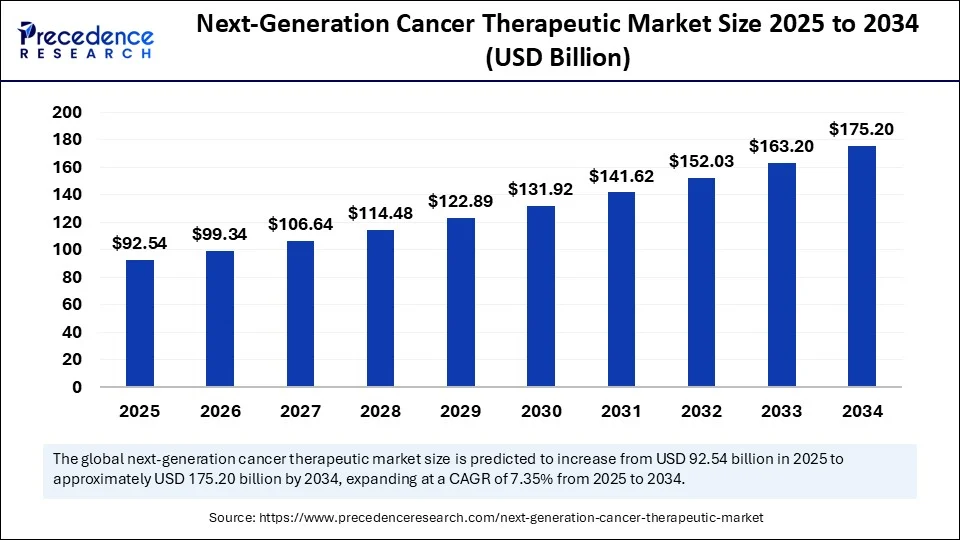

The global next-generation cancer therapeutics market size was evaluated at USD 86.20 billion in 2024 and is predicted to gain around USD 175.20 billion by 2034, growing at a CAGR of 7.35%.

Next-Generation Cancer Therapeutics Market Key Insights

- North America held the largest market share of 41% in 2024, while Asia Pacific is expected to register the fastest growth during the forecast period.

-

By therapy type, targeted therapies dominated the market in 2024, whereas antibody-drug conjugates (ADCs) are anticipated to grow at a notable CAGR.

-

Among cancer types, lung cancer accounted for the largest market share in 2024, while blood cancers are projected to grow at the fastest rate.

-

Based on modality, monotherapy led the market in 2024, with combination therapies expected to see substantial growth.

-

By route of administration, intravenous (IV) therapies held the majority share in 2024, whereas the subcutaneous route is expected to gain momentum in the coming years.

-

Regarding mechanism of action, immune activation via checkpoint inhibition was the leading segment in 2024, while tumor microenvironment modulation is expected to experience rapid expansion.

-

In terms of end users, specialized cancer hospitals captured the largest market share in 2024, while the homecare segment (especially for oral or subcutaneous delivery) is projected to grow significantly over the forecast period.

Next-Generation Cancer Therapeutics Market Market Overview

The next-generation cancer therapeutics market represents a pivotal frontier in oncology, transforming the paradigm from traditional cytotoxic chemotherapy to more precise, targeted, and individualized treatments. This market encompasses a broad spectrum of therapies, including immunotherapies (such as checkpoint inhibitors and CAR-T cell therapy), targeted molecular therapies, cancer vaccines, gene and cell therapies, bispecific antibodies, and RNA-based treatments.

As cancer continues to be a leading cause of death globally, affecting millions annually, the urgency to develop innovative and effective treatment modalities is growing. With increasing knowledge of tumor biology, genomics, and immune-oncology, pharmaceutical and biotech companies are investing heavily in next-gen platforms that aim to not only improve survival rates but also reduce side effects and enhance the quality of life. The market is poised for substantial growth over the coming decade, driven by robust R&D pipelines, favorable regulatory frameworks, and increasing patient and clinician preference for personalized and less toxic therapies.

Next-Generation Cancer Therapeutics Market Growth Factors

Numerous factors are contributing to the rapid expansion of this market. Foremost is the escalating global cancer burden, which is anticipated to rise with aging populations, lifestyle-related risk factors, and environmental influences. In response, healthcare systems are prioritizing early diagnosis and effective treatments, creating fertile ground for next-gen therapies. Another major growth driver is technological advancements in genomics, proteomics, and bioinformatics, which have enabled researchers to identify novel cancer targets and develop therapies that can home in on specific mutations or immune checkpoints.

Additionally, faster regulatory approvals and designations, such as Breakthrough Therapy and Orphan Drug status, are incentivizing innovation and accelerating time-to-market. Expanding biopharmaceutical investments, strategic partnerships, and the emergence of platform-based biotech firms are also catalyzing the development and commercialization of cutting-edge therapeutics.

Role of AI in the Next-Generation Cancer Therapeutics Market

Artificial Intelligence (AI) is revolutionizing every stage of cancer drug discovery and development, significantly enhancing the growth potential of the next-generation cancer therapeutics market. AI-driven algorithms are being used to predict novel cancer targets, identify druggable mutations, and simulate molecule-receptor interactions in silico, thereby reducing time and cost in early-stage research. In clinical trials, AI assists in patient stratification, ensuring better trial outcomes by matching therapies to patients most likely to respond based on genetic and clinical data.

