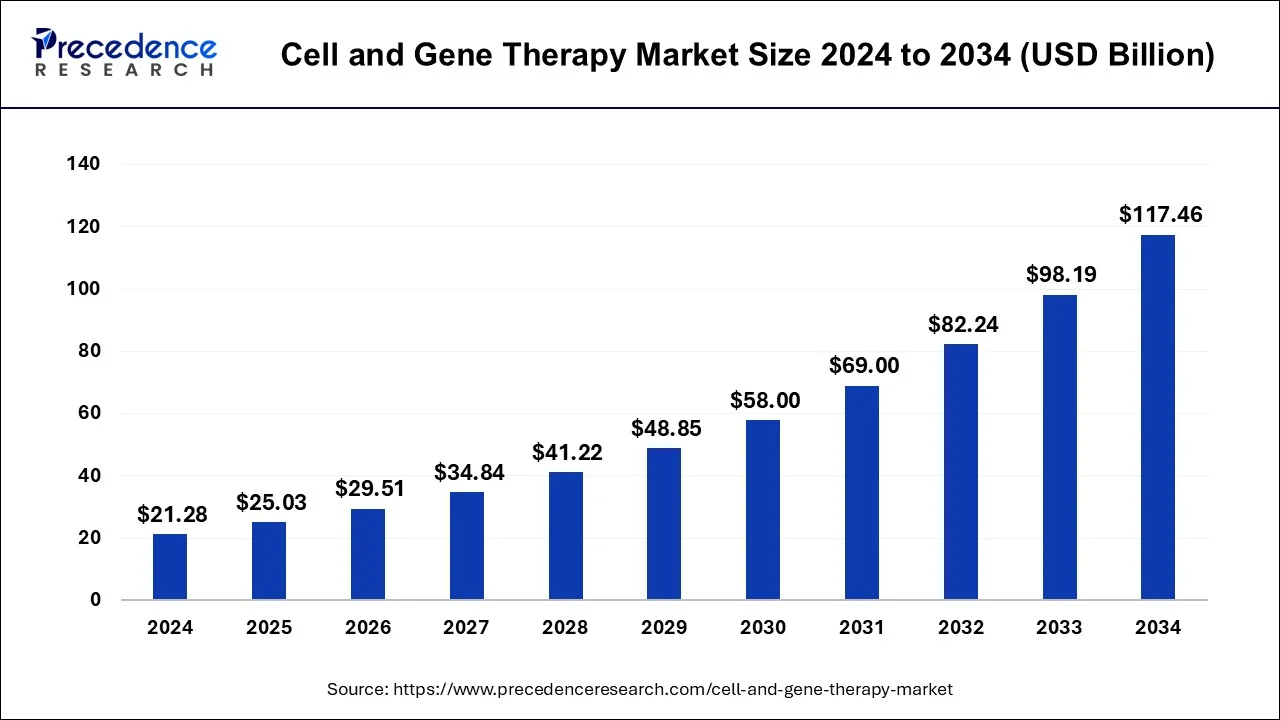

The global cell and gene therapy market is entering a transformative phase, projected to grow from USD 8.94 billion in 2025 to over USD 39.61 billion by 2034. With a CAGR of 17.98% during the forecast period, this dynamic sector is driven by innovations in biotechnology, rising investments in research and development, and the growing prevalence of chronic and genetic diseases.

