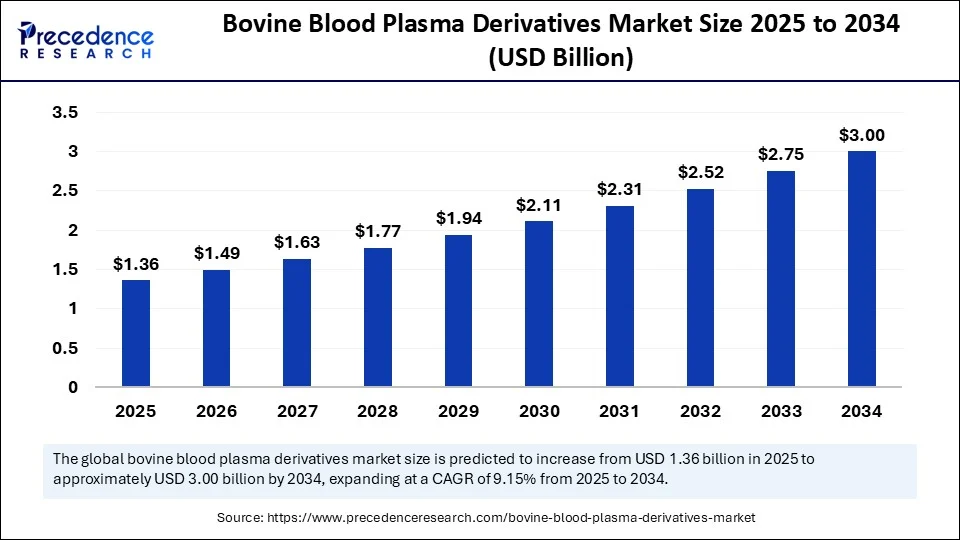

According to Precedence Research, the global bovine blood plasma derivatives market is expected to grow from USD 1.36 billion in 2025 to an estimated USD 3.00 billion by 2034, representing a compound annual growth rate (CAGR) of 9.15% during the forecast period.

This robust expansion is being driven by increasing demand across pharmaceutical applications, animal feed formulations, and biotechnology research. With a growing emphasis on protein-based therapeutics, immune-supportive feed supplements, and advanced biological products, bovine blood plasma derivatives have become a critical component in several industrial value chains.

Bovine Blood Plasma Derivatives Market Highlights and Key Insights

In 2024, the global bovine blood plasma derivatives market reached a value of USD 1.25 billion and is projected to touch USD 1.36 billion in 2025. It is anticipated to double in size to USD 3.00 billion by 2034.

North America emerged as the dominant regional market in 2024, capturing the largest revenue share due to its highly developed pharmaceutical and healthcare infrastructure, along with a mature veterinary health sector.

Asia-Pacific, however, is forecasted to witness the fastest growth rate through the forecast period, driven by expanding biopharmaceutical production, rising pet ownership, and increasing demand for high-protein feed in emerging economies.

Fetal bovine serum led the product segment in 2024 due to its extensive use in cell culture, while immunoglobulins are expected to record the highest growth rate over the coming years. Among applications, pharmaceuticals accounted for the largest market share, and hospitals and clinics stood out as the top end-user category.

Growth Drivers, AI Integration, and Emerging Trends

The market is witnessing accelerating demand due to increasing utilization of plasma-derived proteins in therapeutic development, diagnostic assays, and immune-nutrition. The pharmaceutical industry’s reliance on high-purity immunoglobulins and albumins for various biologics and treatment formulations is a central driver. Furthermore, the use of bovine plasma in spray-dried forms in animal feed to boost immunity, especially in poultry and swine, is rapidly growing.

Artificial Intelligence is beginning to play a significant role in optimizing bovine plasma processing. AI-powered technologies are enhancing quality assurance in fractionation, predicting batch yields, and maintaining stringent safety and consistency protocols. These innovations not only improve manufacturing efficiency but also minimize contamination risk, thereby supporting higher production volumes of plasma derivatives for sensitive applications like injectable biologics. Advanced machine learning models are also being deployed to forecast raw material sourcing needs and manage cold-chain logistics more effectively, especially in international supply chains.

