Oxycodone Hydrochloride Market Key Points

- North America held the largest share of the global market in 2024, accounting for 49% of total revenue.

- The Asia Pacific region is projected to grow at a notable CAGR between 2025 and 2034.

- Based on type, the controlled-release segment dominated the market in 2024.

- The immediate-release segment is expected to register a steady CAGR during the forecast period.

- By route of administration, the oral route segment generated the highest revenue in 2024.

- The parenteral route segment is anticipated to witness significant growth between 2025 and 2034.

- In terms of distribution channel, hospital pharmacies led the market in 2024.

- The retail pharmacies segment is forecasted to grow at a noteworthy CAGR over the projected timeline.

Oxycodone Hydrochloride Market Overview

The Oxycodone Hydrochloride market plays a critical role in the global pharmaceutical landscape, particularly within the segment of opioid analgesics. Oxycodone hydrochloride is a semi-synthetic opioid derived from thebaine, used extensively to manage moderate to severe pain. It is prescribed for acute post-operative pain, cancer-related pain, injury-related trauma, and chronic pain conditions when other treatments prove insufficient. Available in both immediate-release and extended-release formulations, it is marketed under various brand names and generic labels. Over the years, oxycodone has become a mainstay in pain management therapy due to its high efficacy, rapid onset of action, and predictable pharmacokinetics.

Despite its therapeutic utility, the market is heavily regulated and closely monitored due to its potential for abuse, addiction, and misuse—issues that have contributed significantly to the ongoing opioid epidemic, particularly in North America. As such, the market’s growth trajectory is tightly linked to regulatory frameworks, societal attitudes, and technological advancements in monitoring, prescribing, and abuse-deterrent formulation development. In recent years, the demand for opioid analgesics has seen both growth and contraction depending on public health policies, the emergence of alternative pain management therapies, and litigation pressures on opioid manufacturers. Nevertheless, the oxycodone hydrochloride market continues to evolve through innovation in formulation technologies, digital monitoring tools, and AI-powered prescription practices that aim to balance pain relief with safety.

Oxycodone Hydrochloride Market Growth Factors

A primary growth factor for the oxycodone hydrochloride market is the persistent demand for effective pain management solutions, especially among aging populations with chronic conditions such as arthritis, cancer, and neuropathic disorders. As life expectancy rises globally, so does the incidence of age-related diseases that require long-term pain control, driving sustained demand for potent opioid analgesics.

Another contributor is the increased number of surgical procedures and trauma-related injuries, which necessitate the short-term use of opioids like oxycodone during post-operative recovery. With the expansion of healthcare access in emerging economies and rising surgical volumes worldwide, the consumption of oxycodone is expected to remain robust in acute care settings.

In addition, technological progress in abuse-deterrent formulation (ADF) has spurred renewed interest and regulatory support for safer opioid medications. These formulations are designed to resist manipulation for misuse, thus retaining therapeutic value while mitigating risks of abuse. Pharmaceutical companies are increasingly investing in ADF innovation to meet both patient needs and compliance standards, which positively influences market dynamics.

The growth of telemedicine and digital health platforms is also contributing indirectly by facilitating more accessible and timely pain management consultations, especially in remote or underserved regions. As these platforms expand, they provide new channels for legitimate prescribing of oxycodone under controlled conditions, widening the market’s geographic and demographic reach.

Impact of AI on the Oxycodone Hydrochloride Market

Artificial Intelligence (AI) is beginning to reshape the oxycodone hydrochloride market through enhanced prescription monitoring, risk mitigation, and patient adherence tracking. AI-powered platforms are being integrated into electronic health records (EHRs) and pharmacy systems to analyze prescription patterns, flag potential overprescribing, and identify patients at risk of developing opioid dependence.

In clinical settings, AI algorithms help doctors by offering data-driven pain management recommendations, including whether oxycodone is the most suitable option based on patient history, comorbidities, and genetic markers. Predictive analytics can assist in determining optimal dosages and treatment durations, reducing the likelihood of adverse events or dependency.