AI-powered radiomics and digital pathology tools are also helping to track tumor progression, predict response, and assess biomarkers with greater accuracy. Furthermore, machine learning models are facilitating real-world evidence analysis, post-market surveillance, and adaptive trial designs, ultimately improving the safety and efficacy profile of emerging therapies. As AI matures, it is expected to play a central role in unlocking personalized oncology and accelerating the discovery of curative interventions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 175.20 Billion |

| Market Size in 2025 | USD 92.54 Billion |

| Market Size in 2024 | USD 86.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Cancer Type, Modality, Route of Administration, Mechanism of Action, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key market drivers include the increasing shift from generalized treatments to precision and personalized medicine. Patients, clinicians, and healthcare systems are leaning toward therapies that are more targeted and tailored to individual tumor profiles, thereby improving outcomes while minimizing toxicity. The success of immunotherapies like PD-1/PD-L1 inhibitors and CAR-T cell therapies has validated the commercial and clinical potential of next-gen modalities, driving broader adoption and development.

Pharmaceutical and biotechnology companies are racing to expand their oncology portfolios, and high-profile acquisitions, licensing deals, and collaborations are becoming common. Additionally, rising government and private sector funding, especially for cancer genomics and immuno-oncology research, supports the long-term sustainability of this market.

Opportunities

There are significant opportunities within the next-generation cancer therapeutics landscape. Expansion into solid tumors for therapies initially developed for hematologic malignancies—such as CAR-T and TCR therapies—is a major area of growth. The development of off-the-shelf (allogeneic) cell therapies is also underway, which could lower manufacturing costs and broaden accessibility. Novel platforms like mRNA-based cancer vaccines (similar to those used for COVID-19) and oncolytic viruses are gaining traction as they show promise in stimulating robust and specific anti-tumor immune responses.

The rise of tumor-agnostic therapies—drugs approved based on genetic mutations rather than tumor origin—is creating opportunities for pan-cancer treatments and further advancing precision oncology. Moreover, the integration of companion diagnostics with therapies allows for biomarker-driven decision-making, optimizing treatment outcomes and driving market value.

Challenges

Despite its promise, the next-generation cancer therapeutics market faces several challenges. High development costs, particularly for cell and gene therapies, can lead to prohibitively expensive treatment options, raising questions about affordability and access. The complex manufacturing processes for therapies like CAR-T cells and gene-edited treatments pose logistical hurdles and require specialized infrastructure. Regulatory uncertainties, especially for novel platforms, can slow development timelines. In addition, safety concerns—such as cytokine release syndrome (CRS), neurotoxicity, or autoimmune responses—remain significant for immunotherapies.

Patient selection and resistance mechanisms also continue to challenge developers, as not all patients respond equally to targeted or immune-based approaches. Ensuring equitable access, especially in low- and middle-income countries, is another issue that must be addressed to unlock the full potential of these therapies on a global scale.

Regional Outlook

North America, particularly the United States, dominates the next-generation cancer therapeutics market due to its strong R&D infrastructure, high healthcare spending, and rapid adoption of cutting-edge technologies. The presence of leading biopharma companies, academic institutions, and regulatory support from the FDA further strengthens the region’s leadership.

Europe follows closely, with robust clinical research ecosystems in Germany, the UK, and France, supported by the European Medicines Agency’s adaptive licensing pathways for advanced therapies.

Asia-Pacific is expected to register the fastest growth in the coming years, driven by rising cancer prevalence, increasing healthcare investment, and the emergence of domestic biopharma innovators in China, Japan, South Korea, and India. Governments in these regions are actively funding genomics research and forming strategic alliances with Western biotech companies to co-develop advanced cancer therapeutics.

Latin America and the Middle East & Africa remain underpenetrated but present future growth potential as healthcare infrastructure improves and awareness around innovative cancer treatments increases.

Next-Generation Cancer Therapeutics Market Companies

- Roche Holding AG

- Bristol Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- Novartis AG

- AstraZeneca plc

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Seagen Inc. (Pfizer)

- Amgen Inc.

- Genentech, Inc.

- Moderna, Inc.

- BioNTech SE

- Bluebird Bio, Inc.

- BeiGene, Ltd.

- Innovent Biologics

- Immatics Biotechnologies

- Adaptimmune Therapeutics

- Fate Therapeutics

- Legend Biotech Corporation

Segments Covered in the Report

By Therapy Type

- Targeted Therapy (Small Molecule Inhibitors)

- Immunotherapy

- Checkpoint Inhibitors (PD-1, PD-L1, CTLA-4)

- CAR-T Cell Therapy

- Cancer Vaccines

- Gene Therapy

- Cell Therapy (e.g., TILs, NK cells)

- Antibody-Drug Conjugates (ADCs)

- RNA-based Therapy (mRNA, siRNA, ASO, LNA, etc.)

By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Blood Cancers (Leukemia, Lymphoma, Myeloma)

- Prostate Cancer

- Brain Cancer (e.g., GBM)

- Pan-Tumor (Tumor-agnostic therapies)

By Modality

- Monotherapy

- Combination Therapy

- Immunotherapy + Targeted Drugs

- Chemotherapy + ADC

- mRNA + Checkpoint Inhibitors

By Route of Administration

- Intravenous (IV)

- Oral

- Intratumoral / Localized

- Subcutaneous

By Mechanism of Action

- Immune Activation (Checkpoint Inhibition)

- Oncogene Targeting (e.g., BRAF, KRAS, EGFR)

- DNA Damage Response Modulators (e.g., PARP inhibitors)

- Tumor Microenvironment Modulatio

- Apoptosis Induction

By End-User

- Specialized Cancer Hospitals

- Academic & Research Institutes

- Ambulatory Infusion Centers

- Homecare (for oral or SC delivery)

Read Also: Adrenoleukodystrophy Drugs Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025

- Diabetes Care Devices Market Set to Surge to USD 118.34 Billion by 2034, Driven by Innovation and Rising Prevalence - August 8, 2025