing region, bolstered by the UK and Germany’s advanced R&D, increasing adoption of wearable biosensors, and emphasis on personalized medicine.

Asia Pacific is the fastest-growing market, supported by healthcare infrastructure expansion, government initiatives, and high investments in digital health across China and India.

Latin America and Middle East & Africa are experiencing steady adoption, particularly in electrochemical biosensors for point-of-care diagnostics, food safety, and environmental monitoring.

Technology Trends

-

Optical biosensors are expected to see the highest growth due to their high sensitivity, non-invasive nature, and integration with smartphones and wearable devices for real-time health monitoring.

-

Electrochemical biosensors remain the dominant technology, valued for their affordability and adaptability across applications.

-

Innovations include nano-enabled biosensors, label-free detection technologies, and multiplexing for simultaneous analyte detection.

Application Outlook

-

Agriculture is projected to be the fastest-growing application area, leveraging biosensors for soil health monitoring, pathogen detection, and precision farming.

-

Medical applications continue to dominate revenue share, driven by rising chronic disease prevalence and increased demand for remote patient monitoring.

-

Food industry adoption is accelerating, with biosensors used for pathogen detection, allergen monitoring, and smart packaging solutions to reduce food waste.

Key Players

Major companies in the market include Bio-Rad Laboratories Inc., Abbott Laboratories, Biosensors International Group Ltd., DuPont Biosensor Materials, Johnson & Johnson, and Molecular Devices Corporation.

Recent developments include Bruker Corporation’s acquisition of Dynamic Biosensors GmbH in October 2024, enhancing single-cell interaction analysis capabilities, and the April 2025 launch of a gold nanoparticle–enhanced optical biosensor for highly sensitive detection.

Market Outlook

With AI integration, IoT-enabled devices, and increased demand across healthcare, agriculture, and food safety sectors, the biosensors market is set for significant expansion through 2034. However, growth may be tempered by stringent regulations and slower adoption in low- and middle-income nations.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025