The market is also influenced by the regulatory pressure to combat antimicrobial resistance (AMR), prompting innovation in antibiotic stewardship and alternatives. North America dominated the global market in 2024 due to its advanced veterinary infrastructure and widespread use of antibiotics in livestock. However, the Asia Pacific region is expected to experience the fastest growth through 2034, fueled by growing meat consumption, increasing livestock population, and expanding access to veterinary care.

Veterinary Antibiotics Market Key Insights

- Asia Pacific held the largest market share of 38% in 2024, while North America is forecasted to register the fastest growth rate during the forecast period.

-

By product type, tetracyclines led the market with a 29% share in 2024, whereas fluoroquinolones are expected to grow at a noteworthy CAGR through 2034.

-

In terms of route of administration, the oral segment accounted for the largest share at 45% in 2024, while the injectable segment is projected to grow at the highest CAGR moving forward.

-

Based on animal type, the livestock segment held the largest share at 36% in 2024, while the companion animals segment is anticipated to see significant growth during the forecast period.

-

Regarding mode of delivery, prescription-based antibiotics dominated with a 62% share in 2024, whereas the over-the-counter (OTC) segment is set to grow at the fastest pace.

-

Among end users, animal farms represented the largest share at 48% in 2024, with online veterinary pharmacies expected to grow at the highest rate by 2034.

-

By distribution channel, distributors/wholesalers led with a 52% share in 2024, while online platforms are anticipated to expand at a notable CAGR throughout the forecast period.

The veterinary antibiotics market refers to the pharmaceutical products used to prevent and treat bacterial infections in animals. These antibiotics are crucial for maintaining animal health, ensuring food safety, and supporting global meat, dairy, and poultry industries. They are administered to both companion animals and livestock to treat a wide range of infections and promote growth in farm animals.

Historically, the widespread use of antibiotics in livestock production played a significant role in improving animal health and productivity. However, concerns over antibiotic resistance and stringent regulatory frameworks have reshaped the industry, promoting more judicious use and encouraging the development of alternative therapeutics. Despite these challenges, veterinary antibiotics remain vital to animal agriculture, veterinary services, and public health.

Veterinary Antibiotics Market Scope

| Report Coverage | Details |

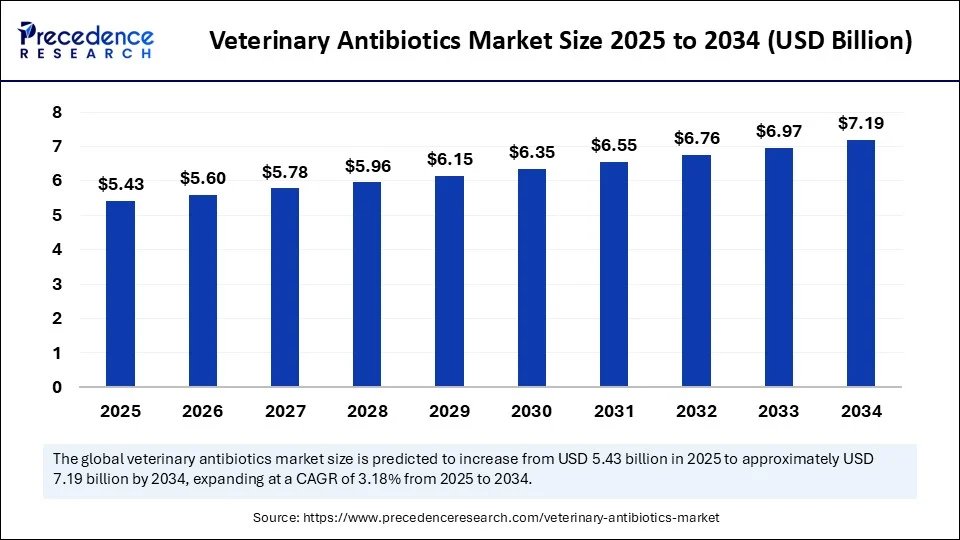

| Market Size by 2034 | USD 7.19 Billion |

| Market Size in 2025 | USD 5.43 Billion |

| Market Size in 2024 | USD 5.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.18% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Animal Type, Mode of Delivery, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Veterinary Antibiotics Market Dynamics

Drivers

The primary drivers of the veterinary antibiotics market include the rising global demand for animal protein, the increasing population of companion and livestock animals, and the heightened incidence of zoonotic and infectious diseases. Technological advancements in veterinary diagnostics and the expansion of commercial animal farming are further fueling antibiotic demand.

Restraints

The market faces limitations due to growing global concerns over antimicrobial resistance (AMR), leading to stricter regulations on antibiotic usage in animal health. Regulatory bans or restrictions on growth-promoting antibiotics and the push for antibiotic-free meat in developed markets may negatively impact sales volume.

