Life Science Logistics Market Size and Growth 2025 to 2034

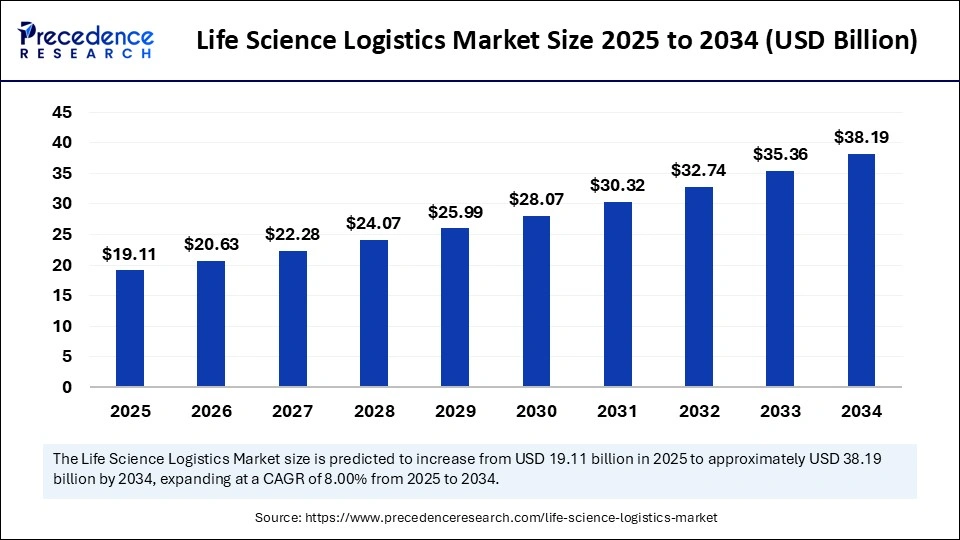

The global life science logistics market size is estimated to cross around USD 38.19 billion by 2034 increasing from USD 17.69 billion in 2024, with a CAGR of 8.00%.

Role of AI in the Life Science Logistics Market

Artificial intelligence is significantly enhancing the life science logistics landscape by introducing automation, predictive analytics, and real-time monitoring. AI-powered platforms are now capable of route optimization for cold chain deliveries, demand forecasting for pharmaceuticals, and anomaly detection for temperature excursions.

One of the most valuable contributions of AI is in risk prediction and mitigation. By analyzing historical data and real-time variables such as weather conditions or port delays, AI can suggest alternate routes or preventive actions to avoid delivery failures or product degradation. Machine learning algorithms also support warehouse automation, intelligent inventory management, and compliance documentation, helping logistics companies meet the stringent requirements of the life sciences industry.

Additionally, AI-driven vision systems are being used in packaging quality control and container loading/unloading, ensuring proper handling of sensitive materials. The result is improved reliability, lower operational costs, and enhanced patient safety.

Life Science Logistics Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 38.19 Billion |

| Market Size in 2025 | USD 19.11 Billion |

| Market Size in 2024 | USD 17.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

A major driver for the life science logistics market is the rising demand for temperature-sensitive biopharmaceuticals and biologics, such as insulin, vaccines, and cell/gene therapies. These products require specialized storage and transportation infrastructure, fueling demand for cold chain logistics solutions.

Another important factor is the expansion of clinical trials across geographies, which necessitates reliable logistics support for trial materials and biological samples. The globalization of pharmaceutical manufacturing also drives the need for seamless and secure cross-border logistics.

Regulatory frameworks that emphasize product safety and quality — such as Good Distribution Practices (GDP) — have led to increased adoption of traceable, temperature-controlled supply chains. Digitization and automation in logistics workflows are also enabling faster delivery cycles and higher service quality.

Market Opportunities

There are abundant opportunities in last-mile delivery innovations, especially for direct-to-patient models and e-pharmacy services. The integration of IoT-enabled tracking and blockchain-based authentication also opens doors for advanced visibility and traceability, which are becoming crucial in the life sciences supply chain.

Growth in emerging markets such as Latin America, Southeast Asia, and Africa offers new avenues for logistics providers, especially those offering GDP-compliant infrastructure. Additionally, the expansion of biosimilars and generics requires efficient logistics support to meet rising market demands with cost-effective operations.

There is also a strong opportunity for sustainability-focused logistics solutions, including green transport fleets, reusable thermal containers, and AI-based route optimization to reduce fuel consumption and emissions.

Market Challenges

The life science logistics market is not without its challenges. One of the most pressing is ensuring temperature integrity across long-haul and multimodal shipments. Any failure in cold chain continuity can result in product loss or compromise.

Another challenge is navigating the complex regulatory landscape that differs across countries and regions. Logistics providers must comply with stringent documentation, labeling, and reporting requirements to ensure that products meet quality standards upon delivery.

The high cost of infrastructure development — such as temperature-controlled warehouses, specialized containers, and IT systems — can be a barrier for small and mid-sized logistics companies. Moreover, geopolitical issues, border restrictions, and customs delays continue to pose risks to cross-border transport operations.

Regional Outlook

North America

North America leads the life science logistics market, largely due to the presence of major pharmaceutical manufacturers and strong regulatory enforcement. The U.S. and Canada have advanced cold chain infrastructure and are major hubs for both clinical trials and product distribution.

Europe

Europe holds a substantial market share, driven by strict regulatory frameworks and the growth of biotech firms. Countries like Germany, Switzerland, and the UK are major contributors, with well-established logistics networks and GDP compliance.

Asia Pacific

Asia Pacific is the fastest-growing region, fueled by pharmaceutical outsourcing, expanding clinical trials, and a booming healthcare market. India, China, Japan, and South Korea are actively investing in life science logistics infrastructure to support both domestic and international demand.

Latin America

Latin America presents a growing opportunity, especially in Brazil and Mexico. Rising pharmaceutical imports and the need for vaccine distribution have led to increased investments in logistics capabilities.

Middle East & Africa

This region is developing rapidly, especially in Gulf countries like the UAE and Saudi Arabia, where healthcare infrastructure modernization is underway. Africa’s life science logistics is emerging, with international aid and private investment supporting medical supply distribution.

Competitive Landscape

The life science logistics market features a mix of global logistics companies, 3PL providers, and niche players specializing in cold chain solutions. Competition is based on service reliability, global reach, regulatory compliance, and technological integration.

Key players include:

- DHL

- World Courier

- Quick STAT

- CEVA Logistics

- Marken

- Agility

- Rhenus Group

- MNX Global Logistics

- CRYOPDP

- Langham Logistics

- Life Science Logistics

- Biocair

- Others

These companies are expanding their GDP-compliant networks, deploying IoT and AI in operations, and forming strategic partnerships with pharmaceutical firms and CROs.

Life Science Logistics Market Future Outlook and Trends

The future of the life science logistics market is tied to innovation, compliance, and digital transformation. Automation and AI will continue to revolutionize operations — from predictive maintenance of cold storage systems to AI-led planning of transport routes.

Blockchain will likely become a standard for product authentication and supply chain traceability, especially in high-value or controlled substances. As personalized medicine and direct-to-patient delivery grow, logistics providers will need to offer more flexible, patient-centric solutions.

Furthermore, sustainability will become a core focus, with companies investing in eco-friendly packaging, low-emission fleets, and carbon tracking. As healthcare globalizes and new therapies are introduced, logistics will evolve into a more agile, intelligent, and value-driven service ecosystem.

Also Read: AI Skin Analysis Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6218

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025