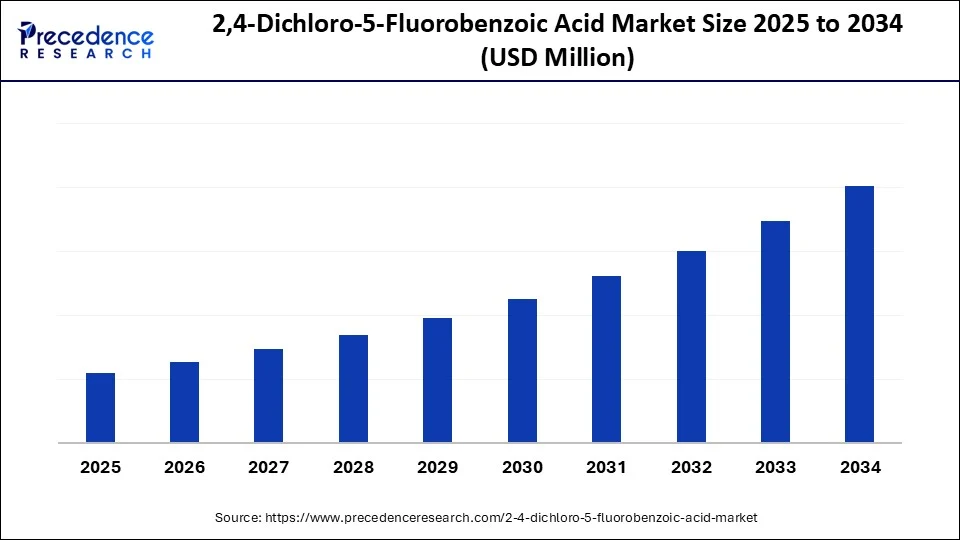

2,4 Dichloro 5 Fluorobenzoic Acid Market Trends and Key Players

2,4-Dichloro-5-Fluorobenzoic Acid Market Key Points:

-

Asia Pacific led the global market for 2,4-dichloro-5-fluorobenzoic acid in 2024, holding the largest share.

-

North America is projected to register the fastest compound annual growth rate (CAGR) between 2025 and 2034.

-

Based on purity, the ≥98% segment dominated the market in 2024 with the highest share.

-

The 95–97% purity segment is expected to grow at a notable CAGR throughout the forecast period.

-

In terms of form, the powder segment held the largest market share in 2024.

-

The liquid segment is forecasted to expand at a significant CAGR over the coming years.

-

By application, pharmaceutical intermediates accounted for the largest market share, reaching 58% in 2024.

-

The agrochemical intermediates segment is projected to grow at a strong CAGR from 2025 to 2034.

-

Among end-use industries, the pharmaceutical industry captured a substantial market share in 2024.

-

The contract manufacturing organizations (CMOs) segment is expected to grow significantly over the forecast period.

-

Regarding distribution channels, direct sales held the major market share in 2024.

-

The online platforms segment is anticipated to grow at an impressive CAGR through 2034.

2,4-Dichloro-5-Fluorobenzoic Acid Market Growth Factors

DCFBA demand is buoyed by four structural trends. First, the surge in small‑molecule oncology pipelines requires ever‑cleaner aromatic acid precursors that tolerate harsh reaction conditions without by‑product formation. Second, global agrochemical consumption is climbing as growers pursue higher crop yields; halogenated benzoic acids such as DCFBA enhance the potency of next‑generation selective herbicides. Third, continuous‑flow and micro‑reactor technologies now enable safer, more cost‑effective chlorination–fluorination sequences, lowering price barriers for mid‑scale custom synthesis. Finally, stricter impurity and residual‑solvent guidelines in both pharma and crop‑protection regulations favour high‑purity (≥ 98 %) grades of DCFBA, spurring capacity expansions among speciality chemical manufacturers.

Role of AI in 2,4-Dichloro-5-Fluorobenzoic Acid Market

Artificial‑intelligence tools are transforming the way DCFBA is produced and used. In production, machine‑learning models track reaction exotherms, reagent ratios, and impurity profiles in real time, dynamically adjusting feed rates or cooling loops to maximise yield and minimise waste—a critical advantage when handling energetic halogenation chemistry.

In quality control, computer‑vision systems coupled with spectroscopy quickly flag off‑spec batches, reducing batch‑release times by days. On the demand side, AI‑driven molecule‑design platforms screen millions of virtual compounds, repeatedly highlighting fluorinated, dichlorinated benzoic‑acid motifs for lead optimisation; this keeps DCFBA and similar intermediates high on procurement lists for drug‑discovery labs and agrochemical R&D teams.

Market Drivers

Regulatory and customer requirements are the primary market accelerants. Health authorities now demand tighter control of trace metal catalysts and halogenated by‑products, making DCFBA’s predictably clean synthesis route attractive. Pharmaceutical CMOs specify it because its glass‑transition and melting characteristics simplify downstream solid‑state control and API isolation.