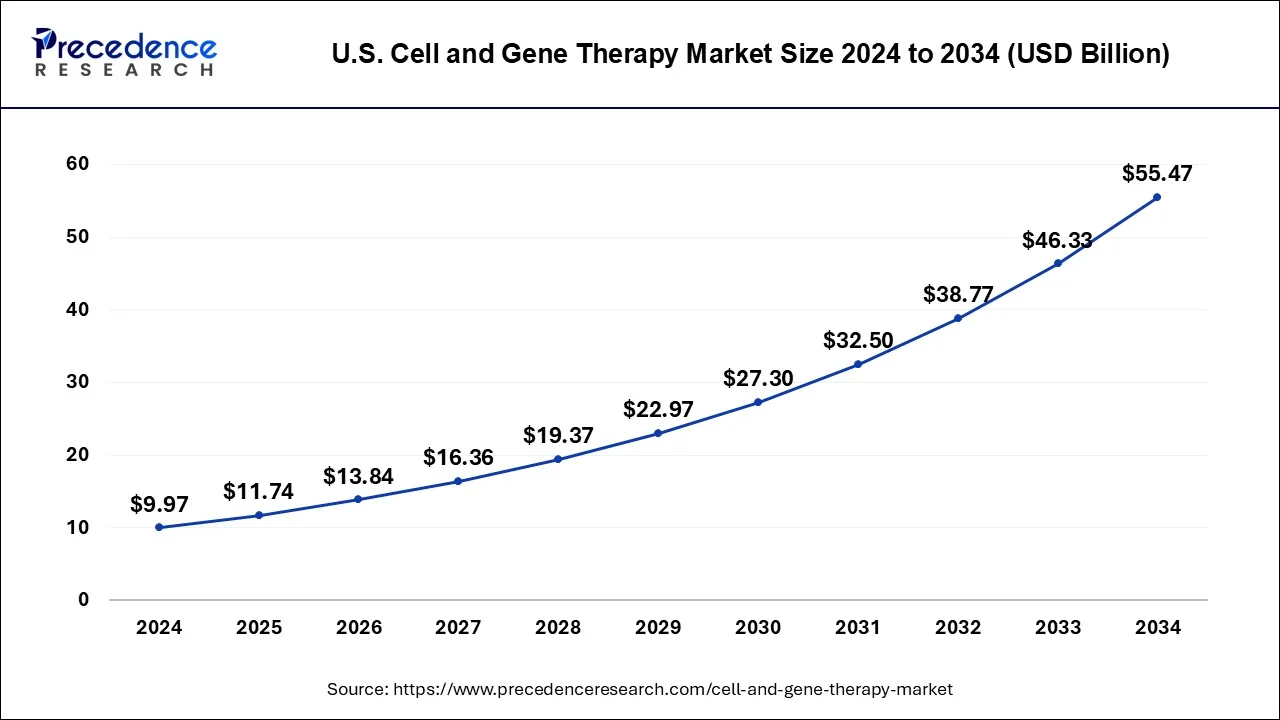

U.S. Market Outlook

The U.S. remains a global leader in cell and gene therapy innovations. In 2024, the U.S. market was valued at USD 3.59 billion, with projections pointing to USD 16.93 billion by 2034, growing at a CAGR of 17.10%. Growth is propelled by an increasing number of clinical trials and corporate investments in gene editing and regenerative medicine.

Market Overview

Cell and gene therapies (CGTs) offer curative potential for diseases previously considered untreatable. The U.S. FDA has approved over 20 CGTs, many priced between USD 37,500 to USD 2 million per treatment. This high-value market demands efficient biomanufacturing, streamlined logistics, and integrated service models.

Industry Dynamics:

-

Strategic mergers (e.g., Gilead/Kite, Roche/Spark Therapeutics)

-

Expanding CDMO partnerships

-

Investments in cryopreservation, standardized vector manufacturing, and off-the-shelf allogeneic cell solutions

Market Drivers

-

Rising Clinical Approvals: Growth in FDA and EMA approvals is enabling faster commercialization of CGTs.

-

Strategic Outsourcing: Small biotech firms increasingly collaborate with CDMOs due to financial and infrastructure constraints.

-

Technological Advancements: Adoption of single-use technologies is reducing production time and costs.

-

High Investment Flow: Capital inflow into CGT R&D is accelerating innovation across therapeutic categories.

Market Challenges

-

High Treatment Costs: CGTs remain prohibitively expensive, limiting access and adoption.

-

Regulatory Hurdles: Complex approval protocols and safety concerns pose barriers.

-

Manufacturing Bottlenecks: Limited production capacity can delay treatment availability—as seen in CAR T-cell therapy waitlists.

-

Clinical Complexities: Addressing toxicity, delivery efficiency, and cell specificity remains a technical challenge.

Emerging Opportunities

The market is witnessing robust developments across rare disease applications. Companies like Astellas, Biogen, Roche, and Sangamo Therapeutics are exploring next-gen gene therapy vectors to enhance expression, reduce immunogenicity, and improve durability. Continued innovation in CRISPR, transposon technologies, and ex vivo therapies presents promising future avenues.

Segment Insights

By Therapy Type

-

Cell Therapy: Includes stem cells, T cells, dendritic cells, NK cells, and tumor cells

-

Gene Therapy: Focused on repairing or replacing defective genes

By Therapeutic Class

-

Top Segment (2024): Infectious disease

-

Others: Cancer, genetic disorders, cardiovascular disease, hematology, ophthalmology, and neurological disorders

By Delivery Method

-

In Vivo: Expected to dominate due to simplified application within the body

-

Ex Vivo: Preferred for more controlled manipulation outside the body

By End-User

-

Leading Segment: Cancer care centers

-

Others: Hospitals and specialized treatment centers

Regional Analysis

North America

-

Over 400 active enterprises in CGT R&D

-

Dominates global clinical trial volume

-

Strong manufacturing infrastructure and academic support

Europe

-

Innovation driven by Horizon 2021 initiatives

-

Viral vector research gaining momentum

-

Skilled workforce and developed biotech hubs

Asia Pacific, Latin America, MEA

-

Growing government initiatives

-

Improving healthcare infrastructure

-

Increasing awareness of gene-based therapies

Competitive Landscape

Leading Companies:

-

Novartis AG

-

Pfizer Inc.

-

Biogen Inc.

-

Alnylam Pharmaceuticals

-

Amgen Inc.

-

CORESTEM Inc.

-

Helixmith Co. Ltd.

-

Kolon TissueGene Inc.

-

Dendreon Pharmaceuticals

-

JCR Pharmaceuticals

Recent Developments

-

McKinsey launched a Digital Capability Center to accelerate CGT manufacturing excellence.

-

Alexion Genomic Medicines acquired LogicBio, enhancing rare disease gene delivery capabilities.

-

Moderna and Merck collaborate on mRNA-based cancer vaccines in Phase II trials.

-

Pfizer acquired Biohaven Pharmaceuticals to expand its neurological portfolio.

Segments Covered in the Report

By Therapy Type:

-

Cell Therapy (Stem Cells, T Cells, Dendritic Cells, NK Cells, Tumor Cells)

-

Gene Therapy

By Therapeutic Class:

-

Cardiovascular Disease, Cancer, Genetic Disorders, Rare Diseases, Oncology, Hematology, Ophthalmology, Infectious Disease, Neurological Disorders

By Delivery Method:

-

In Vivo, Ex Vivo

By End Users:

-

Hospitals, Cancer Care Centers, Others

By Region:

-

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Conclusion

As the cell and gene therapy market continues to evolve, the convergence of technological innovations, regulatory flexibility, and patient-centered research is reshaping the future of medicine. Companies that invest early in scalable infrastructure and form strategic partnerships are best positioned to thrive in this high-growth market.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025