Veterinary Antihistamines Market Key Insights

- North America dominated the market in 2024, accounting for the largest revenue share of 38%, while the Asia Pacific region is anticipated to grow at the fastest CAGR through 2034.

-

Based on drug type, H1 receptor antagonists (H1 blockers) led the market with a 60% share in 2024, whereas H2 receptor antagonists (H2 blockers) are projected to witness significant growth over the forecast period.

-

By dosage form, tablets and capsules held the largest share at 45% in 2024, while oral liquids and suspensions are expected to register notable growth.

-

In terms of animal type, the dogs segment held the dominant share of 50% in 2024, with the cats segment forecasted to grow at a substantial pace in the coming years.

-

Among distribution channels, veterinary clinics and hospitals accounted for the largest market share at 55% in 2024, while online pharmacies are expected to experience robust growth during the forecast period.

Impact of AI on the Veterinary Antihistamines Market

Artificial Intelligence is increasingly playing a transformative role in the veterinary antihistamines market. AI technologies are enabling faster and more accurate diagnosis of allergic reactions in animals, which leads to more precise and personalized treatment plans. Advanced AI algorithms integrated into veterinary diagnostic tools can analyze symptoms and medical histories to suggest the most effective antihistamine therapies.

AI is also contributing to the development of optimized drug formulations and improving treatment efficacy while minimizing side effects. Furthermore, AI-enabled platforms are helping veterinarians track allergy triggers and monitor animal responses, enhancing overall care and efficiency in treatment outcomes.

U.S. Market Size and Regional Analysis

North America, particularly the United States, leads the global veterinary antihistamines market, accounting for 38% of global revenue in 2024. This leadership stems from a combination of factors, including the region’s high pet ownership rates, strong emphasis on pet wellness, and advanced veterinary healthcare systems. The presence of major pharmaceutical companies and well-established distribution channels also contributes to market dominance.

Conversely, Asia Pacific is expected to witness the highest CAGR during the forecast period, driven by a surge in companion animal ownership, rising awareness about animal health, and government initiatives aimed at strengthening veterinary care infrastructure in countries such as China, India, and Indonesia.

Market Overview

Veterinary antihistamines are pharmaceutical drugs used to treat allergic conditions in animals, such as skin irritation, inflammation, respiratory issues, and allergic reactions to food, environmental triggers, or insect bites. These drugs function by blocking histamine receptors, thus alleviating symptoms and improving animal comfort and health.

The market spans across applications in both companion animals (such as dogs and cats) and livestock (including cattle, sheep, and horses). As allergy-related diagnoses increase in veterinary practices, antihistamines play a critical role in preventive and therapeutic care plans.

Veterinary Antihistamines Market Growth Factors

Several key factors are fueling the growth of the veterinary antihistamines market. A major driver is the rise in pet ownership and the humanization of pets, which is encouraging greater expenditure on animal healthcare. Advancements in veterinary pharmaceutical research are also contributing to the development of new, more effective antihistamines with better delivery mechanisms.

Additionally, increased regulatory support for animal drugs, coupled with broader access to veterinary services, is improving medication penetration across global markets. Growth in e-commerce and telehealth platforms is further improving accessibility to veterinary drugs, especially in underserved areas.

