Sterile Injectables CDMO Market Key Insights

-

In 2024, North America held the highest revenue share of 41%.

-

The Asia Pacific region is expected to grow at the fastest CAGR of 10.7% between 2025 and 2034.

-

By molecule type, large molecules dominated the market with a 67% revenue share in 2024.

-

The small molecules segment is projected to grow at a significant CAGR from 2025 to 2034.

-

Based on product, the pre-filled syringes segment captured the largest share at 42% in 2024.

-

The specialty injectables segment is forecasted to grow at the fastest CAGR over the projection period.

-

In terms of services, the formulation development segment generated the highest revenue share of 40% in 2024.

-

The manufacturing segment is anticipated to grow at a solid CAGR of 10% from 2025 to 2034.

-

By therapeutic area, the oncology segment held the largest share of 31% in 2024.

-

The central nervous system diseases segment is expanding at a notable CAGR of 10.31% over the forecast period.

-

Based on route of administration, the intravenous (IV) segment led the market with a 31% share in 2024.

-

The subcutaneous (SC) segment is expected to grow at a remarkable CAGR of 10.42% from 2025 to 2034.

-

Among end-users, biopharmaceutical companies accounted for the largest revenue share of 44% in 2024.

-

The pharmaceutical companies segment is projected to register a significant CAGR between 2025 and 2034.

What Are Sterile Injectables and Why Are CDMOs Important in Their Production?

Sterile injectables are pharmaceutical products administered via injection and must be manufactured under strict aseptic conditions to ensure they are free from microorganisms and contaminants. These products include solutions, suspensions, emulsions, and biologics delivered through intravenous (IV), intramuscular (IM), or subcutaneous (SC) routes. They are widely used in treatments requiring fast action, such as oncology, cardiovascular diseases, infectious diseases, and critical care.

Given the complex regulatory and technical requirements for manufacturing sterile injectables—including cleanroom environments, advanced fill-finish technologies, and stringent quality control—many pharmaceutical companies partner with CDMOs (Contract Development and Manufacturing Organizations). CDMOs offer specialized capabilities in formulation development, lyophilization, aseptic processing, vial/syringe filling, and regulatory support, enabling companies to bring products to market more efficiently and cost-effectively.

How Is the Sterile Injectables CDMO Market Evolving?

The sterile injectables CDMO market is experiencing robust growth, driven by increasing demand for biologics, biosimilars, and vaccines, as well as the growing prevalence of chronic diseases. The market was valued at approximately USD 30–35 billion in 2024 and is projected to grow at a CAGR of over 10% in the coming years. Outsourcing is especially appealing to small and mid-sized biotech firms that lack in-house sterile manufacturing capabilities.

Key trends include:

-

Expansion of pre-filled syringe and auto-injector platforms.

-

Adoption of single-use technologies to increase flexibility and reduce contamination risks.

-

Growth in parenteral manufacturing capacity in emerging markets like Asia-Pacific.

-

Heightened focus on compliance with FDA, EMA, and PIC/S guidelines.

How is AI Revolutionizing the Sterile Injectables CDMO Market?

AI is playing a crucial role in transforming the sterile injectables CDMO (Contract Development and Manufacturing Organization) market by enhancing formulation development and process efficiency. Machine learning models analyze formulation data to optimize drug stability, solubility, and compatibility with delivery systems. This accelerates the development of injectable products while minimizing the need for extensive physical trials.

In manufacturing, AI improves precision and compliance by enabling real-time monitoring of sterile conditions, production parameters, and batch consistency. Predictive analytics help identify potential failures before they occur, reducing downtime and ensuring product safety. AI also streamlines regulatory documentation and quality assurance, making it a key enabler of faster, safer, and more scalable production of sterile injectable drugs.

Growth Factors in the Sterile Injectables CDMO Market

The demand for sterile injectables CDMO services is being propelled by the increasing prevalence of chronic and complex diseases like cancer, diabetes, and autoimmune disorders, which often require biologics, monoclonal antibodies, and gene therapies delivered via sterile injectable formats. Pharmaceutical and biotech companies are outsourcing manufacturing to CDMOs to accelerate development timelines, reduce operational costs, and ensure regulatory compliance. Technological advancements—such as innovations in aseptic filling, lyophilization, single-use systems, isolation technologies, robotics, and automation—are enhancing production efficiency, product quality, and scalability.

