Deoxycholic Acid Obesity Drugs Market Key Takeaways

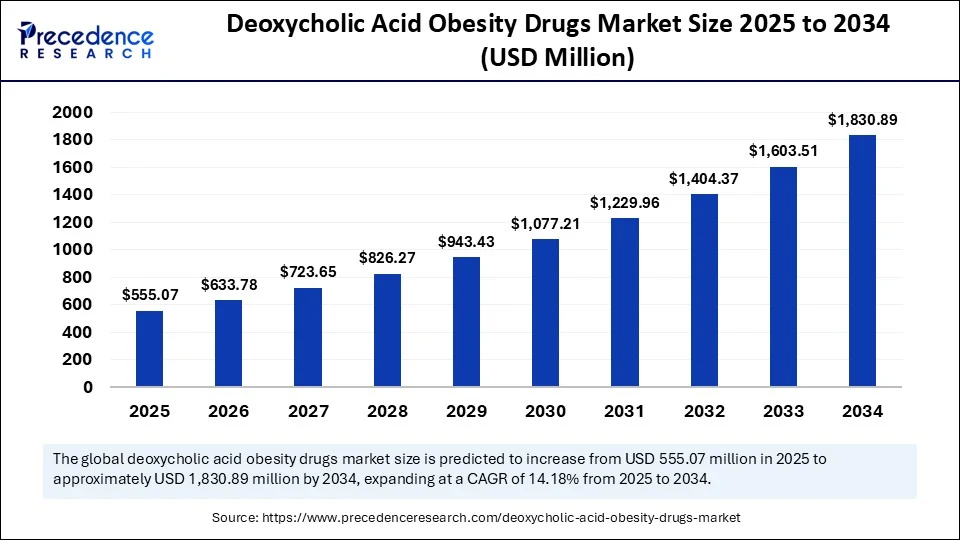

- In terms of revenue, the global deoxycholic acid obesity drugs market was valued at USD 486.14 million in 2024.

- It is projected to reach USD 1,830.89 million by 2034.

- The market is expected to grow at a CAGR of 14.18% from 2025 to 2034.

- North America led the global deoxycholic acid obesity drugs market with the largest market share of 67% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By drug type, the ATX-101 (Deoxycholic Acid Injection / Kybella / Belkyra) segment held the biggest market share of 94% in 2024.

- By drug type, the experimental / compounded deoxycholic acid formulations segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the submental fat reduction (double chin) segment captured the highest 88% of market share in 2024.

- By application, the abdominal fat reduction (off-label) segment is expected to expand at a notable CAGR over the projected period.

- By end user, the aesthetic clinics & medspas segment contributed the major market share of 61% in 2024.

- By end user, the plastic surgery centers segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the physician-dispensed / in-clinic administration segment generated the largest market share of 84% share in 2024.

- By patient demographic, the adults aged 25–45 years segment accounted for the significant market share of 38.1% in 2024.

- By patient demographic, the 46–60 Years segment is expected to expand at a notable CAGR over the projected period.

AI Advances Development of Deoxycholic Acid-Driven Obesity Drugs

Artificial intelligence is becoming a game-changer in the quest for next-generation deoxycholic acid (DCA) treatments targeting obesity. Its role is growing in the development of peptide-based drugs, especially those designed to leverage DCA’s fat-reducing properties. A 2025 patent describes a DCA-peptide compound aimed at preventing fat cell formation and increasing lipolysis—paving the way for more targeted, AI-assisted obesity therapies.

Emerging studies also reveal DCA’s influence on metabolic function, showing its potential to reduce insulin resistance and increase thermogenesis via mitochondrial activation in preclinical models. AI can play a key role in fine-tuning these pathways through advanced molecular modeling and predictive analytics. Together, these breakthroughs highlight how AI can significantly speed up and refine the development of DCA-based obesity treatments.

Market Overview

The deoxycholic acid obesity drugs market sits within a niche but growing corner of pharmacological aesthetics. Initially approved for targeting submental fat (double‑chin reduction), key players are exploring pipeline expansion into larger subcutaneous fat pockets and obesity adjunct therapy.

As consumer spending on non‑invasive cosmetic treatments increases and as the medical aesthetics market matures, pharmaceutical developers are pursuing scalable injectable fat‑dissolution products. Strategies include partnerships with aesthetic dermatology chains, licensing deals with pharmaceutical firms, and crossover studies combining obesity medications with deoxycholate fat‑reduction therapy to capture broader patient bases.