Market Scope

| Report Coverage | Details |

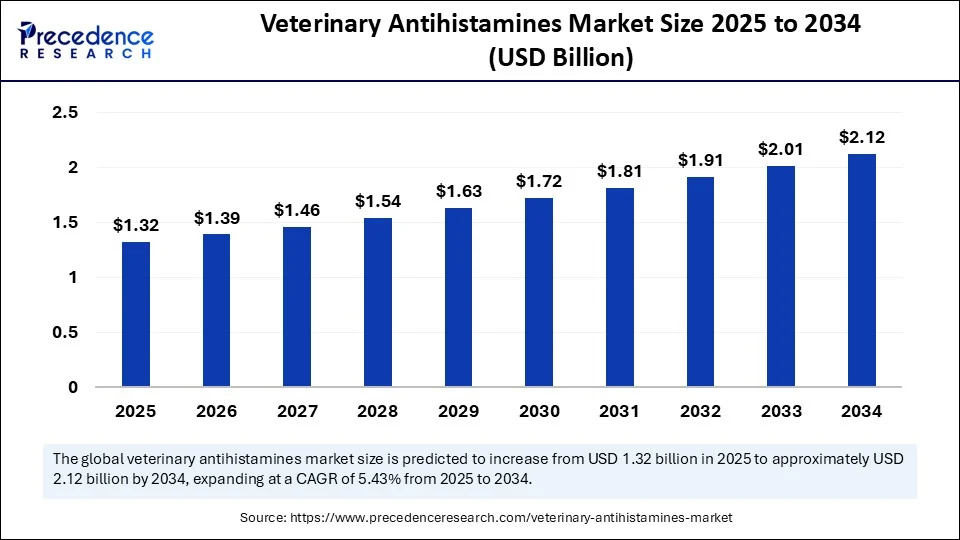

| Market Size by 2034 | USD 2.12 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Dosage Form, Animal Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Veterinary Antihistamines Market Dynamics

Drivers:

The increasing prevalence of allergic conditions in animals is a primary growth driver. With more pets experiencing skin and respiratory allergies, the need for antihistamines has surged. Innovations in veterinary drug development and increasing pet health awareness are also contributing to growth.

Restraints:

One of the main restraints is the potential for adverse reactions and variability in efficacy across different animal species. In some cases, resistance to certain antihistamines may develop. Additionally, in low-income regions, limited access to veterinary care and medications can hinder market penetration.

Opportunities:

There are significant opportunities in the development of AI-powered diagnostics, novel antihistamine formulations, and personalized medicine approaches. Expanding into emerging markets with growing pet populations and rising healthcare awareness offers further growth potential for manufacturers and service providers.

Veterinary Antihistamines Market Segment Insights

By Type:

-

H1 Antihistamines – Widely used for treating skin allergies and respiratory conditions.

-

H2 Antihistamines – Primarily used to manage gastric issues and inflammation in animals.

By Dosage/Form:

-

Tablets & Capsules – Most commonly prescribed form due to ease of use and dosage control.

-

Injections – Used in acute allergic episodes requiring rapid response.

-

Topical Creams & Sprays – Ideal for localized allergic reactions.

-

Oral Liquids – Used primarily for small animals or pets with difficulty swallowing pills.

By End User/Animal Type:

-

Dogs – Account for the largest market share due to their high allergy incidence and popularity as pets.

-

Cats – Growing segment with increased indoor allergies and dermatological issues.

-

Equines – Usage growing in high-performance horses prone to skin and respiratory issues.

-

Livestock (Cattle, Sheep, etc.) – Treated for food or environment-related allergic conditions.

By Distribution Channel:

-

Veterinary Hospitals & Clinics – Largest segment due to professional prescription-based sales.

-

Retail Pharmacies – Widely accessible but dependent on vet prescriptions.

-

Online Pharmacies – Fast-growing segment offering convenience and competitive pricing.

-

Veterinary Research Institutes – Focused on R&D and specialized treatments.

Competitive Landscape

The veterinary antihistamines market is moderately consolidated, with a mix of global leaders and regional players competing based on product quality, innovation, and distribution reach. Companies are focused on expanding their portfolios through new product launches, acquisitions, and strategic partnerships.

Key Players Include

-

Zoetis Inc.

-

Elanco Animal Health

-

Boehringer Ingelheim Animal Health

-

Vetoquinol

-

Ceva Santé Animale

-

Virbac

-

Norbrook

-

Dechra Pharmaceuticals

Recent Developments:

In 2024, Zoetis introduced a new chewable antihistamine targeting seasonal allergies in dogs. Virbac announced its integration of AI in allergy testing systems. In 2023, Elanco completed the acquisition of a veterinary dermatology firm to strengthen its allergy treatment portfolio.

Segments Covered in the Report

-

By Type:

-

H1 Antihistamines

-

H2 Antihistamines

-

-

By Dosage/Form:

-

Tablets & Capsules

-

Injections

-

Topical Creams & Sprays

-

Oral Liquids

-

-

By End User/Animal Type:

-

Dogs

-

Cats

-

Equines

-

Livestock

-

-

By Distribution Channel:

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

Online Pharmacies

-

Veterinary Research Institutes

-

-

By Region:

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Read Also: Veterinary Parasiticides Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.co |+1 804 441 9344

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025