Induced Pluripotent Stem Cells Market Key Takeaways

- In terms of revenue, the global induced pluripotent stem cells market was valued at USD 1.93 billion in 2024.

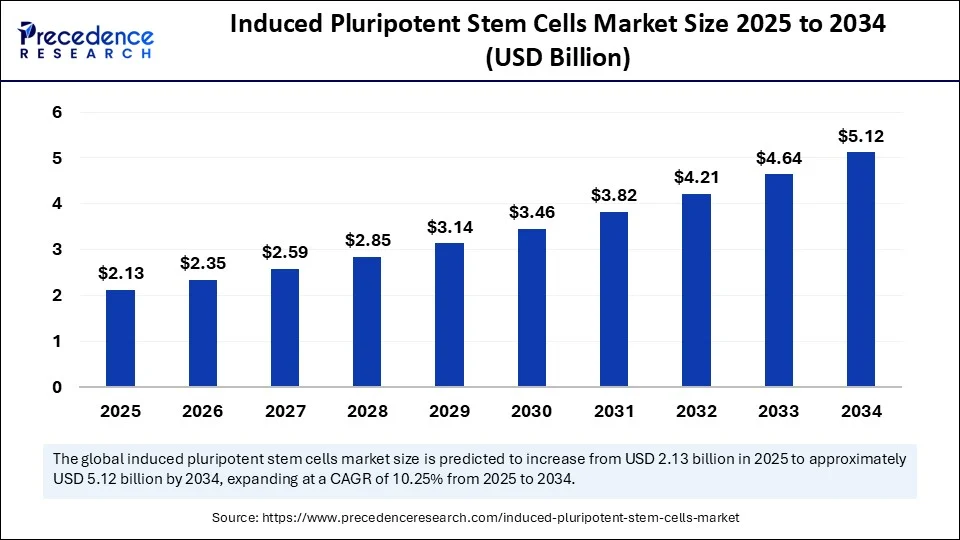

- It is projected to reach USD 5.12 billion by 2034.

- The market is expected to grow at a CAGR of 10.25% from 2025 to 2034.

- North America dominated the global induced pluripotent stem cells market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the drug discovery & toxicology testing segment held the major market share of 36% in 2024.

- By application, the disease modelling segment is projected to grow at a CAGR between 2025 and 2034.

- By cell type/lineage, the hematopoietic cells segment contributed the biggest market share in 2024.

- By cell type/ lineage, the hepatocytes segment is expanding at a significant CAGR between 2025 and 2034.

- By product & services, the iPSC-derived cells segment captured the highest market share of 41% in 2024.

- By product & services, the stem cell banking services segment is expected to grow at a significant CAGR over the projected period.

- By end user, pharmaceutical & biotech companies segments generated the major market share of 44% in 2024.

- By end user, the CROs & CDMOs segment is expected to grow at a notable CAGR from 2025 to 2034.

- By technology, non-integrating methods dominated the global induced pluripotent stem cells market in 2024 and are expected to sustain the growth in the coming years.

Impact of Artificial Intelligence on the Induced Pluripotent Stem Cells Market

AI is revolutionizing the iPSC market by driving greater efficiency, reliability, and scalability in stem cell research and therapeutic development. Advanced AI models streamline the reprogramming of adult cells into iPSCs by reducing variability, improving accuracy, and increasing reproducibility across laboratories and biotech companies.

With continued innovation, AI is unlocking new potential for large-scale clinical applications, paving the way for broader deployment of iPSC-based technologies worldwide and fueling the growth of regenerative medicine markets.

Market Overview

The global induced pluripotent stem cells market has matured into a vibrant ecosystem of biotechnology research, clinical trial development, and commercial bioprocessing. Investors and pharma view iPSC platforms as essential infrastructure for next-generation cell therapies, high-value drug screening tools, and personalized medicine. North America leads in regulatory filings and trial activity, while Asia-Pacific fast-tracks clinical translation.

Market growth is catalyzed by venture capital, strategic alliances between major pharmaceutical companies and iPSC specialists, and steadily expanding GMP-compliant production capacity. Demand extends across therapy development, safety pharmacology, and high-content drug discovery screening.

Drivers

A core driver is investment momentum and strategic alliances: Major pharma companies and venture-backed startups are forming joint ventures to co-develop iPSC-based therapeutics and screening tools. Expanding clinical pipelines: With several iPSC-derived product candidates in Phase I/II trials, investor interest focuses on assets approaching commercialization. Cost reductions from innovation in automation: Automated stem cell platforms and closed-system bioreactors are lowering per-batch cost and improving reproducibility.

Rising demand for human cell-based assays: Drug companies increasingly rely on iPSC-derived neuron, cardiomyocyte, and hepatocyte assays for liability and efficacy testing, replacing or supplementing animal models. Regulatory push for cell therapy frameworks: Governments and agencies are streamlining regulatory paths for cell-based medicinal products, facilitating trial initiation.

Opportunities

Therapeutic manufacturing partnerships: CMOs can capitalize by offering end-to-end iPSC services—from reprogramming to final cell therapy formulation. Disease-specific iPSC line libraries: Licensing or selling curated libraries of patient-derived lines accelerates R&D in neurodegenerative and genetic diseases.