Agrochemical formulators value its chemical robustness, which allows finished products to retain activity under sunlight and soil microbes. In parallel, the expansion of contract manufacturing—particularly among Western drug sponsors seeking dual‑sourcing away from single‑country supply chains—stimulates long‑term offtake contracts for validated, GMP‑capable DCFBA suppliers.

Opportunities

• Purity‑driven premium niches: Demand for ≥ 98 % DCFBA offers high‑margin supply opportunities for producers willing to certify GMP‑level traceability.

• Flow‑chemistry retrofits: Installing continuous chlorination‑fluorination modules lets existing plants boost capacity without major capex, positioning them for quick wins as orders rise.

• Agri‑transition to specialty herbicides: As older broad‑spectrum herbicides face resistance, novel benzoyl‑based actives that rely on DCFBA cores are entering regulatory review, promising fresh volume streams.

• Digital‑supply‑chain platforms: Logistics providers that integrate real‑time temperature, humidity, and impurity tracking can differentiate when shipping moisture‑sensitive DCFBA grades to CMOs and CROs.

Challenges

Production of halogenated benzoic acids still faces several hurdles. Chlorine and hydrofluoric‑acid feedstocks are prone to price spikes, squeezing margins on spot contracts. Environmental, health, and safety (EHS) regulations around halogen handling tighten every year, pushing manufacturers to invest continuously in scrubbers and closed‑loop waste‑acid recovery. In many emerging‑market plants, the absence of advanced emission controls threatens licence renewals.

On the demand side, competitive intermediates—such as chloro‑trifluoromethyl benzoic acids—sometimes substitute for DCFBA in crop‑science applications if supply tightens. And while global logistics have improved since pandemic‑era disruptions, volatile freight rates and geopolitical tensions still complicate long‑distance movements of dangerous goods.

2,4 Dichloro 5 Fluorobenzoic Acid Market Regional Outlook

-

Asia‑Pacific: Largest producer and consumer, owning the bulk of kilo‑ to tonne‑scale capacity. China and India benefit from integrated chlor‑alkali and fluorochemical supply chains, keeping unit costs low.

-

North America: Poised for the fastest CAGR through 2034 thanks to reshoring initiatives, biologics/antibody–drug‑conjugate growth, and the expansion of US‑based CDMOs seeking dual‑sourced halogen intermediates.

-

Europe: Steady, regulation‑driven demand from fine‑chemicals clusters in Germany, Switzerland, and Ireland; stringent REACH compliance favours suppliers with documented low‑impurity DCFBA.

-

Latin America & MEA: Niche but rising consumption, mainly tied to agrochemical formulation hubs in Brazil and South Africa, with incremental imports substituted for older benzoic‑acid intermediates.

2,4-Dichloro-5-Fluorobenzoic Acid Market Segmental Insights

-

By Purity: ≥ 98 % grade dominates due to strict pharmacopeial and agrochemical specifications, while 95–97 % grade is the fastest‑growing slice for cost‑sensitive research and pilot‑plant use.

-

By Form: Powder accounts for the biggest share, preferred for dry‑blend API synthesis and easy metering; the liquid (solution/suspension) form is gaining traction where flow‑chemistry lines need pumpable feeds.

-

By Application: Pharmaceutical intermediates command roughly three‑fifths of demand, reflecting the compound’s role in anti‑inflammatory and oncology APIs; agrochemical intermediates follow, logging the highest forecast CAGR as new herbicide actives clear field trials.

-

By End‑Use Industry: The pharmaceutical industry leads overall volume, but contract‑manufacturing organisations (CMOs) are the fastest‑expanding end‑user class as outsourcing deepens.

-

By Distribution Channel: Direct sales remain predominant, ensuring supply‑chain security for regulated industries; online platforms are the standout growth channel, especially for small‑batch R&D orders.

2,4-Dichloro-5-Fluorobenzoic Acid Market Companies

- Thermo Fisher Scientific

- Merck KGaA (Sigma-Aldrich)

- TCI Chemicals

- Toronto Research Chemicals (LGC Standards)

- Clearsynth

- Combi-Blocks Inc.

- Jubilant Ingrevia

- Beijing Chemsynlab Co., Ltd.

- Viva Pharmaceutical Co., Ltd.

- Shandong Xinhua Pharmaceutical

- ABCR GmbH

- Biosynth Carbosynth

- MolPort

- Alfa Aesar

- Accela ChemBio Inc.

- Hangzhou Trylead Chemical Technology

- Otto Chemie Pvt. Ltd.

- J&K Scientific Ltd.

- Loba Chemie

- Anvia Chemicals

- Other Players

Also Read: Patient Monitoring and Ultrasound Devices Display Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6336

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025