Opportunities

Emerging economies present substantial opportunities due to increasing livestock productivity, government support for animal health programs, and the growing presence of multinational veterinary pharmaceutical companies. Additionally, innovations such as targeted drug delivery systems, combination therapies, and biosynthetic antibiotics offer new avenues for market expansion.

What Role is AI Playing in the Veterinary Antibiotics Market?

Artificial Intelligence (AI) and digital technologies are becoming increasingly relevant in the veterinary antibiotics space. In smart manufacturing, AI is enabling automated production, quality control, and optimized formulation processes, enhancing efficiency and consistency. Automation is also streamlining supply chains and reducing production timelines for veterinary drugs.

In research and development (R&D), AI and machine learning tools are being applied to analyze pathogen behavior, antibiotic interactions, and resistance patterns, expediting the development of next-generation antimicrobials. Predictive analytics support veterinarians in making data-driven decisions about dosage and treatment timing, reducing overuse and supporting better clinical outcomes.

Additionally, AI-powered veterinary diagnostic platforms are enabling real-time monitoring of animal health and early detection of diseases, minimizing the misuse of antibiotics and fostering more targeted therapy approaches.

Veterinary Antibiotics Market Segment Analysis

By Product Type

In 2024, tetracyclines held the largest market share due to their broad-spectrum activity and affordability. Penicillins, macrolides, and sulfonamides also maintained significant shares. Looking forward, cephalosporins and fluoroquinolones are expected to grow steadily, particularly in companion animal care, due to their high efficacy and lower resistance risk.

By Application

Livestock disease treatment accounted for the largest share in 2024, particularly in cattle, swine, and poultry industries. The increasing global consumption of meat and dairy products is driving the need for effective antibiotics in livestock management. The companion animal segment is anticipated to witness notable growth through 2034 due to rising pet ownership, veterinary visits, and wellness awareness.

By End-User

Veterinary hospitals and clinics remain the primary end-users, driven by the high frequency of antibiotic prescriptions and treatments. Farm owners and commercial livestock producers also constitute a significant user base, especially in developing regions. The online pharmacy segment is growing in urban markets, where pet owners prefer digital platforms for veterinary drug purchases.

Veterinary Antibiotics Market Regional Insights

North America

North America led the global market in 2024, largely due to the U.S.’s established veterinary healthcare infrastructure, extensive livestock production, and presence of key pharmaceutical companies. The U.S. accounted for the majority of the region’s revenue, supported by continued investment in animal health technologies.

Europe

Europe remains a strong market, led by countries such as Germany, France, and the UK, which focus on regulated antibiotic usage and animal welfare standards. Growth is also driven by the EU’s veterinary innovation funding programs and stringent oversight on antimicrobial resistance.

Asia Pacific

Asia Pacific is expected to witness the fastest CAGR through 2034. This is attributed to increasing livestock populations, expanding veterinary care infrastructure, and rising meat consumption in countries like China, India, and Indonesia. Moreover, growing government focus on food safety and animal disease control contributes to regional market expansion.

Latin America

In Latin America, countries such as Brazil and Mexico are investing in livestock healthcare and veterinary pharmaceuticals, supporting growth. However, regulatory uncertainties may pose challenges in some sub-regions.

Middle East & Africa

The market in MEA is gradually developing due to the growing importance of animal husbandry and the expansion of animal healthcare services in countries like South Africa and the UAE.

Recent Developments

-

Zoetis Inc. (March 2024): Launched a new long-acting injectable antibiotic formulation for livestock, designed to reduce the frequency of dosing and improve compliance on farms.

-

Elanco Animal Health (January 2024): Entered a strategic partnership with a diagnostics firm to integrate AI-based monitoring systems for disease detection and antibiotic stewardship.

-

Boehringer Ingelheim (October 2023): Announced investment in a veterinary R&D facility in Germany, focusing on antimicrobial alternatives and combination therapies.

-

Virbac (August 2023): Introduced a new oral antibiotic line for companion animals in Southeast Asia, expanding its reach in emerging markets.

Veterinary Antibiotics Market Companies

-

Zoetis Inc.

-

Elanco Animal Health

-

Merck Animal Health

-

Boehringer Ingelheim

-

Ceva Santé Animale

-

Virbac

-

Vetoquinol

-

Phibro Animal Health Corporation

-

Dechra Pharmaceuticals

-

Bimeda Animal Health

-

Norbrook Laboratories

-

HIPRA

-

Kyoritsu Seiyaku

-

Zydus Animal Health

-

Neogen Corporation

Segments Covered in the Report

-

By Product Type:

-

Tetracyclines

-

Penicillins

-

Macrolides

-

Sulfonamides

-

Cephalosporins

-

Fluoroquinolones

-

Others

-

-

By Application:

-

Livestock Disease Treatment

-

Companion Animal Infections

-

Preventive and Prophylactic Use

-

-

By End-User:

-

Veterinary Hospitals & Clinics

-

Farm Owners & Livestock Producers

-

Online Pharmacies

-

Research Institutes

-

-

By Region:

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Read Also: Wegovy Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025