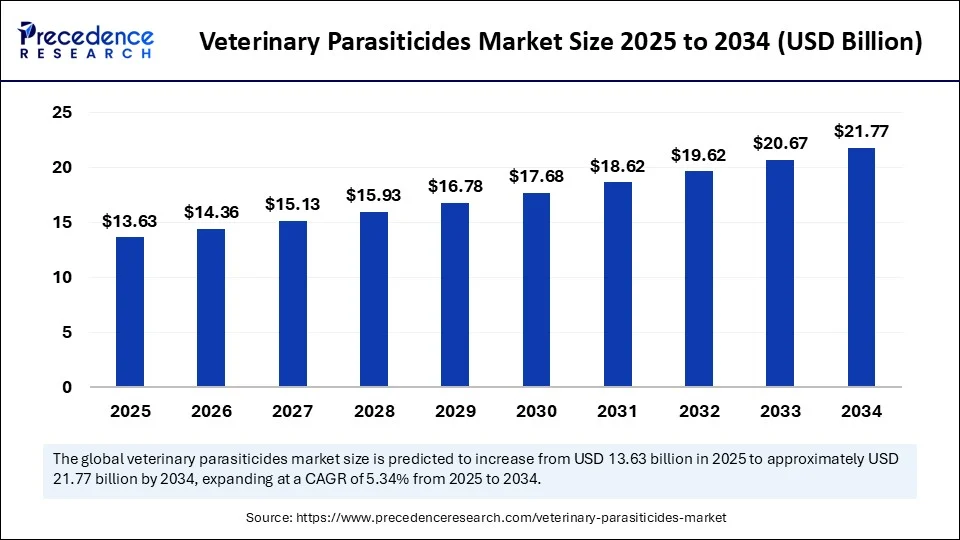

The global veterinary parasiticides market size is estimated to attain around USD 21.77 billion by 2034 increasing from USD 12.94 billion in 2024, with a CAGR of 5.34%. The growth is driven by increasing companion and livestock animal ownership, heightened awareness of zoonotic disease transmission, and advancements in diagnostic technologies.

- North America led the market with a 33% share in 2024, while the Asia Pacific region is anticipated to register the fastest growth during the forecast period.

-

By product type, endoparasiticides accounted for the largest share at 41% in 2024, whereas endectocides are expected to witness the highest CAGR through 2034.

-

Based on animal type, livestock animals dominated the market with a 61% share in 2024, while the companion animals segment is forecasted to grow at a notable rate over the projected period.

-

In terms of mode of administration, the oral segment held the largest share of 47% in 2024, whereas the topical segment is set to expand at a significant CAGR in the coming years.

-

By distribution channel, veterinary clinics and hospitals led the market with a 51% share in 2024, while online pharmacies are projected to grow at the fastest pace over the forecast period.

-

Regarding end users, farmers and livestock owners accounted for the majority share of 57% in 2024, while pet owners are expected to experience the highest CAGR during the forecast timeline.

What Is the Veterinary Parasiticides Market and Why Is It Important?

Veterinary parasiticides are pharmaceutical agents used to prevent and treat parasitic infections in animals, including ectoparasites (fleas, ticks, lice) and endoparasites (worms, protozoa). These products play a critical role in ensuring animal health, welfare, and productivity, particularly in preventing zoonotic diseases that can be transmitted to humans. As both companion animals and livestock are increasingly integrated into human life and the global food chain, parasiticides are a frontline defense in veterinary public health and biosecurity.

Parasiticides are essential tools in both preventive and therapeutic veterinary care, forming a key part of One Health initiatives that link human, animal, and environmental health.

How Is AI Impacting Diagnostic Accuracy in Veterinary Care?

AI is revolutionizing veterinary parasiticide diagnostics by automating sample analysis, improving accuracy, and reducing time-to-diagnosis. AI-powered imaging tools can detect parasites in fecal samples or blood smears more reliably than manual inspection. Machine learning models also help predict parasite outbreaks and treatment responses, allowing veterinarians to prescribe more targeted parasiticides.

Furthermore, digital record systems and AI-integrated diagnostic platforms streamline clinic workflows, enabling better disease tracking and compliance monitoring.

What Regional Trends Are Shaping the Market?

North America remains the global leader due to its advanced veterinary infrastructure, strong regulatory frameworks (USDA, FDA), and pet insurance penetration, which supports spending on preventive treatments.

