Injectable Cytotoxic Drugs Market Key Takeaways

- In terms of revenue, the global injectable cytotoxic drugs market was valued at USD 19.48 billion in 2024.

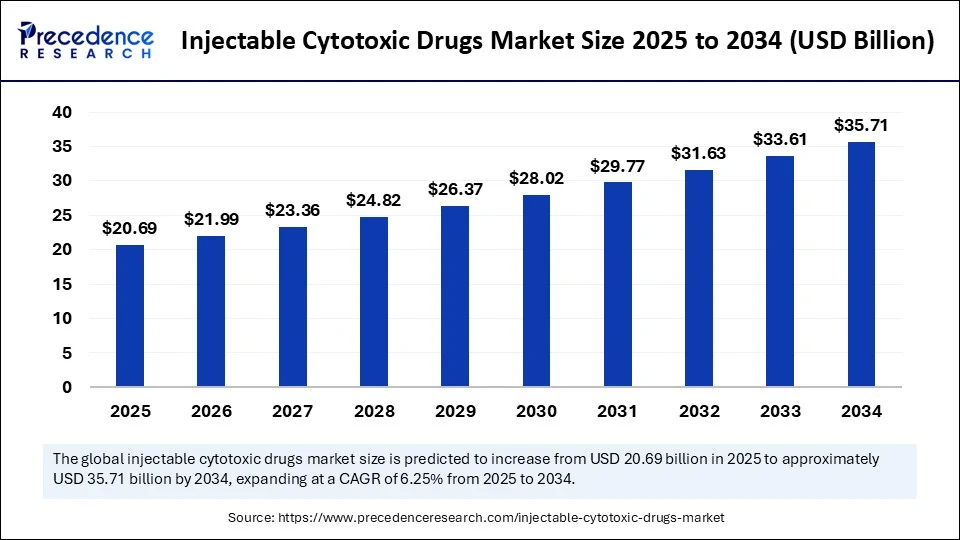

- It is projected to reach USD 35.71 billion by 2034.

- The market is expected to grow at a CAGR of 6.25% from 2025 to 2034.

- North America dominated the injectable cytotoxic drugs market with the largest share of 40% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By drug class, the alkylating agents segment captured the biggest market share of 29% in 2024.

- By drug class, the antimetabolities segment is anticipated to show considerable growth, under which the cytarabine sub-segment is likely to lead the charge in the market over the forecast period.

- By indication, the breast cancer segment contributed the highest market share of 18% in 2024.

- By indication, the hematological malignancies segment is anticipated to show considerable growth over the forecast period.

- By end user, the hospitals segment held the biggest market share of 59% in 2024.

- By end user, the ambulatory surgical centers segment is anticipated to show considerable growth over the forecast period.

- By route of administration, the intravenous injection/infusion segment generated the major market share of 81% in 2024.

- By route of administration, the intramuscular segment is anticipated to show considerable growth over the forecast period.

- By drug origin, the branded cytotoxic drugs segment held a significant market share in 2024.

- By drug origin, the generic cytotoxic drugs segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Injectable Cytotoxic Drugs Market?

AI is revolutionizing the cytotoxic drugs market by making drug discovery faster, treatment decisions smarter, and therapy delivery more efficient. Through advanced analytics, AI evaluates the effectiveness and toxicity of potential cytotoxic agents, helping researchers identify promising compounds more quickly and cost-effectively.

On the clinical side, AI-driven diagnostics track tumor response in real time, allowing oncologists to tailor treatment plans and improve outcomes. Beyond the lab and clinic, AI also supports supply chain optimization by predicting demand patterns in hospitals and ensuring that life-saving drugs are available when and where they are needed most.

Market Overview

The injectable cytotoxic drugs market is a mature but evolving segment within oncology pharmaceuticals. It includes generics of traditional agents (e.g. cisplatin, fluorouracil, cyclophosphamide) and branded specialty products like ADCs. As patent expirations hit major chemotherapeutic brands, generics and biosimilar versions have decreased prices and improved accessibility.

