Cholesterol Testing Products Market Size to Soar to USD 22.4 Billion by 2034, Driven by Preventive Healthcare and Home-Based Diagnostics

Rising Burden of Cardiovascular Risk Fuels Global Demand for Rapid and Reliable Cholesterol Monitoring Solutions

According to Precedence Research, the global cholesterol testing products market size reached USD 10.36 billion in 2024 and is expected to surge to USD 22.4 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.01% from 2025 to 2034. This robust growth reflects rising health awareness, the increasing prevalence of cardiovascular diseases, and the rapid shift toward home-based cholesterol testing and preventive care solutions.

Cholesterol Testing Products Market Quick Insights

-

Market Size in 2024: Valued at USD 10.36 billion

-

Forecast for 2034: Expected to reach USD 22.4 billion

-

CAGR (2025–2034): Projected at 8.01%

-

Top Region: North America led the global market with over 38% revenue share in 2024

-

Key Segment by Product: Test Kits accounted for the highest revenue share

-

Leading End-Use: Homecare settings are experiencing rapid adoption due to convenience

-

Notable Companies: Roche, Siemens Healthineers, Abbott, Thermo Fisher Scientific, Danaher Corporation, and Quest Diagnostics

What’s Driving This Demand Surge?

The global burden of cardiovascular diseases now the leading cause of death worldwide—has intensified the emphasis on routine cholesterol monitoring. Public health campaigns and government guidelines encourage regular lipid profile screenings, especially among high-risk groups. Technological advancements have improved the accuracy, affordability, and accessibility of cholesterol tests, which is particularly critical in remote or underserved regions.

Simultaneously, the consumerization of healthcare is reshaping the diagnostic landscape. Portable cholesterol test kits and digital home testing solutions are gaining momentum, enabling individuals to proactively track their lipid levels without visiting a clinic or laboratory.

Read Also: Thermal Cycler Market

Cholesterol Testing Products Market Revenue Contribution by Segment

| Segment | 2024 Value (USD Billion) | Forecast 2034 (USD Billion) | Key Insights |

|---|---|---|---|

| Product | |||

| Test Kits | Highest Share | Continued dominance | Ease of use and affordability driving adoption |

| Strips | Growing steadily | Useful in home testing setups | |

| End User | |||

| Hospitals & Clinics | Significant Share | Diagnostic reliability and integration with EMRs | |

| Homecare | Fastest Growing | Accelerated by telemedicine and digital health tools |

AI is enhancing predictive diagnostics in cholesterol testing by enabling real-time data analysis, trend monitoring, and risk scoring. Integrated into testing platforms, AI algorithms can evaluate cholesterol levels alongside user health data—such as diet, BMI, blood pressure, and activity levels—to provide personalized recommendations and flag potential risks early.

Moreover, AI-powered mobile apps and wearable technologies are integrating with cholesterol monitoring devices, creating a seamless experience from testing to interpretation. These digital interfaces not only improve patient engagement but also support healthcare professionals in delivering tailored interventions.