Asia Pacific is the most promising emerging region, thanks to:

-

Rapid expansion of the pet care industry in China and India

-

Government-led livestock health programs

-

Increasing public awareness of zoonotic risks

In particular, India’s National Animal Disease Control Programme (NADCP) and China’s rural animal health campaigns are boosting demand for veterinary parasiticides.

What Factors Are Driving Growth in the Veterinary Parasiticides Market?

1. Rising Pet Ownership and Spending on Animal Healthcare

Globally, pet adoption is on the rise, especially in urban and middle-income populations. This has significantly boosted demand for preventive healthcare measures, including routine parasiticide treatments.

2. Growing Awareness of Zoonotic Disease Prevention

Parasitic diseases such as toxoplasmosis, echinococcosis, and giardiasis can affect humans, prompting strict preventive measures in animal care. Organizations like the USDA, CDC, and EFSA promote parasiticide use under One Health strategies.

3. Livestock Industry Growth in Developing Countries

Increased meat and dairy production, especially in India, China, and Brazil, necessitates strict parasite control programs to avoid productivity losses and ensure food safety.

What Challenges Are Hindering Market Growth?

1. Regulatory Hurdles and Product Approval Timelines

Developing new parasiticide compounds involves lengthy and expensive regulatory processes. Variability in regional approval standards (e.g., FDA, EMA) creates complexity for global market players.

2. Cost Barriers for Rural and Low-Income Pet Owners

High treatment costs and lack of awareness limit parasiticide adoption, especially in low-income areas and among rural livestock owners who may rely on cheaper, less effective alternatives.

What Opportunities Exist for Market Players?

1. Emergence of At-Home Diagnostics and Telemedicine Integration

The rise of remote diagnostics and mobile apps for animal health tracking creates potential for DIY parasiticide testing kits and teleconsultation-based prescriptions, improving accessibility and compliance.

2. Expansion into Online Retail Platforms

E-commerce platforms like Chewy, Amazon, and Vets First Choice are driving growth in parasiticide sales, offering convenience and a broader product range.

3. Strategic Collaborations and M&As

Collaborations between pharma companies, vet clinics, and AI-tech firms are fueling innovation and broader market penetration.

Why Did Immunodiagnostics Dominate Among Test Types in 2024?

Immunodiagnostics—especially ELISA—are highly sensitive, rapid, and cost-effective, making them ideal for detecting parasitic antigens and antibodies in clinical practice. Their widespread use in identifying infections like giardiasis, toxoplasmosis, and leishmaniasis has made them the go-to diagnostic test for veterinary parasitic infections.

Which Animal Type Segment Is Expected to Grow the Fastest?

Cats are expected to witness the fastest growth in the coming years, supported by increasing feline adoption, improved feline healthcare awareness, and advances in feline-specific parasiticides and diagnostics, which were traditionally dog-focused.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.77 Billion |

| Market Size in 2025 | USD 13.63 Billion |

| Market Size in 2024 | USD 12.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Animal Type, Mode of Administration, Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Veterinary Parasiticides Market Leading Players

-

IDEXX Laboratories

-

Zoetis Inc.

-

Heska Corporation

-

Antech Diagnostics (Mars Inc.)

-

Boehringer Ingelheim Animal Health

-

Elanco Animal Health

-

Virbac

-

Bayer Animal Health (now part of Elanco)

-

Ceva Santé Animale

-

Vetoquinol

-

Merck Animal Health (MSD Animal Health)

-

Dechra Pharmaceuticals

Veterinary Parasiticides Market Recent Developments

-

March 2025 – IDEXX Laboratories launched a new AI-powered platform for fecal diagnostics

-

January 2025 – Zoetis Inc. received FDA approval for a novel flea and tick oral chew for cats

-

October 2024 – Elanco Animal Health completed acquisition of a European parasiticide brand

-

August 2024 – Heska partnered with Vetology AI to enhance its diagnostic imaging suite

-

June 2024 – Boehringer Ingelheim launched long-acting injectable parasiticide for livestock in Asia

What Segments Are Covered in the Veterinary Parasiticides Market?

By Test Type

-

Hematology

-

Urinalysis

-

Immunodiagnostics (ELISA, Rapid Tests)

-

Molecular Diagnostics (PCR)

-

Imaging

-

Others

By Animal Type

-

Dogs

-

Cats

-

Others (Horses, Rabbits, Birds)

By Technology

-

ELISA

-

PCR

-

Imaging

-

Others

By End User

-

Veterinary Hospitals

-

Veterinary Clinics

-

Veterinary Laboratories

-

Research Institutes

By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Platforms

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Red Also: Veterinary Antibiotics Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025