At the same time, investors and pharma players see value in specialty cytotoxics—such as ADCs and advanced formulations—due to high clinical demand and complexity barriers. Geographically, North America and Western Europe remain dominant markets, though Asia-Pacific growth is accelerating, driven by healthcare expansion and rising cancer care budgets.

Market Drivers

Generic conversion and pricing dynamics: Many cytotoxic injectables are off-patent, enabling high-volume generic production and price reduction—making them staples of national oncology protocols. Portfolio diversification by pharma companies: Companies leverage branded generics and advanced cytotoxic formulations to blend volume and margin.

Procurement and tender policies in public health systems favor injectable cytotoxic generics for budget predictability. Hospital purchasing power: Networked hospital systems and purchasing consortia drive bulk volume deals. A growing emphasis on cost-effective cancer care in less-developed markets positions high-volume generics as foundational therapies.

Opportunities

Portfolio expansion into long‑acting formulations and ADCs enables branded pricing power and differentiation. Manufacturing partnerships with contract manufacturing organizations (CMOs) can support scale and cost control while fulfilling complex injectable requirements.

Regional licensing and distribution deals for generic cytotoxic lines in emerging nations allow fast market entry. Value-added service offerings—such as centralized infusion management, bundled supportive care, or administration training programs—enhance customer retention. Integration with hospital oncology digital platforms—track dosing regimes, toxicities, and infusion schedules—adds utility and stickiness for suppliers.

Challenges

Price erosion and margin pressure for generic injectable cytotoxic agents. Vendor competition: large generic drug producers compete aggressively, requiring scale-efficient manufacturing and lean operations. Regulatory and supply chain complexity: sterile injectable manufacturing demands facility investment and strict documentation, reducing attractiveness for smaller firms.

Liability and risk of adverse events: high-risk therapy requires provider training and pharmacovigilance infrastructure. Shifting payers and care models: as targeted therapies become standard-of-care, some healthcare systems may phase down reliance on cytotoxic-heavy regimens, impacting volume.

Recent Developments

Major generic manufacturers expanded capacity for cytotoxic injectable lines to supply national tender programs. New ADCs with cytotoxic payloads attracted high-value licensing deals between large pharma and biotech innovators. CMO facilities tailored to oncology injectable manufacturing scaled up to handle compounded sterile cytotoxic products.

Hospital networks introduced integrated oncology drug delivery systems coupling infusion scheduling, dosing analytics and side-effect management platforms. Distribution partnerships were signed between global suppliers and regional oncology chains in Asia and Latin America to bring low-cost cytotoxic injectables to underserved markets. Subscription-based supply models for high-use cytotoxic agents were piloted with consistent-volume pricing and inventory management support.

Segments Covered in the Report

By Drug Class

- Alkylating Agents

- Cyclophosphamide

- Ifosfamide

- Busulfan

- Antimetabolites

- 5-Fluorouracil (5-FU)

- Methotrexate

- Cytarabine

- Plant Alkaloids

- Vincristine

- Vinblastine

- Paclitaxel, Docetaxel

- Antitumor Antibiotics

- Doxorubicin

- Bleomycin

- Mitomycin

- Platinum-Based Drugs

- Cisplatin

- Carboplatins

- Oxaliplatin

- Combination Cytotoxic Regimens (e.g., CHOP, FOLFIRINOX)

By Indication

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Hematological Malignancies

- Ovarian & Cervical Cancer

- Pancreatic & Liver Cancer

- Bladder & Prostate Cancer

- Others (Sarcoma, Head & Neck, Gastric)

By End User

- Hospitals

- Cancer & Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Homecare Settings (with mobile infusion units)

- Government Oncology Centers

By Route of Administration

- Intravenous (IV) Injection/Infusion

- Intramuscular (IM)

- Intrathecal

- Intraperitoneal (used in HIPEC protocols)

- Subcutaneous (for select agents)

By Drug Origin

- Branded Cytotoxic Drugs

- Generic Cytotoxic Drugs

- Compounded Cytotoxic Preparations (niche)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Free sample @ https://www.precedenceresearch.com/sample/6505

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025