U.S. Radiopharmaceutical Therapies Market Key Takeaways

- By therapy type, the targeted beta therapy segment held the largest share of 66.29% in 2024.

- By therapy type, the targeted alpha therapy segment is expected to grow at the fastest CAGR of 25.27% during the forecast period.

- By radioisotopes used, the beta emitters segment held the largest share of 66.29% in 2024.

- By radioisotopes used, the alpha emitters segment is expected to grow at the fastest CAGR of 25.26% in the upcoming period.

- By therapeutic area, the oncology segment held the biggest market share of 88.14% in 2024.

- By therapeutic area, the non-oncology segment is emerging as the fastest growing during the forecast period.

- By route of administration, the intravenous injection segment generated the major market share of 80.14% in 2024.

- By route of administration, the intratumoral (investigational) segment is expected to grow at the fastest CAGR of 25.06% during the forecast period.

- By end-user, the hospitals segment held the highest market share of 62.81% in 2024.

- By end-user, the radiopharmacies (centralized radiopharmacy networks) segment is observed to grow at the fastest CAGR of 17.50% during the forecast period.

Impact of AI on the U.S. Radiopharmaceutical Therapies Market

Artificial Intelligence is rapidly reshaping the landscape of radiopharmaceutical therapies in the U.S. by boosting diagnostic accuracy, accelerating the pace of drug development, and enabling highly personalized treatment strategies. Within nuclear medicine, AI-driven imaging—particularly through PET/CT—enhances lesion detection and improves the targeting precision of agents such as Pluvicto and Lutathera. This allows clinicians to better identify suitable patients and improve therapeutic outcomes.

Beyond diagnostics, AI supports accurate dosimetry calculations to ensure safer, more targeted radiation doses. It also plays a critical role in predicting molecular interactions during drug discovery and managing the complex logistics of isotope delivery, which is vital for time-sensitive treatments.

As AI technologies become more deeply embedded in clinical workflows, they are paving the way for a more dynamic, efficient, and patient-tailored radiopharmaceutical ecosystem in U.S. healthcare.

Market Overview

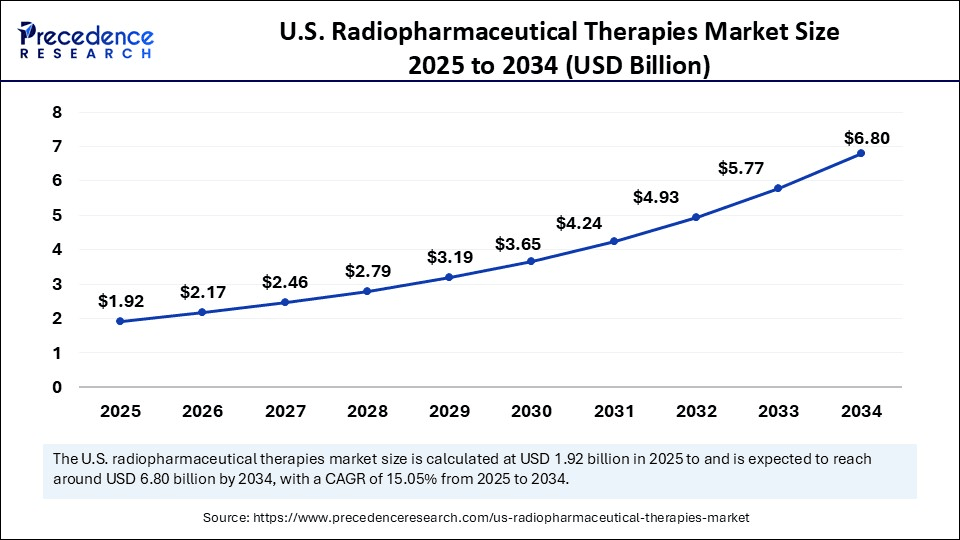

The U.S. radiopharmaceutical therapies market sits at the intersection of oncology innovation and nuclear medicine infrastructure. Fueled by both diagnostic and therapeutic applications, the sector has witnessed rapid growth in theranostic agents, especially in metastatic prostate cancer and neuroendocrine tumors. With growing awareness of nuclear medicine’s clinical power and streamlining of FDA approval pathways, the domestic market is forecast to surge through 2030.

Market Drivers

-

Epidemiological forces: Rising cancer incidence, along with age‑associated conditions, results in increased demand for nuclear medicine solutions.

