Lyophilization Equipment and Services Market Key Points

-

North America led the global lyophilization equipment and services market in 2024, accounting for the largest revenue share of 41%.

-

The Asia Pacific region is projected to experience the fastest CAGR from 2025 to 2034.

-

In terms of modality, the dryer type segment captured the highest market share in 2024.

-

The services segment, by modality, is anticipated to grow at a notable CAGR throughout the forecast period.

-

Based on application, the pharmaceutical and biotech manufacturing segment held the dominant market share in 2024.

-

The food processing and packaging segment, by application, is expected to register the highest CAGR between 2025 and 2034.

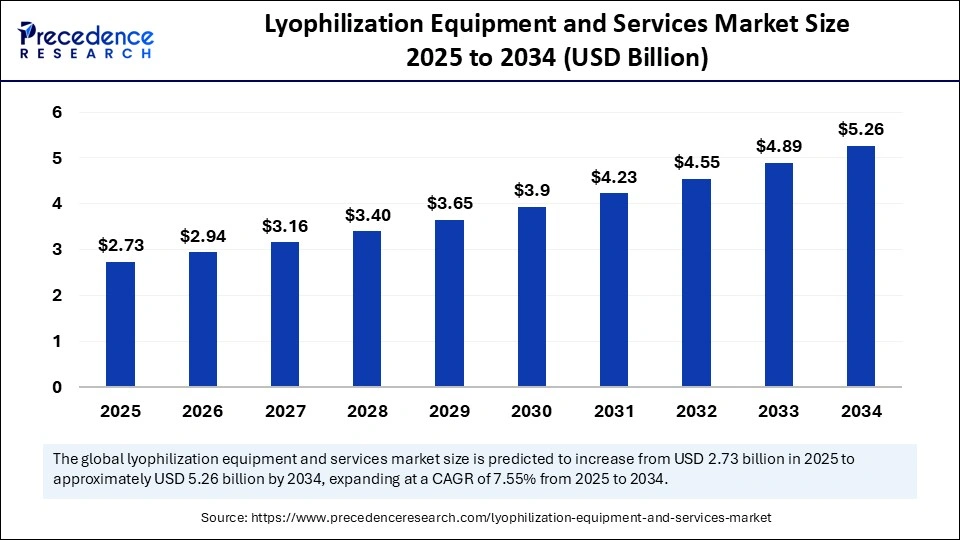

Lyophilization Equipment and Services Market Overview

The lyophilization equipment and services market—commonly associated with freeze-drying technology—is experiencing strong and sustained growth across pharmaceutical, biotechnology, and food processing sectors. Lyophilization (or freeze-drying) is a dehydration process widely used to preserve perishable materials, improve shelf life, and enhance the stability of heat-sensitive products. In pharmaceuticals, it is particularly essential for the long-term preservation of biologicals, vaccines, injectable formulations, proteins, and diagnostics reagents.

As the global demand for biologics, vaccines, and injectable drugs continues to rise, lyophilization has become a standard procedure in pharmaceutical manufacturing. Moreover, the COVID-19 pandemic amplified the need for stable vaccines and biologics that could be stored and transported without a strict cold chain, underscoring the critical role of freeze-drying technology. Beyond life sciences, the market is also gaining traction in the food industry, where freeze-drying is used for premium snack products and nutrient preservation. As regulatory requirements for product stability and safety tighten, and with increasing outsourcing trends, both equipment manufacturers and contract lyophilization service providers are seeing expanded opportunities.

Growth Factors

The primary growth engine for the lyophilization equipment and services market is the rising demand for biologics and injectable pharmaceuticals, which are more temperature-sensitive and complex than traditional oral drugs. Biologics, including monoclonal antibodies, cell and gene therapies, and vaccines, require stringent formulation and storage standards, making freeze-drying essential to their commercial success. As chronic diseases and immunological disorders continue to rise, the pharmaceutical pipeline is increasingly dominated by such formulations, driving the demand for lyophilization technology.

Another strong growth factor is the expansion of global biomanufacturing capacity. Pharmaceutical companies, CMOs (contract manufacturing organizations), and CDMOs (contract development and manufacturing organizations) are investing in freeze-drying capabilities to scale up production while meeting international quality standards. The increased adoption of personalized medicines and high-value, small-batch production is also favoring the growth of flexible and modular lyophilization systems.

The demand for lyophilized diagnostic kits, reagents, and biospecimen preservation—especially in low-resource and remote settings—has further stimulated market expansion. Additionally, the trend of ready-to-use and stable drug products in prefilled syringes, dual-chamber cartridges, and combination devices is accelerating the integration of lyophilization in packaging and final product processing.

Impact of AI on the Lyophilization Equipment and Services Market

Artificial Intelligence (AI) is significantly transforming the design, monitoring, and control of lyophilization processes, making them more efficient, reproducible, and cost-effective. AI algorithms can be used to simulate and optimize the freeze-drying cycle—often a complex and time-consuming procedure—by analyzing historical process data and predicting the optimal time and temperature profiles needed to achieve the desired product quality.

AI is also enabling real-time process control through predictive analytics and machine learning models that analyze sensor and imaging data. These tools can detect critical quality deviations, anticipate process anomalies, and suggest corrections dynamically, thus reducing batch failures and increasing yield. Moreover, AI-powered digital twins—virtual replicas of the lyophilization process—allow companies to run simulations and fine-tune process parameters without disrupting production.