Drivers

Principal drivers include the high-margin nature of cosmetic aesthetic procedures, attractive to physicians and med‑spa operators. Provider demand is strong, as clinicians seek to diversify service offerings beyond fillers and neuromodulators. Growing consumer trends towards minimally invasive body‑contouring solutions with quick recovery time fuel demand.

Innovation in formulation costs—more efficient drug manufacturing and scale economies—reduce per-dose costs and allow unit pricing flexibility. Brand differentiation: companies offering proprietary delivery or formulation technologies can pitch safer, more effective protocols. Global cosmetic tourism drives cross-border demand, especially where regulatory barriers differ, creating commercial expansion avenues.

Opportunities

Expanded label for abdominal, back, hip applications can amplify market size beyond submental zones. Strategic partnerships with aesthetic clinic chains may secure recurring product usage and provider loyalty. Bulk purchasing models for injectables by high‑volume providers can lock-in sales and streamline supply chains.

Training and certification programs bundled with product access can build ecosystems and reinforce correct use. Geographic expansion, particularly in cosmetic-aspirational markets such as South Korea, Middle East, and Brazil, presents untapped demand. Strategic marketing stacking: combining deoxycholic acid with energy‑based devices (like laser or ultrasound) as combo protocols can elevate value proposition.

Challenges

Intense competition from global obesity drug leaders like GLP‑1 analogues draws attention away from injectables with minimal systemic effects. Perceived high complexity and risk associated with injections may discourage physician adoption outside of dermatology niches.

Regulatory utilization restrictions inhibit wider use unless substantial efficacy and safety evidence is produced. Limited reimbursement—viewed as cosmetic, not medical—means patients pay out-of-pocket, potentially limiting market penetration. Training and liability concerns: poorly trained injectors risk adverse events and reputational damage potentially harming market growth.

Recent Developments

Commercial alliances are forming between aesthetic chains and biotech developers to implement controlled trials in extended-body regions, testing both safety and speed of fat reduction. Aesthetic training academies introduced certified modules on deoxycholic acid injection safety, anatomy mapping, and volume protocols.

Some companies launched bulk injectable kits tailored to high-use clinics, enabling better margins for providers. Forward-looking firms are piloting combination treatment packages that include deoxycholate injections, cooling-based fat reduction, and injectable obesity drugs, marketed to premium clientele.

Clinical-stage developers announced first-in-human trials using micro-encapsulated systemic deoxycholic acid targeting visceral fat. International clinics in Asia and Latin America reported rising adoption rates under physician protocols, aided by off-label use and aesthetic tourism. Several manufacturers introduced more concentrated deoxycholate formulations—allowing fewer sessions or smaller injection volumes.

Deoxycholic Acid Obesity Drugs Market Companies

- AbbVie Inc.

- Revance Therapeutics, Inc.

- Ipsen

- Hugel, Inc. (South Korea)

- Medytox, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Endo International plc

- Venus Remedies

- Allergan Aesthetics (subsidiary of AbbVie)

- Revexia Life Sciences

- Contura International Ltd.

- OBE Pharma

- NovaBay Pharmaceuticals

- Laboratoires VIVACY (France)

- Sinclair Pharma

- Hyundae Meditech (Korea)

- DermaSculpt

- SinoPharm Group

- Croma Pharma

- Anika Therapeutics

Segments Covered in the Report

By Drug Type

- ATX-101 (Deoxycholic Acid Injection / Kybella / Belkyra)

- Experimental / Compounded Deoxycholic Acid Formulations

- Combination Therapies (under development)

- Oral Deoxycholic Acid Products (limited and non-FDA approved)

By Application

- Submental Fat Reduction (Double Chin)

- Abdominal Fat Reduction (off-label)

- Thighs, Arms, and Flanks (off-label aesthetic uses)

- Lipomas and Localized Fat Deposits

- Cellulite Management (experimental)

By End User

- Aesthetic Clinics & MedSpas

- Dermatology Clinics

- Plastic Surgery Centers

- Hospitals

- Home Administration (emerging, under supervision)

By Distribution Channel

- Physician-Dispensed / In-Clinic Administration

- Retail Pharmacies (in regions where approved for direct sales)

- Online Pharmacies (regulated channels only)

By Patient Demographics

- Adults Aged 25–45 Years

- 46–60 Years

- Millennials Seeking Non-Surgical Aesthetic Procedures

- Men

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get Free Sample @ https://www.precedenceresearch.com/sample/6502

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025