-

Theranostics adoption: The rise of diagnostic‑therapeutic agents like lutetium‑177 labeled ligands drives both imaging and treatment volumes.

-

AI adoption: AI models accelerate identification of biomarkers, yield novel compounds, refine dose planning and enhance scan protocol pipelines.

-

Policy and funding momentum: Federal agencies and NCI‑funded research are funneling significant grants into cyclotron expansion and radiochemistry infrastructure.

Opportunities

-

New isotope and tracer platforms: Companies developing actinium‑225, lead‑212, gallium‑68 and fluorine‑18 labeled agents are breaking new ground in targeting complex tumor types beyond prostate cancer.

-

Mobile delivery models: Rural and community hospitals are gaining access to radiopharmaceutical care through mobile radiopharmacy services, reducing dependency on fixed centralized facilities.

-

Cross‑industry partnerships: Collaborations between pharma, academia, AI firms, and imaging equipment vendors are accelerating commercial translation of novel agents and therapeutic models.

Challenges

-

Supply chain fragility: Centralized isotope production, along with short shelf‑life, complicate logistics and clinical scheduling. Any disruption in cyclotron operations or transport can delay therapies.

-

Financial burdens: Initial capital to set up manufacturing, ensure regulatory compliance, and maintain quality can be prohibitive.

-

Policy gaps: Inconsistent reimbursement mechanisms and slow FDA pathways for novel compounds add uncertainty for broader adoption.

Recent Developments

Major industry players are aggressively entering the radiopharma space. AstraZeneca’s acquisition of Fusion Pharmaceuticals for up to $2.4 billion expanded access to actinium‑225‑based pipelines. Lantheus saw a stock surge after CMS proposed increased reimbursement for high-cost diagnostic agents like Pylarify.

Sanofi invested €300 million in OranoMed to develop lead‑212 radiotherapies for neuroendocrine tumors, seeking breakout assets in distal analgesic targeting.

At clinical and technological fronts, academic centers and pharmaceutical alliances are accelerating theranostic trials across diverse tumor types. AI decision-support tools (e.g. reinforcement‑learning based dosimetry research) are beginning to permeate precision oncology workflows.

Get Free sample @ https://www.precedenceresearch.com/sample/6508

U.S. Radiopharmaceutical Therapies Market Companies

- Bayer

- Novartis

- China Isotope & Radiation

- Dongcheng

- Q BioMed

- Curium Pharmaceuticals

- Jubilant DraxImage

- Lantheus

- Spectrum Pharmaceuticals

- Progenics Pharmaceuticals

- International Isotopes

Segments Covered in the Report

By Therapy Type

- Targeted Alpha Therapy (TAT)

- Actinium-225-based therapies

- Radium-223-based therapies

- Astatine-211-based therapies

- Targeted Beta Therapy

- Lutetium-177-based therapies (e.g., Lu-177 DOTATATE)

- Iodine-131-based therapies

- Yttrium-90-based therapies

- Brachytherapy-based Radiopharmaceuticals

- Auger Electron Emitting Radiopharmaceuticals (emerging)

- Others

By Radioisotope Used

- Beta Emitters

- Lutetium-177 (Lu-177)

- Iodine-131 (I-131)

- Yttrium-90 (Y-90)

- Alpha Emitters

- Actinium-225 (Ac-225)

- Radium-223 (Ra-223)

- Astatine-211 (At-211)

- Brachytherapy-based Radiopharmaceuticals

- Auger Electron Emitting Radiopharmaceuticals (emerging)

- Others

- Samarium-153

- Rhenium-186/188

- Holmium-166

By Therapeutic Area

- Oncology

- Prostate cancer

- Neuroendocrine tumors

- Liver cancer (e.g., HCC)

- Thyroid cancer

- Non-Hodgkin’s lymphoma

- Non-Oncology

- Bone metastases pain palliation

- Hyperthyroidism

- Cardiology (e.g., atrial fibrillation ablation using radioisotopes)

By Route of Administration

- Intravenous Injection

- Oral (primarily Iodine-131)

- Intra-arterial (in case of liver cancer, radioembolization)

- Intratumoral (investigational)

By End-User

- Hospitals

- Academic Medical Centers

- Specialty Cancer Hospitals

- Radiopharmacies (Centralized Radiopharmacy Networks)

- Ambulatory Surgical Centers (ASCs)

- Nuclear Medicine Centers

Also Visit @https://www.precedenceresearch.com/

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025