AI also supports the development of abuse-deterrent drug formulations, using machine learning models to simulate how changes in molecular structure or delivery mechanisms impact abuse potential. This accelerates R&D timelines and enhances the regulatory approval process for next-generation formulations.

On the patient side, AI-enabled apps and wearable devices are increasingly used to monitor adherence, track pain levels, and detect early signs of misuse. These tools empower clinicians to intervene proactively and adjust prescriptions as needed, improving outcomes while lowering risks. In regulatory frameworks, AI is playing a growing role in population surveillance by analyzing prescription data and public health records to identify emerging abuse trends, guiding policy decisions and enforcement.

Market Scope

| Report Coverage | Details |

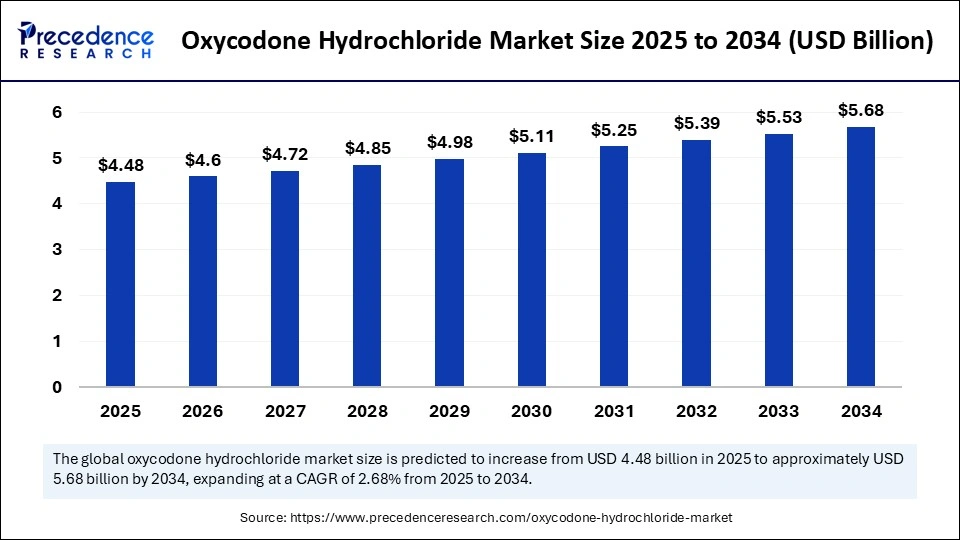

| Market Size by 2034 | USD 5.68 Billion |

| Market Size in 2025 | USD 4.48 Billion |

| Market Size in 2024 | USD 4.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key drivers of the oxycodone hydrochloride market include the high global burden of chronic pain and the limited effectiveness of non-opioid alternatives in severe cases. Despite growing concerns about opioid misuse, oxycodone remains one of the most reliable and widely accepted treatments for intense pain, especially in oncology and palliative care.

Regulatory recognition of the need for balanced pain management also acts as a driver. Agencies such as the FDA and EMA are increasingly focused not only on limiting opioid abuse but also on ensuring that patients with genuine needs have continued access to pain relief. This dual emphasis encourages pharmaceutical innovation and responsible prescribing practices.

The availability of generic versions of oxycodone hydrochloride has made the medication more affordable and accessible in many regions, contributing to higher prescription volumes. Additionally, market penetration is expanding in developing countries, where pain management is becoming a public health priority and opioids are being incorporated more systematically into treatment protocols.

Hospital infrastructure improvements and rising healthcare investments, especially in Asia-Pacific and Latin America, are creating favorable environments for the growth of hospital-based analgesic therapies. The expanding number of surgical and critical care facilities drives demand for injectable and oral opioids for in-patient pain relief.

