Heart Valve Devices Market Key Points

-

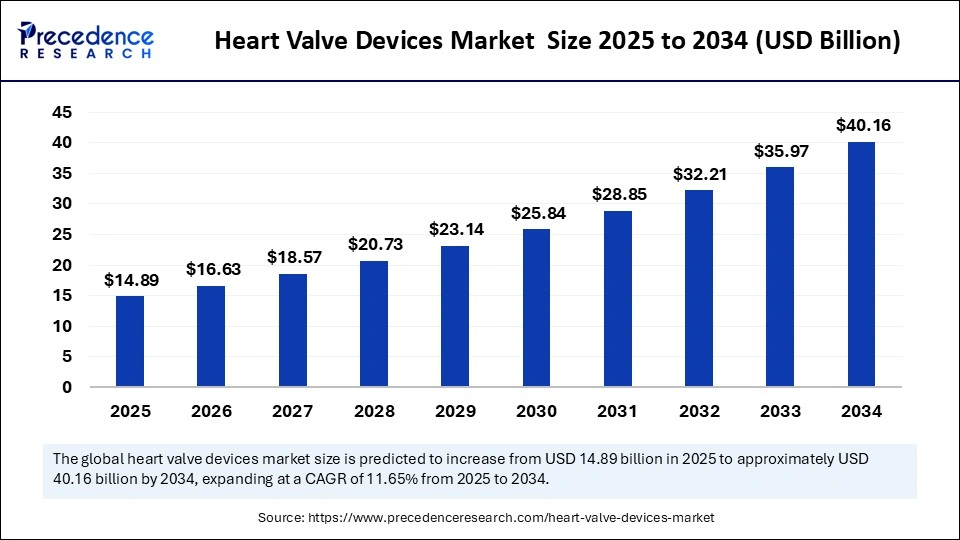

The global heart valve devices market was valued at USD 13.34 billion in 2024 and is projected to reach USD 40.16 billion by 2034, growing at a CAGR of 11.65% from 2025 to 2034.

-

North America dominated the global heart valve devices market in 2024.

-

Asia Pacific is anticipated to register the fastest CAGR in the market between 2025 and 2034.

-

By heart valve type, the aortic valve segment accounted for the largest market share in 2024.

-

The mitral valve segment is expected to grow at a significant CAGR during the forecast period.

-

Based on material, the biological valve segment held the largest share in 2024.

-

The mechanical valve segment is projected to expand at the highest CAGR over the forecast timeline.

-

By age group, adults represented the leading market share in 2024.

-

The geriatric patients segment is forecasted to grow at a notable CAGR during the projection period.

-

Among end-users, hospitals contributed the highest revenue share in 2024.

-

The ambulatory surgical centers segment is expected to witness the fastest growth over the forecast period.

Market Overview

The Heart Valve Devices Market is a vital and rapidly expanding segment within the broader cardiovascular medical devices industry, playing a crucial role in the treatment of valvular heart diseases such as aortic stenosis, mitral regurgitation, and tricuspid valve disorders. These devices are used to repair or replace malfunctioning heart valves, thereby restoring normal blood flow and improving patient outcomes. As cardiovascular diseases (CVDs) remain the leading cause of death worldwide, the demand for advanced, minimally invasive, and long-lasting heart valve solutions continues to rise.

In recent years, the market has seen a significant shift from traditional open-heart surgical procedures toward transcatheter valve therapies, especially transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve repair (TMVr). These procedures offer less invasive alternatives with shorter recovery times, making them particularly beneficial for high-risk and elderly patients. Technological innovations, favorable reimbursement frameworks, and the growing prevalence of valvular diseases have contributed to an impressive growth trajectory. With expanding indications for TAVR and increased clinical acceptance of minimally invasive techniques, the heart valve devices market is set to grow steadily over the next decade.

Heart Valve Devices Market Growth Factors

Multiple factors are fueling the growth of the heart valve devices market. Foremost is the rising global burden of cardiovascular diseases, particularly valvular disorders linked to aging populations, sedentary lifestyles, hypertension, and diabetes. As the incidence of aortic stenosis and mitral regurgitation increases, especially in developed nations, the need for reliable and efficient valve interventions is surging.

The increasing preference for minimally invasive procedures is another pivotal growth driver. Transcatheter heart valve procedures not only reduce surgical trauma and hospital stays but also improve postoperative recovery and lower the risk of complications. The adoption of TAVR has expanded significantly, and its indications have broadened from inoperable and high-risk patients to include intermediate and even low-risk categories.

Furthermore, technological advancements—including next-generation valve designs, improved delivery systems, and enhanced imaging techniques—are elevating procedural success rates and patient satisfaction. The market is also seeing the integration of novel biomaterials that enhance the longevity and biocompatibility of prosthetic valves.

An additional growth factor is the increasing healthcare expenditure and expanding access to advanced cardiac care in emerging economies. With governments investing in specialized cardiac centers and rising patient awareness, the adoption of heart valve procedures is expected to grow in countries outside North America and Europe.

Impact of AI on the Heart Valve Devices Market

Artificial Intelligence (AI) is transforming the heart valve devices market by enhancing the precision, efficiency, and personalization of cardiac care. One of the most significant impacts is seen in preoperative planning and diagnostics, where AI-driven imaging analytics enable clinicians to assess valve morphology, predict surgical risks, and choose optimal intervention strategies with greater accuracy.

In the intraoperative setting, AI is being integrated into robot-assisted and image-guided procedures, supporting surgeons with real-time data and improving valve placement accuracy. These advancements reduce variability in outcomes and enhance procedural safety.

AI algorithms are also facilitating post-operative monitoring and predictive analytics, allowing clinicians to identify early signs of valve deterioration, arrhythmias, or complications through continuous patient data from wearable devices and remote monitoring tools.

