Inactivated Vaccines Market Key Takeaways

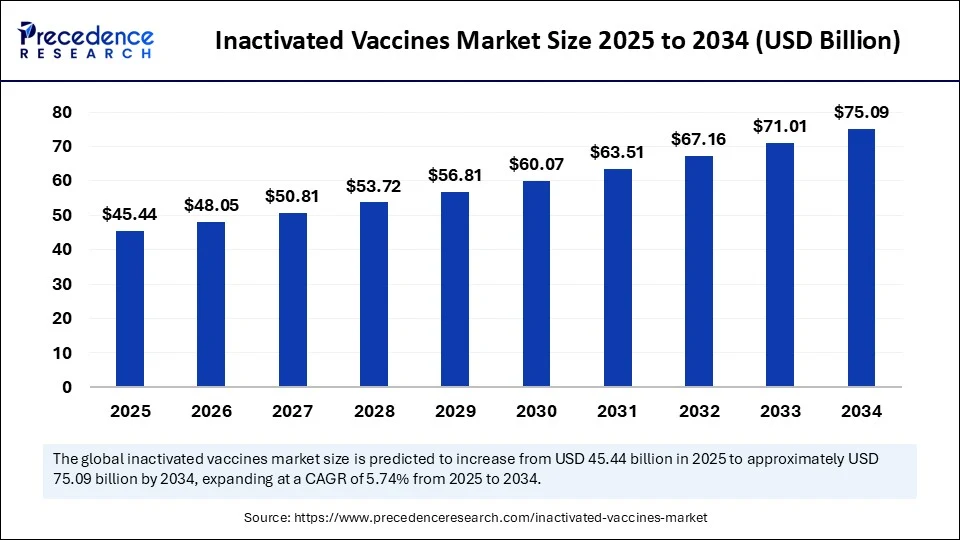

- In terms of revenue, the global inactivated vaccines market was valued at USD 42.97 billion in 2024.

- It is projected to reach USD 75.09 billion by 2034.

- The market is expected to grow at a CAGR of 5.74% from 2025 to 2034.

- Asia Pacific dominated the inactivated vaccines market with the largest share of 39% in 2024.

- The Middle East & Africa is expected to grow at a significant CAGR from 2025 to 2034.

- By vaccine type, the whole virus inactivated vaccines segment held the major market share of 46% in 2024.

- By vaccine type, the subunit inactivated vaccines segment is projected to grow at the highest CAGR between 2025 and 2034.

- By disease indication, the polio segment captured the biggest market share of 27% in 2024.

- By disease indication, the COVID-19 segment is likely to expand at a significant CAGR from 2025 to 2034.

- By age group, the pediatrics (0–18 years) segment contributed the largest market share of 63% in 2024.

By age group, the geriatrics segment is anticipated to grow at a significant CAGR from 2025 to 2034. - By end user, the public immunization programs segment generated the major market share of 68% in 2024.

- By end user, the travel & occupational health centers segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, the government supply contracts segment led the market in 2024.

- By distribution channel, the direct institutional sales segment is expected to grow at a significant CAGR from 2025 to 2034.

How is AI Impacting the Inactivated Vaccines Market?

Artificial intelligence is revolutionizing the inactivated vaccines market by transforming every phase of development and post-market evaluation. By leveraging AI algorithms, researchers can accelerate antigen discovery and engineer vaccine candidates that precisely target immune pathways, resulting in more effective and safer immunogens. These technologies also enhance preclinical testing by modeling biological responses, reducing reliance on trial-and-error approaches.

During clinical trials, AI optimizes operational efficiency through predictive patient recruitment, adverse event forecasting, and adaptive trial design that responds to real-time insights—ultimately shortening time to approval. After a vaccine reaches the market, AI systems continue to track its performance, analyzing data from electronic health records, pharmacovigilance systems, and even social media to ensure long-term safety and efficacy across diverse populations.

Market Overview

The global inactivated vaccines market serves as a cornerstone of routine immunization and outbreak response programs. In 2024 and 2025, demand rebounded as countries pushed seasonal flu campaigns and integrated multi-valent vaccines for broader protection. The market includes inactivated influenza formulations, inactivated poliovirus vaccines, rabies vaccines, hepatitis A, and inactivated COVID-19 shots.

Within major geographies such as the United States, Europe and Asia-Pacific, manufacturers are investing in capacity expansions and co-manufacturing partnerships. Analysts project high single-digit annual growth over the coming decade, supported by strategic stockpile investments, recurring seasonal demand, and emerging developments in antigen fusion and adjuvant science.

Market Drivers

Predictable seasonal and programmatic demand: Influenza and polio vaccination programs generate recurrent, annual need. Emerging-age boosters for adult populations are expanding the customer base. Established infrastructure and economies of scale: Longstanding production facilities, known supply chains, and maturing quality management systems offer manufacturers reliability and cost leverage.