Moreover, the booming pipeline of injectable products, including biosimilars, vaccines, cell and gene therapies, is fueling capacity expansion and strategic collaborations between CDMOs and pharmaceutical firms. Outsourcing trends are especially strong in North America and Europe, where regulatory rigor and sophisticated healthcare infrastructure drive adoption, while the Asia-Pacific region is experiencing rapid growth thanks to rising healthcare investments, cost advantages, and favorable government policies. These dynamics bolster CDMOs’ ability to offer end-to-end sterile injectable solutions tailored for a diverse range of therapeutic areas.

Market Scope

| Report Coverage | Details |

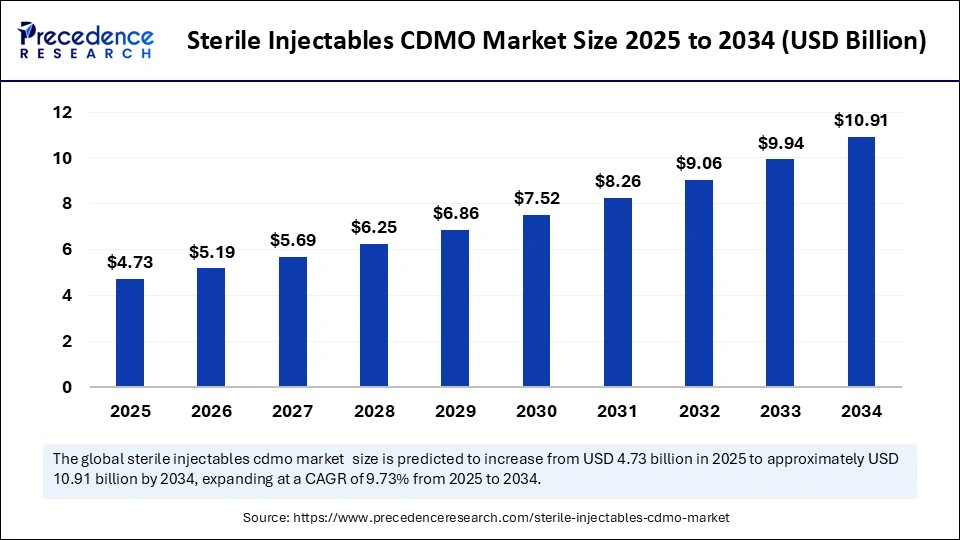

| Market Size by 2034 | USD 10.91 Billion |

| Market Size in 2025 | USD 4.73 Billion |

| Market Size in 2024 | USD 4.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule Type, Product, Service, Therapeutic Area, Route of Administration, End-use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The sterile injectables CDMO (Contract Development and Manufacturing Organization) market is witnessing strong growth, primarily driven by the increasing demand for injectable drugs across various therapeutic areas, including oncology, diabetes, infectious diseases, cardiovascular disorders, and autoimmune conditions. These formulations offer rapid bioavailability and precise dosing, making them a preferred delivery method for acute and chronic diseases alike. As pharmaceutical companies strive to bring injectable products to market faster while controlling costs, they are increasingly outsourcing manufacturing to specialized CDMOs with sterile processing capabilities.

Furthermore, the growing number of biologics and biosimilars in development—many of which require aseptic manufacturing—has significantly contributed to the expansion of this market. Stringent regulatory requirements, rising complexity of sterile drug formulations (such as lyophilized powders, prefilled syringes, and cartridges), and the need for advanced fill-finish solutions are also encouraging companies to rely on CDMOs with specialized expertise and infrastructure.

Market Opportunities

The sterile injectables CDMO market offers multiple growth opportunities as drug development pipelines increasingly shift toward parenteral formulations. One of the most notable opportunities lies in the accelerated approval of biologics and monoclonal antibodies, many of which require aseptic processing due to their sensitivity to contamination and degradation. As pharmaceutical firms focus on innovation and patient convenience, demand is growing for complex injectable formats such as dual-chamber syringes, auto-injectors, and ready-to-use prefilled syringes.

CDMOs that can offer flexible, scalable solutions and provide support across the product lifecycle—from formulation development and clinical trial manufacturing to commercial-scale production—are particularly well-positioned for growth. Additionally, the expansion of personalized medicine and targeted therapies presents an opportunity for CDMOs to cater to niche, small-batch, high-value products that require precision manufacturing. Global supply chain diversification and reshoring trends also provide opportunities for CDMOs located in regions with robust quality systems and regulatory compliance capabilities.