Opportunities

The market presents strong opportunities in the development of next-generation, abuse-deterrent formulations (ADFs) that retain therapeutic efficacy while reducing the potential for addiction. Pharmaceutical firms that can successfully innovate in this space stand to capture significant market share as regulators and healthcare providers prefer ADFs over traditional opioids.

There is also considerable opportunity in expanding geographic access, particularly in low- and middle-income countries where access to pain relief remains limited due to regulatory hurdles, supply chain constraints, or social stigma. International health organizations and government reforms are gradually easing restrictions, presenting new frontiers for market entry.

The rise of personalized pain management opens further avenues, where pharmacogenomics and AI-based tools are used to tailor opioid therapies based on individual patient profiles. This approach enhances treatment outcomes and minimizes the risk of adverse reactions or dependency, making oxycodone a safer and more precise component of broader pain management strategies.

Digital health platforms offer another major opportunity. Telehealth-based pain management services that integrate AI-driven decision support and remote prescription controls can create secure environments for legitimate oxycodone use. Companies offering secure e-prescribing and adherence tracking tools will be instrumental in expanding ethical and controlled access.

Challenges

The oxycodone hydrochloride market faces significant challenges, foremost among them being tight regulatory oversight and increasing legal scrutiny, particularly in North America. Past abuses and the ongoing opioid crisis have led to high-profile lawsuits, stricter prescribing limits, and rising public skepticism toward opioid therapies, which collectively constrain market growth.

Another pressing challenge is the potential for addiction, abuse, and diversion, which not only affects patients but also tarnishes the reputation of prescribing physicians and pharmaceutical companies. Despite advancements in abuse-deterrent technology, the stigma surrounding opioid use remains a barrier to both patient access and prescriber confidence.

Supply chain and manufacturing complexities—including the need for highly controlled production, storage, and distribution under narcotics regulations—further hinder seamless global expansion. Small and medium-sized pharmaceutical players may struggle with the compliance costs and logistical hurdles involved.

Additionally, the rise of non-opioid pain management therapies, such as cannabinoids, neuromodulation devices, and regenerative medicine techniques, poses competitive pressure. While not yet fully substitutive, these alternatives are gaining favor among physicians and patients seeking safer, long-term pain relief options.

Regional Outlook

North America holds the largest share of the oxycodone hydrochloride market due to its established healthcare systems, high surgical volumes, and widespread use of opioids in pain management. However, this region is also the most regulated and litigated, with public health campaigns and federal programs attempting to curb misuse. Demand is likely to stabilize or slightly decline in the U.S. and Canada due to these factors, though abuse-deterrent and AI-powered prescription tools are expected to gain traction.

Europe follows closely, with countries like the UK, Germany, and France exhibiting stable demand for opioid analgesics within clinical settings. However, the region is more cautious and generally favors tight prescription controls and emphasis on non-opioid alternatives, limiting market growth potential compared to North America.

Asia-Pacific is poised for significant expansion, driven by increasing healthcare investments, growing awareness of chronic pain, and improving access to pharmaceutical care. Countries such as China, India, and Japan are witnessing higher surgical volumes, aging populations, and rising acceptance of opioid therapy—factors that contribute to market acceleration.

Latin America and the Middle East & Africa represent emerging markets with high unmet medical needs for pain management. Regulatory barriers and cultural resistance have historically limited opioid use, but progressive policy changes and increasing investments in hospital infrastructure are opening new growth avenues. Brazil, South Africa, and the UAE are examples of countries where the market is gaining attention.

Oxycodone Hydrochloride Market Companies

- Mallinckrodt Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd

- Amneal Pharmaceuticals LLC

- Alvogen

- Rhodes Pharmaceuticals L.P.

- Protega Pharmaceuticals LLC

- Noramco

- Johnson & Johnson

- Pfizer Inc.

Segment Covered in the Report

By Type

- Controlled-Release

- Immediate-Release

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Read Also: Lyophilization Equipment and Services Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6252

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025