In terms of market trends, there’s a marked shift toward automation in plasma fractionation and purification. Companies are investing in scalable, closed-loop systems that ensure product sterility and enhance batch consistency. Additionally, increasing regulatory clarity surrounding plasma products and improved traceability standards are creating a favorable business environment. Collaborations between biotech firms and plasma fractionation specialists are leading to the development of targeted, high-purity derivatives customized for cell therapy, vaccine manufacturing, and regenerative medicine.

What Opportunities are Emerging in Bovine Blood Plasma Derivatives Market?

As the demand for functional proteins and immune-enhancing compounds continues to grow, bovine blood plasma derivatives are positioned to play a central role across multiple sectors. One of the most promising opportunities lies in replacing antibiotics in livestock feed with immunoglobulin-rich plasma proteins, which provide natural immunity enhancement and growth support. Another opportunity is the expansion of bovine plasma-derived reagents in cell-based research, gene therapy, and vaccine production, especially in developing regions with rising biotech investments. Furthermore, new applications are emerging in cosmetic formulations, wound care, and biomaterial engineering. The market is also likely to benefit from increasing global focus on sustainable animal protein sourcing and the valorization of slaughterhouse by-products.

Read Also: Bimekizumab Market Size to Reach USD 8.10 Billion by 2034

Bovine Blood Plasma Derivatives MarketRegional and Segment Analysis

North America led the global market in 2024 with the highest revenue share, supported by its advanced healthcare infrastructure, well-established pharmaceutical and biotechnology industries, and early adoption of protein-based therapies. The presence of top-tier life sciences companies and academic research institutions has further propelled demand in the region.

Asia-Pacific is poised to register the fastest CAGR during the forecast period. Countries like China, India, and South Korea are expanding their biosciences sectors, increasing research activities, and making significant investments in feed and livestock nutrition industries, all of which are propelling market demand.

On the product front, fetal bovine serum emerged as the market leader in 2024, owing to its widespread use in cell culture systems and biomanufacturing. However, immunoglobulins are expected to be the fastest-growing segment due to their expanding use in passive immunotherapy, feed supplementation, and human healthcare applications. Albumin derivatives are also gaining momentum in drug delivery and diagnostics.

In terms of applications, the pharmaceutical segment held the largest share in 2024, driven by the increasing adoption of plasma derivatives in injectable drugs, wound care, and therapeutic protein formulations. The cell culture media segment is also seeing rising adoption, especially with the growing number of biopharma startups and R&D labs.

On the end-user side, hospitals and clinics dominated the market in 2024 due to their role in administering plasma-based therapies and using derivatives in diagnostic procedures. Research laboratories and contract manufacturing organizations are anticipated to grow rapidly, reflecting the rising interest in biotechnological innovation and outsourced drug development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.00 Billion |

| Market Size in 2025 | USD 1.36 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Derivative Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovations and Strategies of Leading Players

Key players in the market are actively investing in R&D and scaling production capacities to meet rising global demand. Companies such as Thermo Fisher Scientific, Merck KGaA, LAMPIRE Biologicals, Bovogen, and Cytiva are pioneering advancements in plasma purification, cold-chain logistics, and immunoglobulin enrichment.

Strategic collaborations with universities and biotech startups have led to breakthroughs in developing derivative-specific applications, particularly in cell therapy and vaccine production. These companies are also enhancing traceability systems and sustainability protocols to meet increasingly strict regulatory standards across the EU and North America.

Industry Challenges and Cost Pressures

Despite strong growth prospects, the market faces several challenges. High production costs and the capital-intensive nature of plasma fractionation facilities present barriers to entry for smaller players. Regulatory scrutiny over blood plasma collection and the risk of zoonotic disease transmission require stringent safety protocols and validated sourcing procedures. There is also growing competition from recombinant protein alternatives and plant-based serum substitutes, which may limit adoption in certain segments. Moreover, ethical concerns related to animal blood usage and inconsistent raw material supply from slaughterhouses can impact operational continuity and stakeholder trust.

Real-World Application: Case Study in Livestock Health

A poultry feed manufacturer in the United States incorporated spray-dried bovine plasma into their starter feed formulations. The result was a marked improvement in chick growth rates, reduced mortality, and a significant decrease in antibiotic use. The inclusion of immunoglobulins helped strengthen the immune systems of the birds, demonstrating how bovine plasma derivatives can drive better productivity and sustainability in the livestock sector.

Explore the Full Report : https://www.precedenceresearch.com/sample/6447

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.co |+1 804 441 9344

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025