Cholesterol Testing Products Market Scope

| Report Coverage | Details |

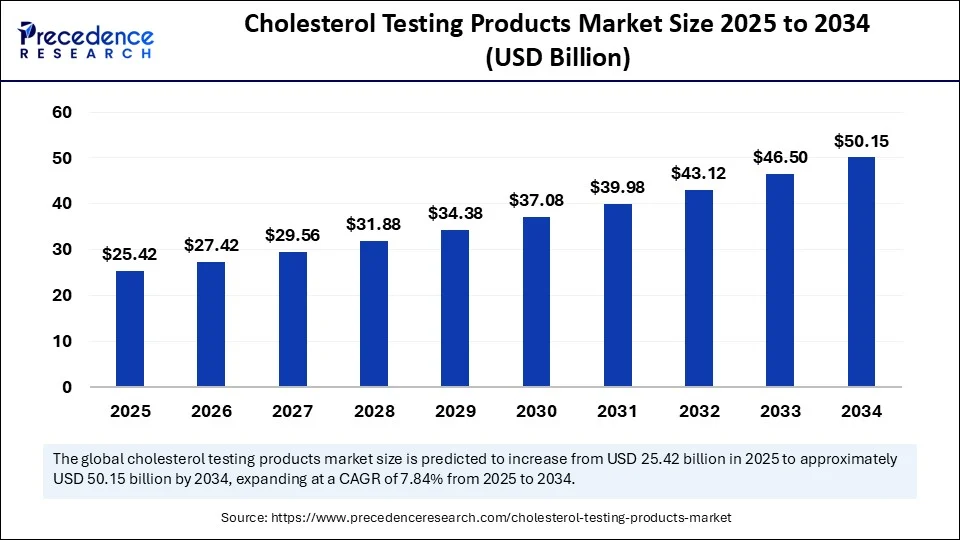

| Market Size by 2034 | USD 50.15 Billion |

| Market Size in 2025 | USD 25.42 Billion |

| Market Size in 2024 | USD 23.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Test Type, Mode of Testing, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Trends and Opportunities Are Reshaping the Market?

Can At-Home Testing Redefine Preventive Healthcare?

Absolutely. The proliferation of home-based cholesterol test kits is one of the most transformative trends in this market. With increasing availability in pharmacies and e-commerce platforms, consumers are empowered to take control of their heart health from the comfort of home—boosting compliance and reducing diagnostic delays.

Will Tech-Enabled Diagnostics Replace Traditional Labs?

While not a complete replacement, digital diagnostics are becoming complementary to lab-based testing. Miniaturized biosensors, Bluetooth connectivity, and AI interpretation tools are enhancing the appeal of at-home and point-of-care devices, creating opportunities for startups and med-tech companies alike.

Expert Viewpoint

“The cholesterol testing products market is undergoing a paradigm shift toward decentralization. As consumers demand convenience, and governments push for early disease detection, the need for scalable, digital-first cholesterol monitoring solutions will become indispensable.”

— Dr. Aditi Menon, Principal Consultant, Precedence Research

Cholesterol Testing Products Market Regional Snapshot

-

North America led the market with a 38% share in 2024, driven by well-established healthcare infrastructure, awareness of routine cholesterol screening, and favorable reimbursement frameworks.

-

Europe is witnessing steady growth due to increasing public interest in preventive diagnostics and government-supported healthcare innovations.

-

Asia Pacific is the fastest-growing region, fueled by large population bases, urbanization, and expanding access to mobile diagnostics, especially in countries like India, China, and across Southeast Asia.

Cholesterol Testing Products Market Segmentation Overview

-

By Product: Includes test kits (most dominant), strips, meters, and others designed for both clinical and home use.

-

By End User: Covers hospitals & clinics, diagnostic centers, rapidly expanding homecare segment, and others, reflecting the growing adoption of decentralized testing solutions.

Industry Leaders and Innovations

Major players are investing in AI, miniaturization, and integrated platforms to stay competitive. Here are some of the key companies mentioned in the report:

-

Abbott

-

Roche

-

Siemens Healthineers

-

Danaher Corporation

-

Thermo Fisher Scientific

-

Quest Diagnostics

Recent Breakthroughs:

-

Roche launched a compact cholesterol analyzer with cloud sync

-

Abbott integrated its testing kits with mobile health tracking

-

Danaher introduced AI-assisted diagnostics in lipid profiling

Challenges and Cost Pressures

Despite robust growth, the market faces hurdles such as:

-

Cost constraints in low-income markets

-

Accuracy issues in low-end self-testing kits

-

Regulatory hurdles delaying product approvals

-

Data privacy concerns with digital test integrations

Case in Point: Home-Based Testing in Urban India

A health-tech startup in India partnered with pharmacies to distribute app-connected cholesterol testing strips. Within six months, user compliance for follow-up checkups improved by 42%, indicating a shift toward tech-driven preventive care in urban emerging markets.

Get the Full Picture

Looking to explore deeper insights, custom segmentation, or schedule a strategy call?

👉 Download a Sample Report: https://www.precedenceresearch.com/sample/6469

👉 Schedule a Consultation: sales@precedenceresearch.com

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025