In lyophilization services, AI enhances resource planning and workflow automation, improving scheduling, maintenance, and compliance documentation. Combined with IoT and Industry 4.0 principles, AI integration supports smart lyophilization systems that are self-learning, scalable, and capable of autonomous decision-making. This not only improves product consistency and regulatory compliance but also reduces energy consumption and operational costs—key benefits for pharmaceutical companies striving for sustainable manufacturing practices.

Market Drivers

A key driver of this market is the increased complexity of drug formulations, especially those involving sensitive biological molecules and biosimilars, which are not stable under conventional drying or storage conditions. Lyophilization preserves the structural integrity and potency of such compounds, ensuring better shelf life and patient outcomes. Additionally, the growth in vaccine development, including mRNA-based vaccines and other temperature-sensitive platforms, is driving continuous investment in lyophilization technologies.

The regulatory push for safe, stable, and high-quality pharmaceutical products across regions such as the U.S., EU, and Japan has made freeze-drying a compliance necessity in injectable drug manufacturing. Furthermore, the increasing trend of outsourcing pharmaceutical manufacturing to CDMOs is expanding the demand for lyophilization services, particularly among small and mid-sized biopharma firms that lack in-house capabilities.

In the food industry, the rising consumer preference for clean-label, additive-free, and shelf-stable natural products is encouraging companies to use freeze-drying over traditional dehydration techniques. Additionally, military and space nutrition programs, as well as premium pet food manufacturing, are leveraging lyophilization to enhance product performance and stability.

Opportunities

There are numerous opportunities for innovation and growth in this market. One of the most promising areas is the development of continuous and automated lyophilization systems, which offer higher throughput, reduced cycle time, and lower labor costs compared to batch systems. This is particularly valuable for high-volume biologic manufacturers aiming to scale operations while maintaining flexibility.

The integration of lyophilization with aseptic filling systems is another major opportunity, enabling pharmaceutical companies to streamline packaging and minimize contamination risks. Modular, small-footprint systems designed for personalized medicine production, clinical trials, and point-of-care manufacturing are also gaining traction.

From a services perspective, there’s a growing opportunity for contract lyophilization services, especially in emerging markets where local production is expanding. Providers that offer end-to-end services—including formulation development, cycle optimization, and regulatory support—will find a receptive customer base among startups and biotech firms.

Moreover, the market is poised for disruption through AI-powered predictive maintenance, smart sensors, and real-time quality control technologies. Companies investing in AI and automation can significantly improve process reliability and regulatory compliance, thereby gaining competitive advantage.

Challenges

Despite its growth potential, the lyophilization market faces significant challenges. The first is the high capital investment and operating cost associated with lyophilization equipment, which can deter adoption among small-scale manufacturers. Additionally, freeze-drying is an energy-intensive process, raising concerns around sustainability and carbon footprint.

Another major challenge is the long development cycle and technical complexity involved in optimizing lyophilization processes for each new drug product. This requires substantial expertise in formulation science, thermodynamics, and regulatory standards—skills that are not universally available. Also, the lack of trained personnel and technical know-how in some regions limits the successful implementation and scale-up of lyophilization systems.

Regulatory scrutiny over process validation, particulate control, and product sterility is increasing, especially in parenteral drug manufacturing. Failure to meet these stringent requirements can lead to product recalls, delays, and financial loss. Additionally, supply chain disruptions, especially for precision components, valves, and control systems used in lyophilization equipment, can affect delivery timelines and cost structures.

Regional Outlook

North America remains the dominant market for lyophilization equipment and services, driven by the strong presence of pharmaceutical and biotech companies, advanced healthcare infrastructure, and a proactive regulatory environment. The U.S. in particular leads in biopharmaceutical innovation, personalized medicine, and vaccine development, all of which are major demand drivers for lyophilization.

Europe is another major market, with countries like Germany, Switzerland, France, and the UK having strong life sciences sectors and robust government support for pharmaceutical R&D. The EU’s emphasis on GMP compliance and high product safety standards ensures sustained investment in advanced lyophilization technologies.

Asia Pacific is the fastest-growing region, fueled by expanding pharmaceutical production in China, India, South Korea, and Japan. Rising healthcare expenditures, growing local drug manufacturing, and increased clinical research outsourcing make this region a lucrative market for both equipment suppliers and lyophilization service providers. Government incentives for local biomanufacturing and improved regulatory frameworks are further catalyzing growth.

Latin America and Middle East & Africa represent emerging markets with growing pharmaceutical consumption and production capacities. Brazil, Mexico, South Africa, and Saudi Arabia are increasing investments in biopharma infrastructure and cold-chain alternatives, which will likely spur future demand for lyophilization systems. However, economic instability and limited technical infrastructure may pose short-term constraints.

Lyophilization Equipment and Services Market Companies

- GEA Group AG

- IMA Industria Macchine Automatiche S.p.A.

- Labconco Corporation

- Martin Christ Gefriertrocknungsanlagen GmbH

- MechaTech Systems Ltd

- Millrock Technology Inc.

- OPTIMA packaging group GmbH

- SP Industries

- Telstar (Azbil Corporation)

- Thermo Fisher Scientific Inc.

- W. L. Gore & Associates Inc.

Segments Covered in the Report

By Modality

- Dryer Type

- Tray-style Freeze Dryers

- Manifold Freeze Dryers

- Rotary Freeze Dryers

- Other Products

- Accessories

- Vacuum Systems

- CIP (Clean-in-place) Systems

- Drying Chamber

- Other Accessories

- Services

By Application

- Food Processing and Packaging

- Pharmaceutical and Biotech Manufacturing

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Leadless Pacemakers Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6247

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025