Market Challenges

Despite the promising outlook, the sterile injectables CDMO market faces several challenges that could impact its growth trajectory. The high cost of establishing and maintaining sterile manufacturing facilities—requiring advanced cleanroom environments, isolators, and automation systems—creates significant entry barriers for new players. Additionally, compliance with strict regulatory standards from agencies like the FDA, EMA, and WHO necessitates rigorous validation, monitoring, and documentation processes, which can be both time-consuming and resource-intensive.

Capacity constraints have also become a bottleneck for many CDMOs, especially during periods of high demand such as during the COVID-19 pandemic, where vaccine manufacturing took precedence. This has led to increased lead times and pressure on delivery timelines for other sterile injectable products. Supply chain disruptions, particularly for specialized materials like sterile containers, stoppers, and active pharmaceutical ingredients, also pose risks. Moreover, managing complex client expectations across formulation, scale-up, and regulatory submission stages adds further operational complexity.

Regional Outlook

North America holds the largest share of the sterile injectables CDMO market, driven by a well-established pharmaceutical industry, high levels of biologics R&D, and the presence of leading CDMOs with sophisticated sterile manufacturing infrastructure. The United States, in particular, benefits from favorable regulatory pathways such as fast-track and breakthrough designations, which fuel outsourcing demand for rapid development and manufacturing services.

Europe follows closely, supported by strong capabilities in aseptic production and a highly regulated environment that encourages outsourcing to specialized CDMOs. Countries like Germany, Switzerland, and Ireland are hubs for sterile manufacturing due to their skilled workforce and infrastructure. The Asia-Pacific region is witnessing the fastest growth, particularly in countries like India, China, and South Korea. These countries are increasingly investing in sterile manufacturing capabilities and attracting global pharma companies seeking cost-effective yet high-quality outsourcing partners. However, regulatory harmonization and quality assurance remain areas of focus.

Latin America and the Middle East & Africa are emerging markets with growing pharmaceutical sectors, but limited access to advanced sterile facilities has thus far restrained large-scale growth. Nevertheless, international collaboration and local capacity-building initiatives could unlock future opportunities in these regions.

Sterile Injectables CDMO Market Companies

- Aenova Group

- Ajinomoto Bio-Pharma

- Alcami Corporation

- Baxter (Simtra BioPharma Solutions)

- Boehringer Ingelheim International GmbH

- Eurofins Scientific

- FAMAR Health Care Services

- Fareva Group

- Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

- IDT Biologika GmbH

- PCI Pharma Services

- Pfizer CentreOne (Pfizer Inc)

- Recipharm AB

- Siegfried AG

- Torbay Pharmaceuticals

- Unither Pharmaceuticals

- Vetter Pharma International GmbH

Latest Announcement by Industry Leader

- In July 2024, INCOG BioPharma Services, a CDMO specializing in manufacturing sterile injectables, is set to expand its production capacity. Cory Lewis, INCOG founder and chief executive, stated, “This supply chain integration is essential in accelerating a drug product to commercial launch, and even more important in today’s constrained markets as the need for sterile injectable products is quickly growing to address challenging diseases and improve healthcare outcomes.”

Recent Development

- In January 2025, Vetter, a globally operating Contract Development and Manufacturing Organisation (CDMO), announced the development and upcoming launch of the new version of its proprietary V-OVS syringe closure system. The new closure, V-OVS next, will further advance a proprietary system with many years of proven market success supporting and differentiating a range of sterile injectables.

Segments Covered in the Report

By Molecule Type

- Small Molecules

- Large Molecules

By Product

- Pre-filled Syringes

- Vials and Ampoules

- Specialty Injectables

- Others

By Service

- Formulation Development

- Analytical and Testing Services

- Method Development and Validation

- Stability Testing

- Drug Substance

- Stability Indicating Method Validation

- Accelerated Stability Testing

- Photostability Testing

- Other Stability Testing Methods

- Extractable & Leachable Testing

- Others

- Manufacturing

- Clinical Trial Manufacturing

- Commercial Manufacturing

- Aseptic Fill-Finish Services

- Packaging

- Storage

- Cold

- Non-cold

- Others

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Central Nervous System Diseases

- Infectious Disorders

- Musculoskeletal Diseases

- Hormonal Diseases

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Intramuscular (IM)

- Others

By End-use

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Read: mRNA Therapeutics CDMO Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6188

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Thermal Cycler Market Size, Trends and Growth 2025 to 2034 - July 28, 2025

- Bovine Blood Plasma Derivatives Market to Reach USD 3.00 Billion by 2034 - July 25, 2025

- Bimekizumab Market Size to Reach USD 8.10 Billion by 2034 - July 24, 2025