Screening-as-a-Service models: Offering iPSC-derived organoid screening panels for pharma reduces time-to-data and enables external validation. Regional manufacturing hubs: Establishing GMP-compliant iPSC production in Asia, Latin America, or Middle East offers localization benefits and lowers costs. Platform licensing and software integration: Companies bundling AI analytics or image cytometry tools with iPSC screening platforms offer differentiated value.

Challenges

Significant barriers include intellectual property complexities: Reprogramming techniques, differentiation protocols, and proprietary cell lines often involve patent disputes and rights negotiations. Manufacturing cost and reproducibility: Maintaining batch consistency, differentiation yield, and genomic integrity at scale remains difficult. Regulatory uncertainty around therapies: Approval pathways for iPSC-based cellular therapies remain evolving, and long-term follow-up for tumorigenicity remains a concern.

Competitive fragmentation: Numerous biotech firms, academic spin-offs, and CDMOs compete for limited pipeline programs and trial funding. Market adoption timelines: Investors and stakeholders expect returns, but commercial launches for iPSC cell therapies still face multi‑year validation cycles.

Recent Developments

Over the past year, new venture capital rounds have funded iPSC startups targeting cardiomyocyte therapies and neurological repair with multimillion-dollar valuations. Major pharmaceutical players entered licensing agreements for iPSC-based tissue screening platforms to support early‑phase drug development. Leading CDMOs opened new GMP iPSC facilities in North America to support Phase I/II trials, with automation to reduce manual variability.

A prominent consortium published initial consensus quality control metrics for iPSC derived lines to standardize viability, differentiation potential, and genomic integrity. In Asia, government-sponsored iPSC centers launched large-scale, ethnically diverse cell line repositories, accelerating local clinical translation. Several biotech providers introduced subscription-based iPSC screening and phenotype analysis services integrated with AI image analytics.

Meanwhile, regulatory agencies in both U.S. and Europe issued clarifying guidance on investigational new drug (IND) submissions for iPSC-derived cell therapies.

Induced Pluripotent Stem Cells Market Companies

- Allele Biotechnology & Pharmaceuticals

- Axol Bioscience Ltd.

- bit.bio (synthetic biology iPSC platform)

- BlueRock Therapeutics (Bayer)

- BrainXell, Inc.

- Cellular Dynamics International (Fujifilm Group)

- Century Therapeutics

- Corning Incorporated

- Evotec SE

- Fujifilm Cellular Dynamics, Inc.

- Lifeline Cell Technology

- Lonza Group AG

- Ncardia

- Newcells Biotech

- Pluricell Biotech

- REPROCELL Inc.

- Stemcell Technologies Inc.

- Sumitomo Pharma Co., Ltd.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc

Latest Announcements by Industry Leaders

Dr. Chikafumi Yokoyama, CEO of REPROCELL Inc.

- In May 2025, REPROCELL is a global leader in providing products and services to support stem cells for clinical and research use. As part of this, REPROCELL launches StemEdit™ Human iPSC non-HLA class 1 (B2M Homo KO) and StemEdit™ Human iPSC non-HLA class 1/2 (B2M/CIITA Homo double KO) cell lines. These cell lines, though intended for research use only, originate from StemRNA Clinical induced pluripotent stem cells (iPSCs) from a healthy donor utilizing our StemEdit™ gene editing technology. “The release of these new hypoimmune StemEdit™ Human iPSC lines represents a key milestone in enhancing immune research and regenerative medicine. By allowing researchers to investigate and modify immune cell interactions with unmatched precision, these cell lines demonstrate REPROCELL’s dedication to supporting scientific progress. We will continue to advance and offer world-class tools to drive innovation in cell therapy and immunology.”

Segments covered in the Report

By Application

- Drug Discovery & Toxicology Testing

- High-throughput drug screening

- Hepatotoxicity and cardiotoxicity testing

- Disease Modeling

- Neurological diseases (ALS, Parkinson’s, Alzheimer’s)

- Cardiovascular and metabolic diseases

- Regenerative Medicine

- Cell-based therapies (retinal, cardiac, hematopoietic)

- Stem Cell Banking

- Academic Research

- Gene Editing Research (iPSC + CRISPR/Cas9)

By Cell Type / Lineage

- Hematopoietic Cells

- Cardiomyocytes

- Neural Stem Cells

- Hepatocytes

- Retinal Pigment Epithelium (RPE)

- Pancreatic Beta Cells

- Chondrocytes & Osteoblasts

- Others (T cells, epithelial cells, etc.)

By Product & Service

- iPSC-Derived Cells

- iPSC Reprogramming Kits & Culture Media

- iPSC Lines & Custom Cell Engineering Services

- CRISPR & Genetic Modification Tools

- Stem Cell Banking Services

- Assay Kits for Differentiation, QC, and Validation

- Instruments & Bioreactors

By End User

- Pharmaceutical & Biotech Companies

- Academic & Research Institutions

- CROs & CDMOs

- Cell Therapy Companies

- Government & Non-Profit Organizations

By Technology

- Integrating Vectors (e.g., Retroviruses)

- Non-Integrating Methods

- Sendai virus

- Episomal vectors

- mRNA & Protein-based reprogramming

- CRISPR-Cas9 & Gene Editing

- Automated iPSC Production Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Free Sample@ https://www.precedenceresearch.com/sample/6503

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025