Public and private sector investments: Governments, NGOs, and private stakeholders continue allocating funds to bulk procurement, particularly for influenza vaccine stockpiles and pandemic preparedness. Regulatory familiarity and policy support: Authorities have deep experience approving and regulating inactivated platforms, facilitating smoother reviews, batch releases, and rollout.

Opportunities

Portfolio expansion and bundling: Combining multiple inactivated antigens—such as influenza plus COVID-19 or influenza–Hepatitis A vaccinations—into single syringes could increase vaccination compliance and simplify logistics. High‑volume contract manufacturing (CMO) growth: Many originator firms are partnering with CMOs in low‑cost regions to boost capacity and reduce production costs.

Next‑generation adjuvants and delivery devices: Development of adjuvants that standardize dose-sparing and extend immune responses opens door for more efficient usage per vial. Delivery innovations like nasal sprays or patch systems reduce barrier to access and cut waste. Emerging market expansion via tiered pricing: Differential pricing and manufacturing localization for lower-income countries offer both volume growth and corporate social responsibility alignment.

Challenges

Price pressure and margin erosion: In mature markets, public tenders drive price competition, forcing manufacturers to balance unit cost with profit. R&D investment return comparison: Newer platforms (e.g., mRNA) may offer higher margins and faster approvals, causing some firms to divert resources away from inactivated vaccine R&D. Cold‑chain and logistics cost burdens: Vaccines requiring refrigeration or freezing remain costlier to distribute in remote areas. Without cold‑chain infrastructure, uptake in rural regions lags. Patent expirations and generic entry: Some inactivated vaccines have long expired patents, allowing biosimilar and generic entrants to undercut established brands on price.

Recent Developments

Recently, manufacturers launched cell‑based inactivated influenza production lines to circumvent egg‑based supply constraints and allergens, increasing yield and flexibility. A new quadrivalent influenza formulation with adjuvant-enhanced immunity has begun roll‑out in North America and Europe. Several vaccine firms have entered partnerships with contract manufacturers in Asia and Africa, targeting tiered pricing for low‑ and middle‑income countries.

Novel thermostable inactivated polio and enterovirus formulations are entering field trials in tropical climate zones, where cold‑chain logistics are particularly challenging. Inactivated COVID‑19 vaccine manufacturers have secured WHO prequalification to enable global supply. Adjuvant innovation firms have filed patents on nanoparticle-based immune boosters that reduce required antigen concentration, enabling dose conservation and scalability.

Get Sample Link@ https://www.precedenceresearch.com/sample/6506

Inactivated Vaccines Market Companies

- Sanofi Pasteur

- GSK plc

- Bharat Biotech (Covaxin, Typbar)

- Sinovac Biotech Ltd.

- Sinopharm (CNBG)

- Serum Institute of India (SII)

- Pfizer Inc.

- Valneva SE

- Moderna, Inc. (expanding into inactivated pipeline)

- Biological E. Limited

- Panacea Biotec Ltd.

- Chumakov Institute of Poliomyelitis and Viral Encephalitides (Russia)

- IDT Biologika

- Emergent BioSolutions

- Novavax, Inc. (subunit but related pipeline)

- Incepta Vaccine Ltd. (Bangladesh)

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Bio Farma (Indonesia)

- Instituto Butantan (Brazil)

- Walvax Biotechnology Co., Ltd. (China)

Segments Covered in the Report

By Vaccine Type

- Whole Virus Inactivated Vaccines

- Inactivated Polio Vaccine (IPV)

- Rabies Vaccine

- Hepatitis A Vaccine

- Inactivated COVID-19 Vaccines (e.g., Sinovac, Covaxin)

- Split-Virion Inactivated Vaccines

- Subunit Inactivated Vaccines

- Pertussis (aP)

- Influenza (Split Virion, Subunit)

- Tetanus & Diphtheria

- Combination Inactivated Vaccines

- DTP

- DTaP-IPV-HepB-Hib

- Adjuvanted Inactivated Vaccines

By Disease Indication

- Polio

- Influenza

- COVID-19

- Hepatitis A

- Rabies

- Japanese Encephalitis

- Cholera

- Pertussis

- Tick-Borne Encephalitis

- Combination Indications

By Age Group

- Pediatrics (0–18 years)

- Adults

- Geriatrics

- Travelers & At-Risk Populations

By End User

- Public Immunization Programs

- Private Clinics & Hospitals

- Military & Emergency Preparedness

- Travel & Occupational Health Centers

By Distribution Channel

- Government Supply Contracts (e.g., UNICEF, Gavi, WHO)

- Hospital Pharmacies

- Retail Pharmacies

- Direct Institutional Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Visit@ https://www.precedenceresearch.com/

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025