On the R&D front, AI is accelerating device innovation and clinical trial design. Machine learning models can analyze vast datasets to simulate device performance, identify potential failure modes, and support regulatory submissions with more robust evidence.

As AI technologies continue to mature, their integration across the heart valve device lifecycle—from diagnosis to long-term care—will significantly improve clinical outcomes, reduce healthcare costs, and expand access to precision cardiovascular interventions.

Market Drivers

- Aging population: The elderly are more susceptible to calcific valve disease and degenerative valve conditions, creating a large and growing patient pool.Expansion of TAVR indications: Clinical trial results supporting TAVR in intermediate- and low-risk patients are expanding the eligible patient population.

- Advancements in valve technology: Development of repositionable, retrievable, and tissue-engineered valves is improving outcomes and device durability.

- Increased awareness and screening programs: Greater recognition of valvular heart disease symptoms and enhanced diagnostic pathways are leading to earlier detection and treatment.

- Favorable reimbursement policies: In many regions, insurance and national health systems are increasingly covering transcatheter procedures, removing cost barriers.

- Rise in comorbid conditions: Conditions such as obesity, diabetes, and hypertension are contributing to earlier onset and greater severity of valve diseases.

Opportunities

The heart valve devices market presents a multitude of opportunities for innovation and expansion. A major opportunity lies in developing next-generation, durable bioprosthetic valves with improved hemodynamic performance and lower rates of structural deterioration, particularly for younger patients who currently rely on mechanical valves and lifelong anticoagulation.

Another promising avenue is the emergence of transcatheter mitral and tricuspid valve repair/replacement technologies, which are still in their early commercialization stages compared to TAVR. Success in this space could open up new patient segments and substantially expand the market.

There are also opportunities in customized and patient-specific valve design using AI-driven 3D imaging and printing. Personalized valves tailored to individual anatomy can enhance compatibility and reduce post-procedure complications.

Geographic expansion, especially in underpenetrated emerging markets, represents a strategic opportunity. As healthcare infrastructure improves and affordability increases in regions like Asia-Pacific, Latin America, and the Middle East, heart valve interventions are likely to gain broader acceptance.

Lastly, synergies between heart valve devices and digital health platforms could create value-added solutions that integrate diagnostics, remote monitoring, and post-operative care management, enhancing patient outcomes and fostering long-term loyalty to device brands.

Challenges

Despite its promising outlook, the heart valve devices market faces several challenges. High procedural and device costs remain a barrier, particularly in low- and middle-income countries where reimbursement is limited or absent. This restricts access to advanced valve replacement options for a significant portion of the global population.

Complex clinical procedures and a steep learning curve associated with transcatheter techniques can also limit adoption, especially in centers lacking adequate training or imaging infrastructure. Consistent procedural success requires multidisciplinary expertise and strong institutional support.

Device durability remains a concern, particularly for bioprosthetic valves used in younger, more active patients. The risk of structural valve deterioration over time necessitates ongoing monitoring and potential reintervention.

Additionally, regulatory challenges and the need for extensive clinical data to support new valve technologies can delay product launches and increase development costs. Regulatory harmonization across geographies is still lacking, adding complexity for multinational device companies.

Lastly, ethical and clinical considerations around valve-in-valve procedures, patient eligibility for newer technologies, and long-term anticoagulation management continue to require careful balancing between innovation and patient safety.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 40.16 Billion |

| Market Size in 2025 | USD 14.89 Billion |

| Market Size in 2024 | USD 13.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Heart Valve, Material, Age Group, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Outlook

North America leads the global heart valve devices market, driven by a high prevalence of cardiovascular disease, strong reimbursement structures, widespread availability of advanced cardiac care, and robust clinical research infrastructure. The U.S. is at the forefront of transcatheter innovation, with leading companies and academic centers driving adoption.

Europe is another major market, with Germany, France, and the UK playing significant roles in TAVR and surgical valve device utilization. The European market benefits from well-established healthcare systems and a collaborative regulatory environment that supports innovation and access.

Asia-Pacific is expected to witness the fastest growth over the forecast period. Countries like China, India, Japan, and South Korea are investing in cardiac infrastructure, expanding health insurance coverage, and adopting newer technologies at a rapid pace. Rising incomes, greater awareness, and government-backed cardiac programs are boosting the demand for valve interventions.

Latin America and the Middle East & Africa represent emerging markets with untapped potential. While adoption is slower due to economic and infrastructure constraints, increasing awareness of heart disease and expanding private healthcare investment are expected to gradually drive growth in these regions.

Heart Valve Devices Market Companies

- Medtronic plc

- Boston Scientific Corporation

- Abbott

- Edwards Lifesciences Corporation

- Foldax Inc.

- Novostia SA

- Meril Life Sciences Pvt. Ltd.

- Corcym UK Limited

- JenaValve Technology, Inc.

- Micro Interventional Devices, Inc.

- Auto Tissue Berlin GmbH

- Anteris Technologies Ltd

- Thubrikar Aortic Valve, Inc.

- MicroPort Scientific Corporation

- Biosensors International Group, Ltd.

Segments Covered in the Report

By Type of Heart Valve

- Aortic Valve

- < 20 mms

- 20–23 mm

- 23–26 mm

- >26 mm

- Mitral Valve

- < 26 mm

- 26–28 mm

- 29–31 mm

- >31 mm

- Tricuspid Valve

- Pulmonary Valve

By Material

- Biological Valve

- TAVI

- Surgical

- Others

- Mechanical Valve

By Age Group

- Pediatric Patients

- Adults

- Geriatric Patients

By End-User

- Hospitals

- Home Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Read Also: Life Science Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6257

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025